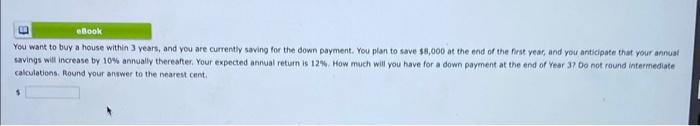

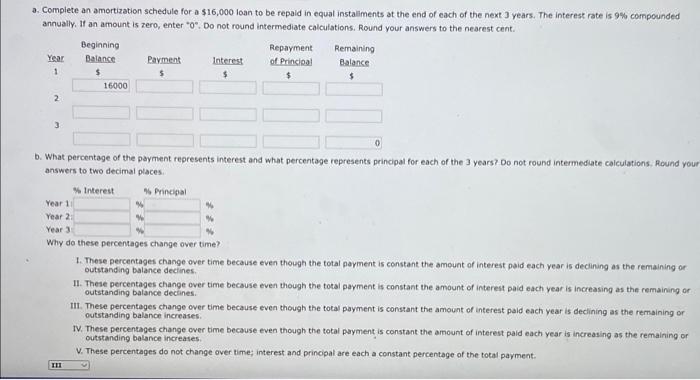

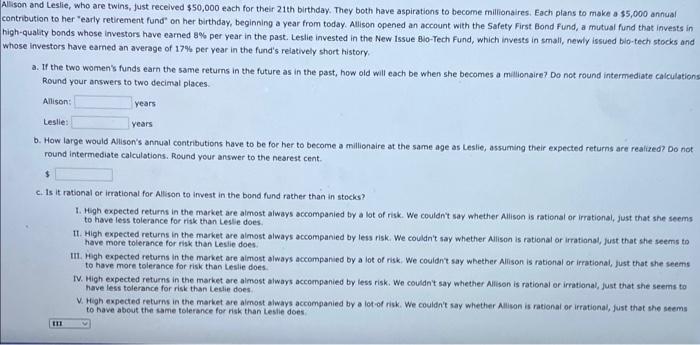

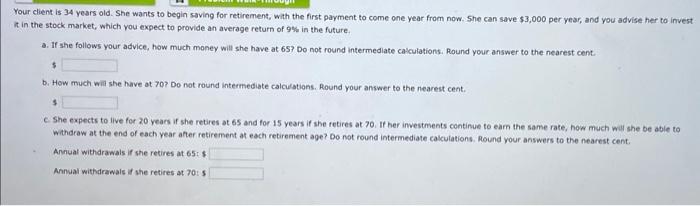

Simon recently received a credit card with a 15% nominal interest rate. With the card, he purchased an Apple iphone 7 for $378.18. The minimum payment on the card is only $20. per manth. a. If 5 imon makes the minimum monthly payment and makes no other charges, how many months will it be before he pays off the card? Do not round intermediate calculations. Aound your answer to the nearest whole number. month(s) b. If simon makes monthly payments of $65, how many months will it be before he pays off the debt? Do not round intermediate calculations. Mound your answer to the nearest whole number: month(s) c. How much more in total payments wisi simon make under the 520 -a-month plan than under the 565 -a-month plan. Do not round intermediate calculations. Round your answer to the nearest cent. 5 It is now December 31,2018(t=0), and a jury just found in faver of a woman who sued the city for injuries sustained in a january 2017 sccident. she requested recovery of iost wages plus $500,000 for pain and suffering plus $100,000 for legal expenses. Her doctor testifed that she has been unable to work since the aceident and that she will not be able to work in the future. She is now 62 , and the jury decided that she would have worked for another three years. She was scheduled to have earned $43,000 in 2017 . (To simpify this problem, assume that the entire annual salary amount would have been received on December 31, 2017.) Her employer testified that she probably would have miceived raises of 3% per year. The actual payment for the jury award will be made on December 31,2019 . The judge stipulated that all dollar amounts are to be adjusted to a present value basis on December 31, 2019, using a 6\%w annual intereit rate and using compound, not simple, interest. Furthermore, he stipulated that the pain and sulfering and legal erpenses sheuld be based on a December 31, 2018, date. How large a check must the city write on December 31, 20197 Do not round intermediate cakculatiens. Aeund vour answer to the nearest dollar. Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85 . He wants a fixed retirement income that has the same purchasing power at the time he retires as $50,000 has today. (The real value of his retirement income will decline annually after he retires.) his retirement incame mil begin the doy he rebires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 5%. He currently has $140,000 saved, and he expects to earn 8% annually on his savings. How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goar? Do not round intermediate caiculations. Round your answer to the nearest dollar. A father is now planning a savings program to put his daughter through coliege. She is 13 , plans to enroll at the university in 5 years, and she should graduate 4 years later. Currently, the annual cost (for everything - food, dothing, tuition, books, transportation, and so forth) is $20,000, but these costs are expected to increase by 5% annually, The college requires total payment at the start of the year. She now has $8,500 in a college savings account that pays 7% annually, Her father will make six equal annual deposits into her account; the first deposit today and whth on the day she starts college. How large must each of the six poyments be? (Hint: Caiculate the cost (inflated at 5% ) for each year of college and find the total present value of thase cests, discounted at 7%, as of the day she enters college. Then find the compounded value of her initial 18.500 on that same day. The difference between the PV of costs and the amount that would be in the savings account must be made up by the father's deposits, so find the six equat payments that wil compound to the required amount.) Do not round intermediate calculations. Pound your answer to the nearest dollar:- You want to buy a house within 3 years, and you are currently saving for the down payment. You plan to save s8,000 at the end of the first yeac, and you anticipate that your annuat savings witi increase by 10% annwally therester. Your expected annual retum is 12%. How much will you have for a down payment at the end of Year 37 Do not round intermediate calculatiens. Round your answer to the nearest cent. a. Complete an amortization schedule for a $16,000 loan to be repaid in equal instaliments at the end of each of the next 3 years. The interest rate is 9% compounded annually, If an amount is zero, enter 0. Do not round intermediate calculations. Round your answers to the nearest cent. b. What percentage of the payment represents interest and what percentage represents principal for each of the 3 years? Do not round intermediate calculations. Round you answers to two decimal places: 1. These percentages change over time because even though the total payment is constant the amount of interest paid each year is decining as the remaining or outstanding balance decines. 