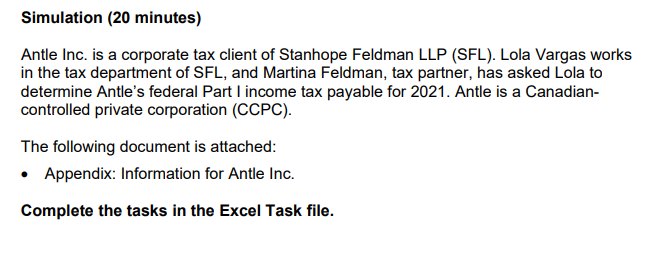

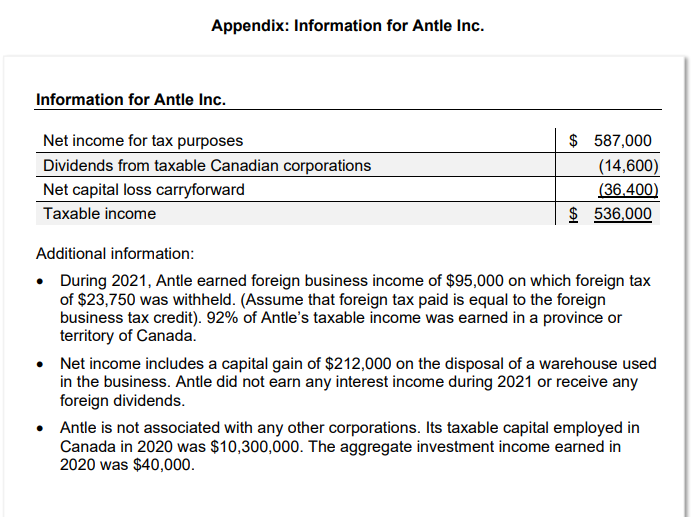

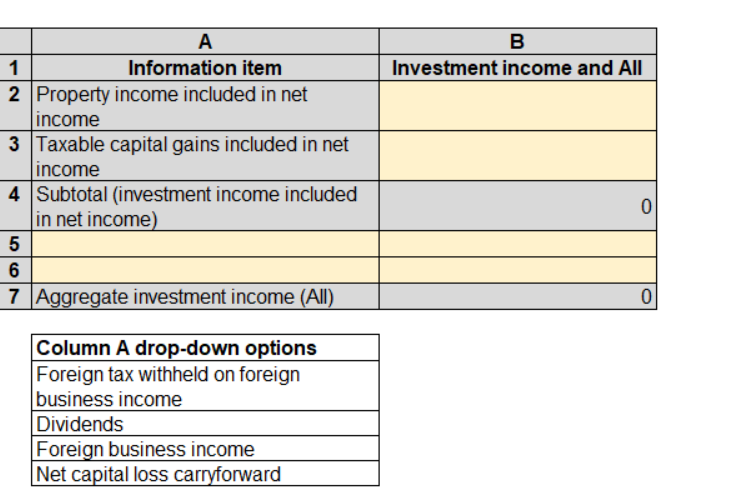

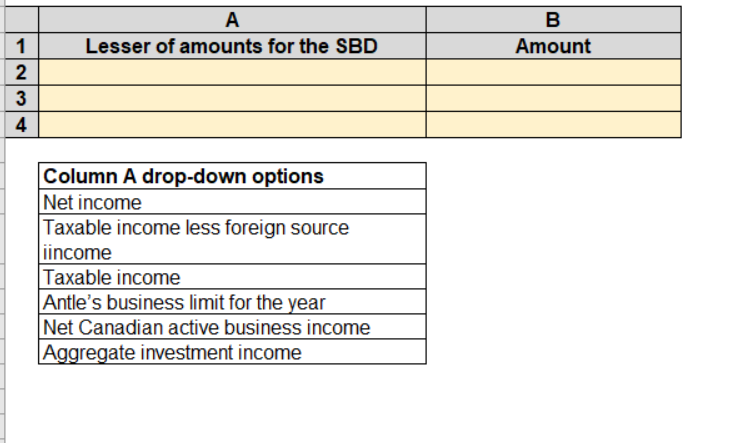

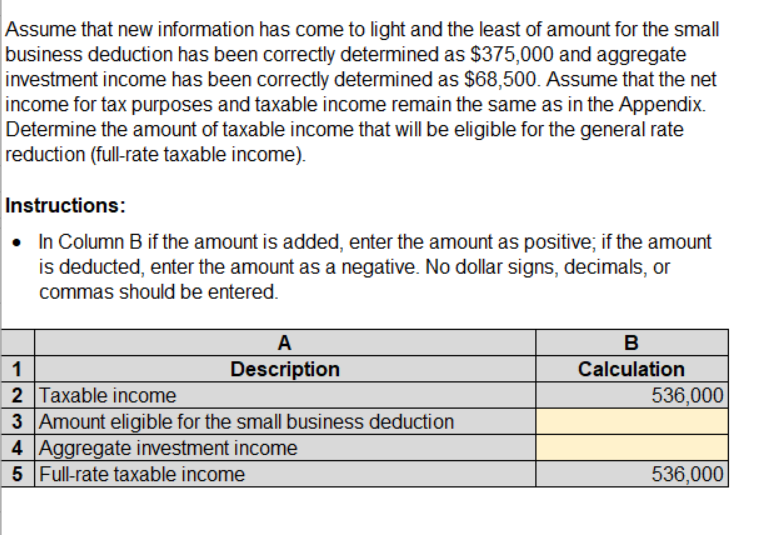

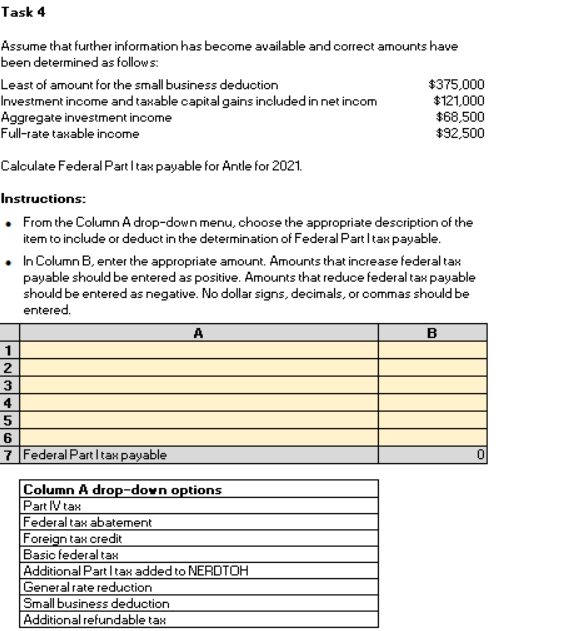

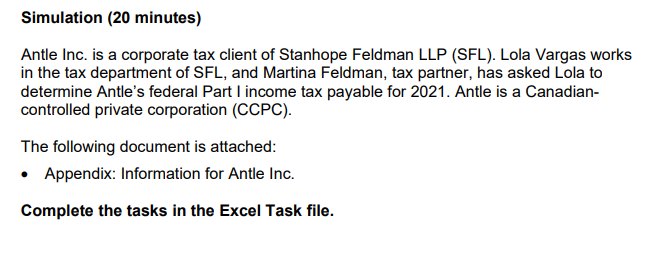

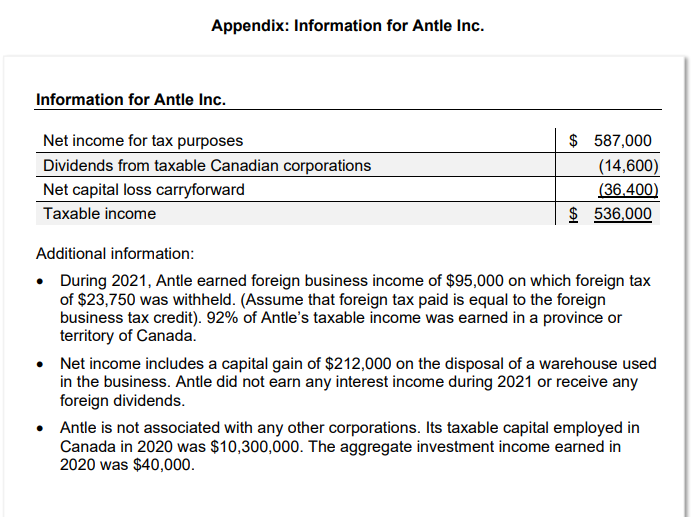

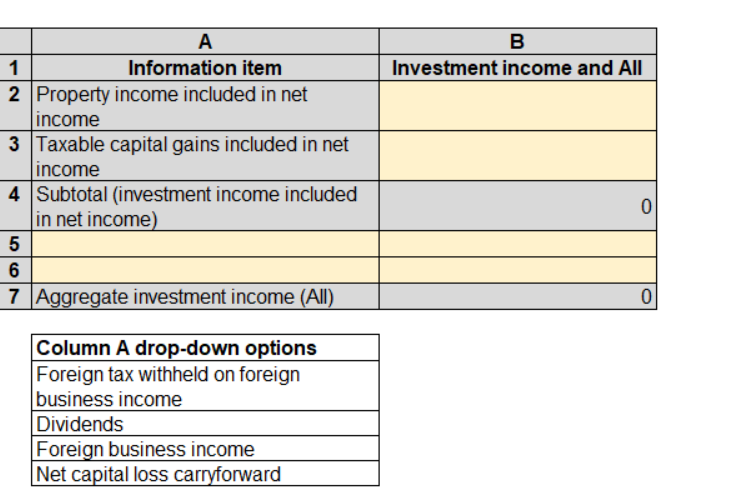

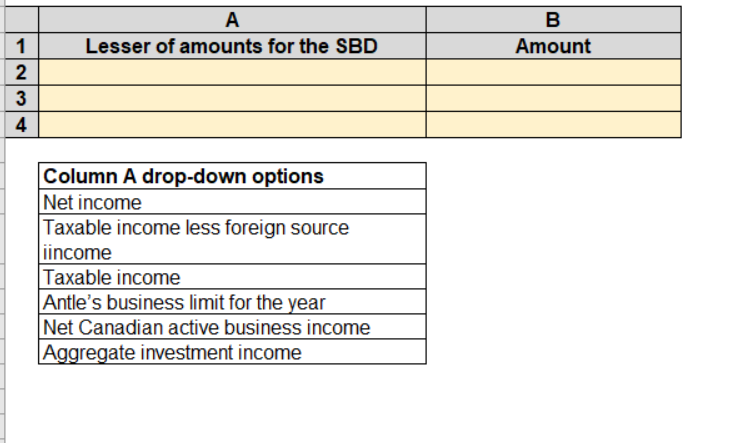

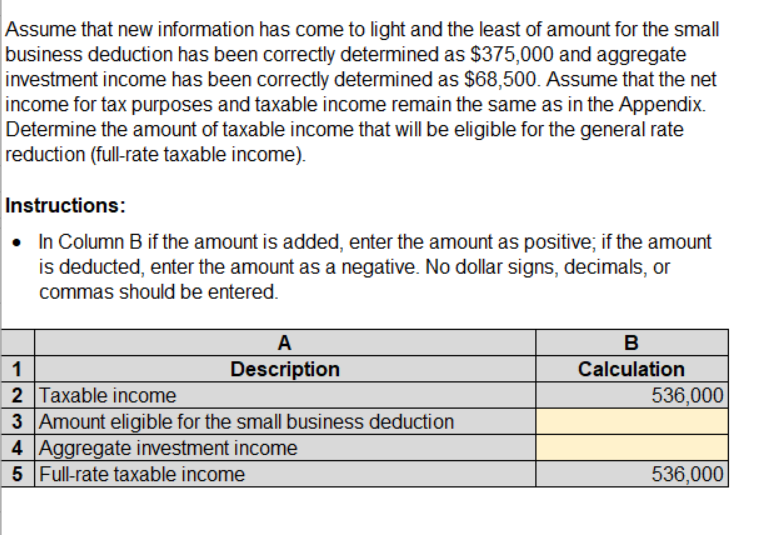

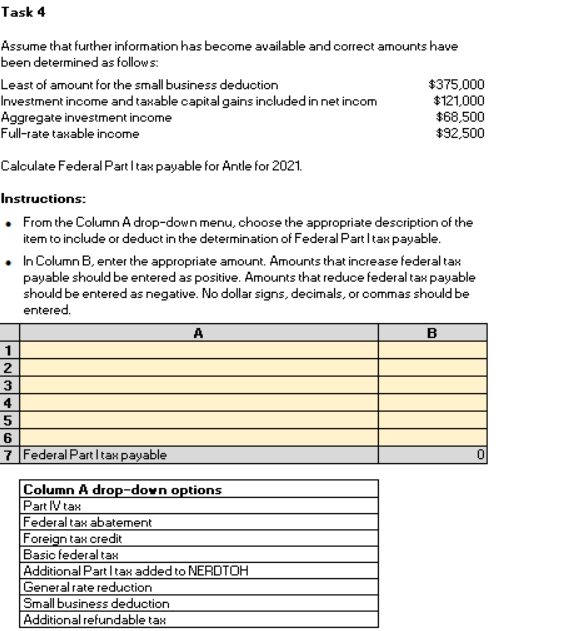

Simulation (20 minutes) Antle Inc. is a corporate tax client of Stanhope Feldman LLP (SFL). Lola Vargas works in the tax department of SFL, and Martina Feldman, tax partner, has asked Lola to determine Antle's federal Part I income tax payable for 2021. Antle is a Canadian- controlled private corporation (CCPC). The following document is attached: Appendix: Information for Antle Inc. Complete the tasks in the Excel Task file. Appendix: Information for Antle Inc. Information for Antle Inc. Net income for tax purposes $ 587,000 Dividends from taxable Canadian corporations (14,600) Net capital loss carryforward (36,400) Taxable income $536,000 Additional information: During 2021, Antle earned foreign business income of $95,000 on which foreign tax of $23,750 was withheld. (Assume that foreign tax paid is equal to the foreign business tax credit). 92% of Antle's taxable income was earned in a province or territory of Canada. Net income includes a capital gain of $212,000 on the disposal of a warehouse used in the business. Antle did not earn any interest income during 2021 or receive any