Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Since October 23, 1995, the country of Jordan has pegged its currency, the dinar, at 1 dinar =1.41044 dollars (1 U.S. dollar =0.709 dinar) Let's

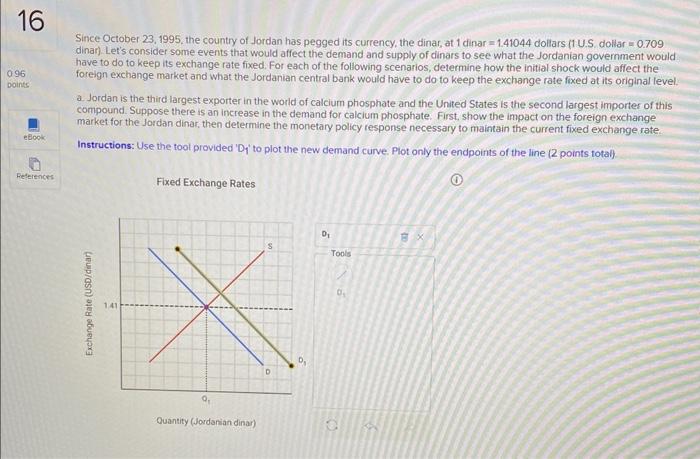

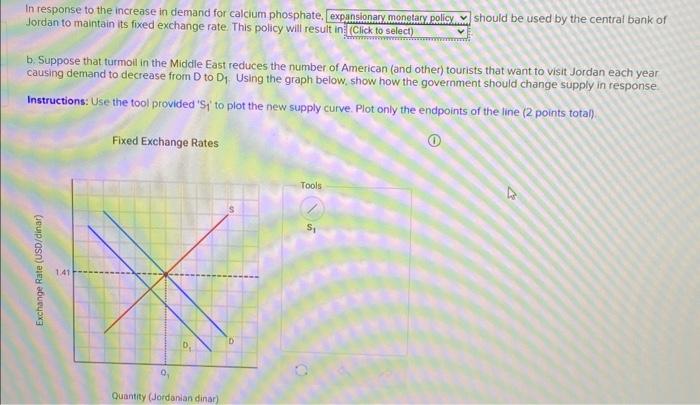

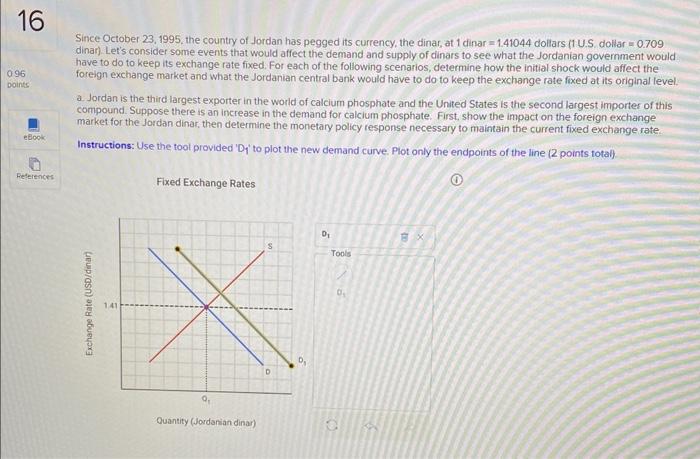

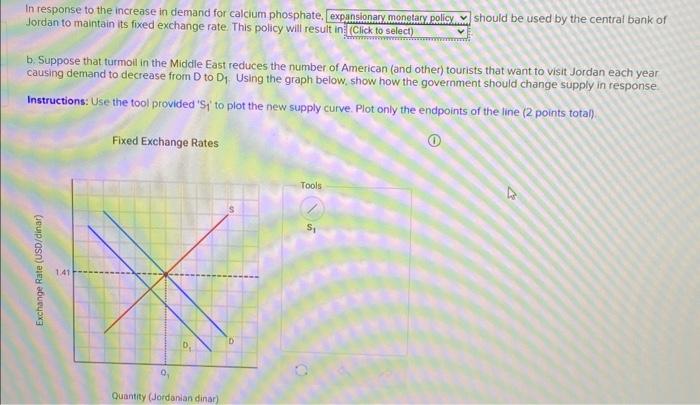

Since October 23, 1995, the country of Jordan has pegged its currency, the dinar, at 1 dinar =1.41044 dollars (1 U.S. dollar =0.709 dinar) Let's consider some events that would affect the demand and supply of dinars to see what the Jordanian government would have to do to keep its exchange rate fixed. For each of the following scenarios, determine how the initial shock would affect the foreign exchange market and what the Jordanian central bank would have to do to keep the exchange rate fixed at its original level. a. Jordan is the third largest exporter in the world of calcium phosphate and the United States is the second largest importer of this compound. Suppose there is an increase in the demand for calcium phosphate. First, show the impact on the foreign exchange market for the Jordan dinar, then determine the monetary policy response necessary to maintain the current fixed exchange rate Instructions: Use the tool provided 'Di' to plot the new demand curve. Plot only the endpoints of the line ( 2 points total) In response to the increase in demand for calcium phosphate. should be used by the central bank of Jordan to maintain its fixed exchange rate This policy will resuit in b. Suppose that turmoli in the Middle East reduces the number of American (and other) tourists that want to visit Jordan each year causing demand to decrease from D to D1. Using the graph below, show how the government should change supply in response Instructions: Use the tool provided 'Si' to plot the new supply curve. Plot only the endpoints of the line (2 points total). Fixed Exchange Rates (1) In response to the decrease in tourism, should be used by the central bank of Jordan to maintain its fuxed exchange rate Since October 23, 1995, the country of Jordan has pegged its currency, the dinar, at 1 dinar =1.41044 dollars (1 U.S. dollar =0.709 dinar) Let's consider some events that would affect the demand and supply of dinars to see what the Jordanian government would have to do to keep its exchange rate fixed. For each of the following scenarios, determine how the initial shock would affect the foreign exchange market and what the Jordanian central bank would have to do to keep the exchange rate fixed at its original level. a. Jordan is the third largest exporter in the world of calcium phosphate