Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Simone is 67 years old and she currently receives OAS benefits of $607 per month and CPP retirement benefits of $840 per month. As it

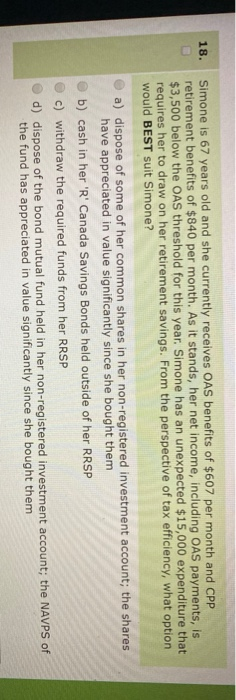

Simone is 67 years old and she currently receives OAS benefits of $607 per month and CPP retirement benefits of $840 per month. As it stands, her net income, including OAS payments, is $3,500 below the OAS threshold for this year. Simone has an unexpected $15,000 expenditure that requires her to draw on her retirement savings. From the perspective of tax efficiency, what option would BEST suit Simone? a) dispose of some of her common shares in her non-registered investment account; the shares have appreciated in value significantly since she bought them b) cash in her ' R ' Canada Savings Bonds held outside of her RRSP c) withdraw the required funds from her RRSP d) dispose of the bond mutual fund held in her non-registered investment account; the NAVPS of the fund has appreciated in value significantly since she bought them

Simone is 67 years old and she currently receives OAS benefits of $607 per month and CPP retirement benefits of $840 per month. As it stands, her net income, including OAS payments, is $3,500 below the OAS threshold for this year. Simone has an unexpected $15,000 expenditure that requires her to draw on her retirement savings. From the perspective of tax efficiency, what option would BEST suit Simone? a) dispose of some of her common shares in her non-registered investment account; the shares have appreciated in value significantly since she bought them b) cash in her ' R ' Canada Savings Bonds held outside of her RRSP c) withdraw the required funds from her RRSP d) dispose of the bond mutual fund held in her non-registered investment account; the NAVPS of the fund has appreciated in value significantly since she bought them Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started