foreign dividends. Antle is not associated with any other corporations. Its taxable capital employed in Canada in 2020 was $10,300,000. The aggregate investment income earned in 2020 was $40,000. A 1 Information item 2 Property income included in net income 3 Taxable capital gains included in net income 4 Subtotal (investment income included in net income) 5 6 7 Aggregate investment income (All) Column A drop-down options Foreign tax withheld on foreign business income Dividends Foreign business income Net capital loss carryforward B Investment income and All 0 0 1 2 23 A Lesser of amounts for the SBD 3 4 Column A drop-down options Net income Taxable income less foreign source iincome Taxable income Antle's business limit for the year Net Canadian active business income Aggregate investment income B Amount Assume that new information has come to light and the least of amount for the small business deduction has been correctly determined as $375,000 and aggregate investment income has been correctly determined as $68,500. Assume that the net income for tax purposes and taxable income remain the same as in the Appendix. Determine the amount of taxable income that will be eligible for the general rate reduction (full-rate taxable income). Instructions: In Column B if the amount is added, enter the amount as positive; if the amount is deducted, enter the amount as a negative. No dollar signs, decimals, or commas should be entered. A B 1 Description Calculation 2 Taxable income 3 Amount eligible for the small business deduction 4 Aggregate investment income 5 Full-rate taxable income 536,000 