Answered step by step

Verified Expert Solution

Question

1 Approved Answer

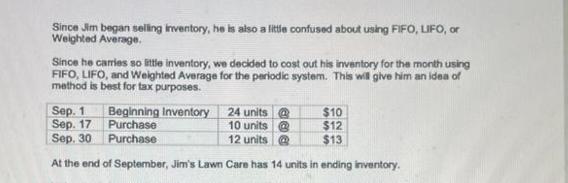

Since Jim began selling inventory, he is also a little confused about using FIFO, LIFO, or Weighted Average. Since he carries so little inventory,

Since Jim began selling inventory, he is also a little confused about using FIFO, LIFO, or Weighted Average. Since he carries so little inventory, we decided to cost out his inventory for the month using FIFO, LIFO, and Weighted Average for the periodic system. This will give him an idea of method is best for tax purposes. Sep. 1 $10 Sep. 17 24 units @ 10 units @ $12 Sep. 30 12 units@ $13 At the end of September, Jim's Lawn Care has 14 units in ending inventory. Beginning Inventory Purchase Purchase Using the information above, calculate Jim's Lawn Care's ending inventory and cost of merchandise sold in all three methods (FIFO, LIFO, Weighted average) using a periodic inventory system.

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Using FIFO FirstIn FirstOut The 24 units from the beginning inventory are sold first Then 10 units are sold from the September 17 purchase leaving 2 u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started