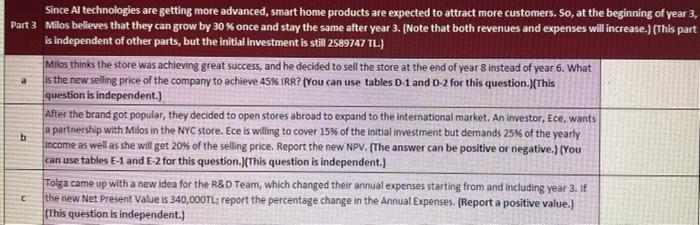

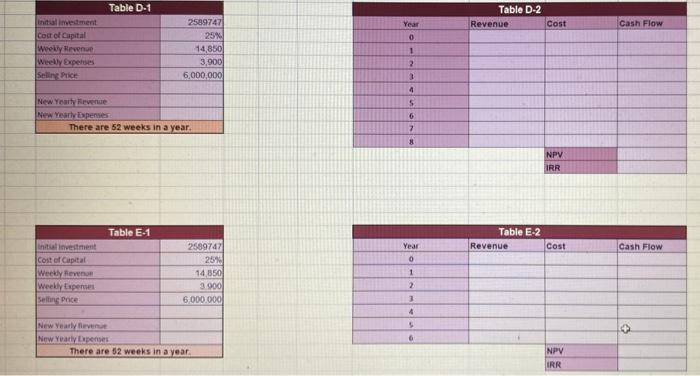

Since Al technologies are getting more advanced, smart home products are expected to attract more customers. So, at the beginning of year 3, Part 3 Milos believes that they can grow by 30% once and stay the same after year 3. (Note that both revenues and expenses will increase.) (This part is independent of other parts, but the initial investment is still 2589747 TL.) Milos thinks the store was achieving great success, and he decided to sell the store at the end of year 8 instead of year 6. What is the new selling price of the company to achieve 45% IRR? [You can use tables D1 and D-2 for this question. (This question is independent.) After the brand got popular, they decided to open stores abroad to expand to the international market. An investor. Ece, wants a partnership with Milos in the NYC store. Ece is willing to cover 15% of the initial investment but demands 25% of the yearly Income as well as she will get 20% of the selling price. Report the new NPV. (The answer can be positive or negative.) (You can use tables E-1 and E-2 for this question. (This question is independent) Tolga came up with a new idea for the R&D Team, which changed their annual expenses starting from and including year 3. If the new Net Present Value is 340,000TL; report the percentage change in the Annual Expenses. (Report a positive value.) (This question is independent.) b Table D-1 Table D-2 Revenue Cost Cash Flow Year 0 Inimestment Coat of Capital Weekly Revenue Weekly Expenses Selling Price 2589747 25% 14,850 3,900 6,000,000 1 2 3 4 New Yearly evene New Yearly penes There are 52 weeks in a year S 6 7 8 NPV IRR Table E-1 Table E-2 Revenue Cost Year 0 Cash Flow initivement Cost of Capital Weekly even Weekly Experts Selling Price 2589747 25% 14 850 3.000 6.000.000 1 2 3 4 New Yearly even New Yearly pense There are 52 weeks in a year 5 6 > NPV IRR Since Al technologies are getting more advanced, smart home products are expected to attract more customers. So, at the beginning of year 3, Part 3 Milos believes that they can grow by 30% once and stay the same after year 3. (Note that both revenues and expenses will increase.) (This part is independent of other parts, but the initial investment is still 2589747 TL.) Milos thinks the store was achieving great success, and he decided to sell the store at the end of year 8 instead of year 6. What is the new selling price of the company to achieve 45% IRR? [You can use tables D1 and D-2 for this question. (This question is independent.) After the brand got popular, they decided to open stores abroad to expand to the international market. An investor. Ece, wants a partnership with Milos in the NYC store. Ece is willing to cover 15% of the initial investment but demands 25% of the yearly Income as well as she will get 20% of the selling price. Report the new NPV. (The answer can be positive or negative.) (You can use tables E-1 and E-2 for this question. (This question is independent) Tolga came up with a new idea for the R&D Team, which changed their annual expenses starting from and including year 3. If the new Net Present Value is 340,000TL; report the percentage change in the Annual Expenses. (Report a positive value.) (This question is independent.) b Table D-1 Table D-2 Revenue Cost Cash Flow Year 0 Inimestment Coat of Capital Weekly Revenue Weekly Expenses Selling Price 2589747 25% 14,850 3,900 6,000,000 1 2 3 4 New Yearly evene New Yearly penes There are 52 weeks in a year S 6 7 8 NPV IRR Table E-1 Table E-2 Revenue Cost Year 0 Cash Flow initivement Cost of Capital Weekly even Weekly Experts Selling Price 2589747 25% 14 850 3.000 6.000.000 1 2 3 4 New Yearly even New Yearly pense There are 52 weeks in a year 5 6 > NPV IRR