536,000 Task 4 Assume that further information has become available and correct amounts have been determined as follows: Least of amount for the small business deduction $375,000 $121,000 Investment income and taxable capital gains included in net incom Aggregate investment income $68,500 Full-rate taxable income $92,500 Calculate Federal Part I tax payable for Antle for 2021. Instructions: From the Column A drop-down menu, choose the appropriate description of the item to include or deduct in the determination of Federal Part I tax payable. In Column B, enter the appropriate amount. Amounts that increase federal tax payable should be entered as positive. Amounts that reduce federal tax payable should be entered as negative. No dollar signs, decimals, or commas should be entered. A B 1 2 3 4 5 6 7 Federal Part Itax payable Column A drop-down options Part IV tax Federal tax abatement Foreign tax credit Basic federal tax Additional Part I tax added to NERDTOH General rate reduction Small business deduction Additional refundable tax |W|N] = 0 Simulation (20 minutes) Antle Inc. is a corporate tax client of Stanhope Feldman LLP (SFL). Lola Vargas works in the tax department of SFL, and Martina Feldman, tax partner, has asked Lola to determine Antle's federal Part I income tax payable for 2021. Antle is a Canadian- controlled private corporation (CCPC). The following document is attached: Appendix: Information for Antle Inc. Complete the tasks in the Excel Task file. Appendix: Information for Antle Inc. Information for Antle Inc. Net income for tax purposes $ 587,000 Dividends from taxable