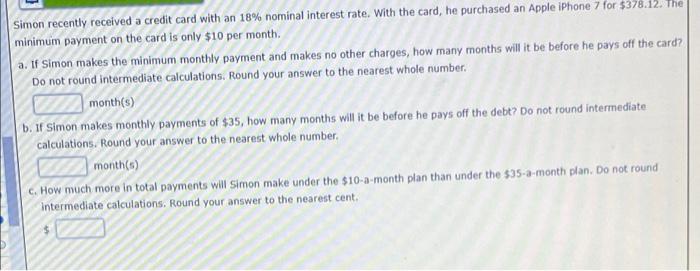

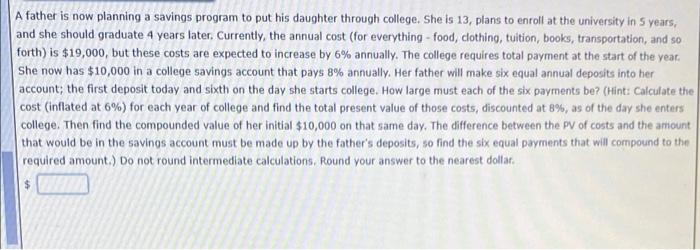

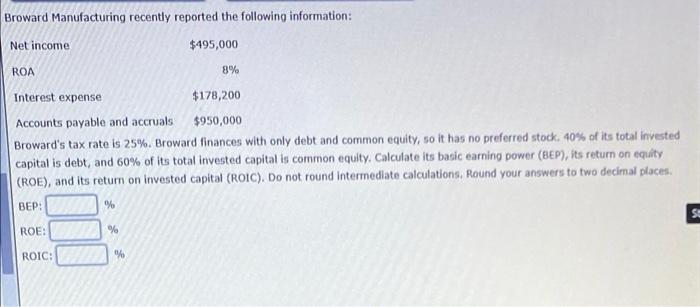

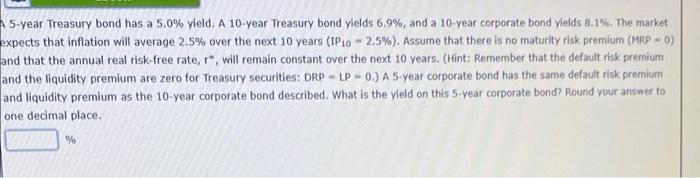

Simon recently received a credit card with an 18% nominal interest rate. With the card, he purchased an Apple iPhone 7 for $378.12. The minimum payment on the card is only $10 per month. a. If Simon makes the minimum monthly payment and makes no other charges, how many months will it be before he pays off the card? Do not round intermediate calculations. Round your answer to the nearest whole number. month(s) b. If Simon makes monthly payments of $35, how many months will it be before he pays off the debt? Do not round intermediate calculations. Round your answer to the nearest whole number. month(s) c. How much more in total payments will Simon make under the $10-a-month plan than under the $35-a-month plan. Do not round intermediate calculations. Round your answer to the nearest cent. A father is now planning a savings program to put his daughter through college. She is 13, plans to enroll at the university in 5 years, and she should graduate 4 years later. Currently, the annual cost (for everything - food, clothing, tuition, books, transportation, and so forth) is $19,000, but these costs are expected to increase by 6% annually. The college requires total payment at the start of the year. She now has $10,000 in a college savings account that pays 8% annually. Her father will make six equal annual deposits into her account; the first deposit today and sixth on the day she starts college. How large must each of the six payments be? (Hint: Calculate the cost (inflated at 6%) for each year of college and find the total present value of those costs, discounted at 8%, as of the day she enters college. Then find the compounded value of her initial $10,000 on that same day. The difference between the PV of costs and the amount that would be in the savings account must be made up by the father's deposits, so find the six equal payments that will compound to the required amount.) Do not round intermediate calculations. Round your answer to the nearest dollar. Broward Manufacturing recently reported the following information: Net income. $495,000 8% Interest expense $178,200 Accounts payable and accruals $950,000 Broward's tax rate is 25%. Broward finances with only debt and common equity, so it has no preferred stock. 40% of its total invested capital is debt, and 60% of its total invested capital is common equity. Calculate its basic earning power (BEP), its return on equity (ROE), and its return on invested capital (ROIC). Do not round intermediate calculations, Round your answers to two decimal places. BEP: % ROA ROE: ROIC: % % St A 5-year Treasury bond has a 5.0% yield. A 10-year Treasury bond yields 6.9%, and a 10-year corporate bond yields 8.1%. The market expects that inflation will average 2.5% over the next 10 years (IP10- 2.5%). Assume that there is no maturity risk premium (MRP - 0) and that the annual real risk-free rate, r", will remain constant over the next 10 years. (Hint: Remember that the default risk premium and the liquidity premium are zero for Treasury securities: DRP LP-0.) A 5-year corporate bond has the same default risk premium and liquidity premium as the 10-year corporate bond described. What is the yield on this 5-year corporate bond? Round your answer to one decimal place. %