Answered step by step

Verified Expert Solution

Question

1 Approved Answer

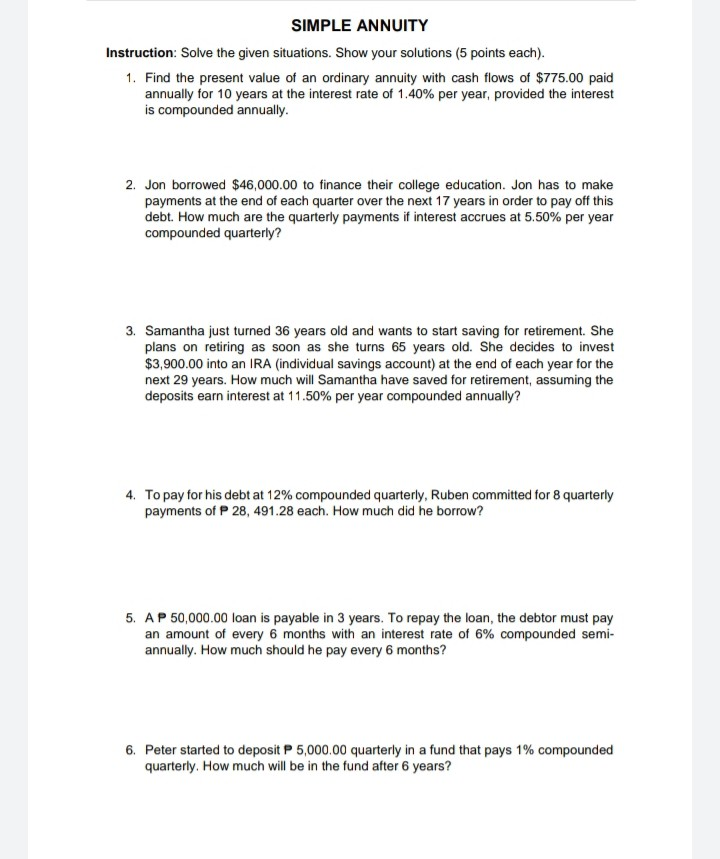

SIMPLE ANNUITY Instruction: Solve the given situations. Show your solutions (5 points each). 1. Find the present value of an ordinary annuity with cash flows

SIMPLE ANNUITY Instruction: Solve the given situations. Show your solutions (5 points each). 1. Find the present value of an ordinary annuity with cash flows of $775.00 paid annually for 10 years at the interest rate of 1.40% per year, provided the interest is compounded annually. 2. Jon borrowed $46,000.00 to finance their college education. Jon has to make payments at the end of each quarter over the next 17 years in order to pay off this debt. How much are the quarterly payments if interest accrues at 5.50% per year compounded quarterly? 3. Samantha just turned 36 years old and wants to start saving for retirement. She plans on retiring as soon as she turns 65 years old. She decides to invest $3,900.00 into an IRA (individual savings account) at the end of each year for the next 29 years. How much will Samantha have saved for retirement, assuming the deposits earn interest at 11.50% per year compounded annually? 4. To pay for his debt at 12% compounded quarterly, Ruben committed for 8 quarterly payments of P 28, 491.28 each. How much did he borrow? 5. AP 50,000.00 loan is payable in 3 years. To repay the loan, the debtor must pay an amount of every 6 months with an interest rate of 6% compounded semi- annually. How much should he pay every 6 months? 6. Peter started to deposit P 5,000.00 quarterly in a fund that pays 1% compounded quarterly. How much will be in the fund after 6 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started