Canadian corporations (14,600) Net capital loss carryforward (36,400) Taxable income $536,000 Additional information: During 2021, Antle earned foreign business income of $95,000 on which foreign tax of $23,750 was withheld. (Assume that foreign tax paid is equal to the foreign business tax credit). 92% of Antle's taxable income was earned in a province or territory of Canada. Net income includes a capital gain of $212,000 on the disposal of a warehouse used in the business. Antle did not earn any interest income during 2021 or receive any foreign dividends. Antle is not associated with any other corporations. Its taxable capital employed in Canada in 2020 was $10,300,000. The aggregate investment income earned in 2020 was $40,000. A 1 Information item 2 Property income included in net income 3 Taxable capital gains included in net income 4 Subtotal (investment income included in net income) 5 6 7 Aggregate investment income (All) Column A drop-down options Foreign tax withheld on foreign business income Dividends Foreign business income Net capital loss carryforward B Investment income and All 0 0 1 2 23 A Lesser of amounts for the SBD 3 4 Column A drop-down options Net income Taxable income less foreign source iincome Taxable income Antle's business limit for the year Net Canadian active business income Aggregate investment income B Amount Assume that new information has come to light and the least of amount for the small business deduction has been correctly determined as $375,000 and aggregate investment income has been correctly determined as $68,500. Assume that the net