11. These percentages change over time because even though the total payment is constant the amount of interent paid each year is increasing as the remaining or outstanding balance decanes. III. These percentages change over time because even though the total payment is constant the amount of interest paid each year is declining as the remaining or outstanding balance increases. IV. These percentages change over time because even though the total payment is constant the amount of interest paid each year is increasing as the remaining or outstanding balance increases. v. These percentages do not change over time; interest and principal are each a constant percentage of the total payment. Wison and Leslie, who are twins, Just recelved $50,000 each for their 21 th birthday. They both have aspirations to become millionaires. Each plans to make a $5,000 annual ontribution to her "early retirement fund" on her birthday, beginning a year from today. Allison opened an account with the Safety First Bond fund, a mutual fund that invests in wigh-quality bonds whose investors have eamed 8% per year in the past. Leslie invested in the New issue Bio-Tech Fund, which invests in small, newiy issued big-tech stocks and vhose investors have eamed an average of 17% per year in the fund's relatively short history. a. If the two women's funds earn the same returns in the future as in the past, how old will each be when she becomes a millionaire? Do not round intermediate calculations Round your answers to two decimal places. b. How large would Alison's annual contributions have to be for her to become a millionaire at the same age as Leslie, assuming their expected returns are realized? Do not round intermediate calculations. Round your answer to the nearest cent. 5 c. Is it rational or irrational for Allison to invest in the bond fund rather than in stocks? 1. High expected returns in the market are aimost always accompanied by a lot of risk. We couldn' say whether Alison is rationat or irrational, just that she seems to have less tolerance for risk than Lesle does. It. High expected returns in the market are almost always accompanied by leis risk. We couldn't say whether Alison is rational or irrational, Just that she seems to have more tolerance for risk than Leslie does. 1i. High expected returns in the market are aimost always accompanied by a lot of risk. We couldnt say whether Alison is rational or irrational, Just that she seems to have more tolerance for risk than Leslie does. IV. Wigh expected returns in the market are almost always accompanied by less risk. We couldn't say whether Alison is rational or imational, Just that she seems to haze less tolerance for risk than Leclie does. V. High expected returns in the market are almost always accompanied by a lot of risk. We couldn't say whether Allivon is rational or irrational, fust that she seems to have about the same tolerance for risk than Lestie does: Your client is 34 years old. She wants to begin saving for retirement, with the first payment to come one year from now. 5 he can save $3,000 per year, and you advise her to invest in the stock market, which you expect to provide an average return of 9% in the future. a. If she follows your advice, how much money will she have at 69 Do not round intermedlate calculations. Round your answer to the nearest cent. b. How much witi she have ot 70 ? Do not round intermediate calculations. Round your answer to the nearest cent. 3 c. She expects to live for 20 years if she retires at 65 and for 15 years if she retires at 70 . If her investments continue to earn the same rate, how much wil she be able to Withdraw at the end of each year after retirement at each retirement age? Do not round intermediate calculations. Round your answers to the nearest cent. Annual witharawals if she retires at 65t. Annwal withdrawals it she retires at 70:5