Answered step by step

Verified Expert Solution

Question

1 Approved Answer

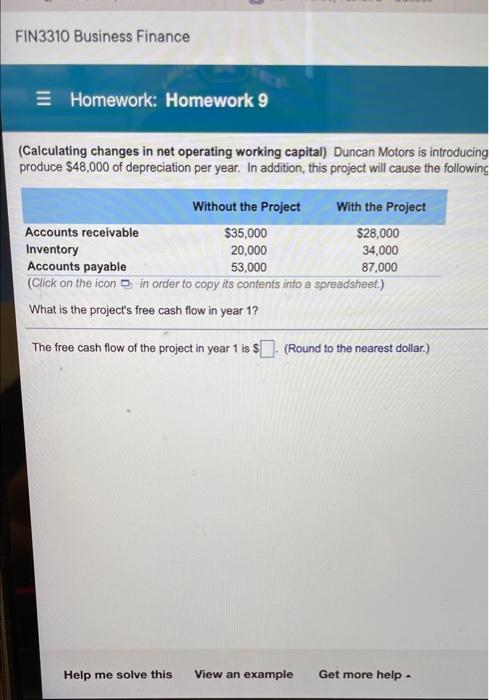

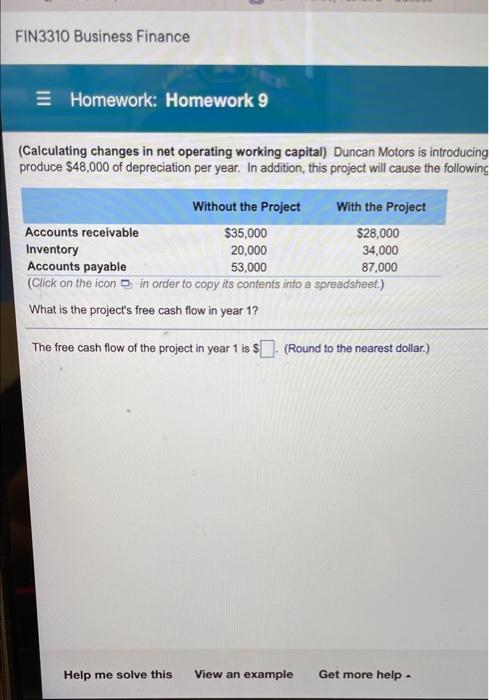

since it come out blurry i added two questions. FIN3310 Business Finance Homework: Homework 9 (Calculating changes in net operating working capital) Duncan Motors is

since it come out blurry i added two questions.

FIN3310 Business Finance Homework: Homework 9 (Calculating changes in net operating working capital) Duncan Motors is introducing produce $48,000 of depreciation per year. In addition, this project will cause the following Without the Project With the Project Accounts receivable $35,000 $28,000 Inventory 20,000 34,000 Accounts payable 53,000 87,000 (Click on the icon in order to copy its contents into a spreadsheet.) What is the project's free cash flow in year 1? The free cash flow of the project in year 1 is $. (Round to the nearest dollar.) Help me solve this View an example Get more help Question 3, P12-9 (simil... HW Score: 62.5%, 50 of 80 points Points: 0 of 10 Save troducing a new product and has an expected change in net operating income of $315,000. Duncan Motors has a 32 percent marginal tax rate. This project will also following changes in year 1: ar) Clear all Check answer help MacBook Pro 1 % 5 & 7 8 6 9 o delete a V P

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started