income for tax purposes and taxable income remain the same as in the Appendix. Determine the amount of taxable income that will be eligible for the general rate reduction (full-rate taxable income). Instructions: In Column B if the amount is added, enter the amount as positive; if the amount is deducted, enter the amount as a negative. No dollar signs, decimals, or commas should be entered. A B 1 Description Calculation 2 Taxable income 3 Amount eligible for the small business deduction 4 Aggregate investment income 5 Full-rate taxable income 536,000 536,000 Task 4 Assume that further information has become available and correct amounts have been determined as follows: Least of amount for the small business deduction $375,000 $121,000 Investment income and taxable capital gains included in net incom Aggregate investment income $68,500 Full-rate taxable income $92,500 Calculate Federal Part I tax payable for Antle for 2021. Instructions: From the Column A drop-down menu, choose the appropriate description of the item to include or deduct in the determination of Federal Part I tax payable. In Column B, enter the appropriate amount. Amounts that increase federal tax payable should be entered as positive. Amounts that reduce federal tax payable should be entered as negative. No dollar signs, decimals, or commas should be entered. A B 1 2 3 4 5 6 7 Federal Part Itax payable Column A drop-down options Part IV tax Federal tax abatement Foreign tax credit Basic federal tax Additional Part I tax added to NERDTOH General rate reduction Small business deduction Additional refundable tax |W|N] = 0