and the United States is the second largest importer of this compound. Suppose there is an increase in the demand for calcium phosphate. First, show the impact on the foreign exchange market for the Jordan dinar, then determine the monetary policy response necessary to maintain the current fixed exchange rate Instructions: Use the tool provided 'Di' to plot the new demand curve. Plot only the endpoints of the line ( 2 points total) In response to the increase in demand for calcium phosphate. should be used by the central bank of Jordan to maintain its fixed exchange rate This policy will resuit in b. Suppose that turmoli in the Middle East reduces the number of American (and other) tourists that want to visit Jordan each year causing demand to decrease from D to D1. Using the graph below, show how the government should change supply in response Instructions: Use the tool provided 'Si' to plot the new supply curve. Plot only the endpoints of the line (2 points total). Fixed Exchange Rates (1) In response to the decrease in tourism, should be used by the central bank of Jordan to maintain its fuxed exchange rate

Since October 23, 1995, the country of Jordan has pegged its currency, the dinar, at 1 dinar =1.41044 dollars (1 U.S. dollar =0.709 dinar) Let's consider some events that would affect the demand and supply of dinars to see what the Jordanian government would have to do to keep its exchange rate fixed. For each of the following scenarios, determine how the initial shock would affect the foreign exchange market and what the Jordanian central bank would have to do to keep the exchange rate fixed at its original level. a. Jordan is the third largest exporter in the world of calcium phosphate and the United States is the second largest importer of this compound. Suppose there is an increase in the demand for calcium phosphate. First, show the impact on the foreign exchange market for the Jordan dinar, then determine the monetary policy response necessary to maintain the current fixed exchange rate Instructions: Use the tool provided 'Di' to plot the new demand curve. Plot only the endpoints of the line ( 2 points total) In response to the increase in demand for calcium phosphate. should be used by the central bank of Jordan to maintain its fixed exchange rate This policy will resuit in b. Suppose that turmoli in the Middle East reduces the number of American (and other) tourists that want to visit Jordan each year causing demand to decrease from D to D1. Using the graph below, show how the government should change supply in response Instructions: Use the tool provided 'Si' to plot the new supply curve. Plot only the endpoints of the line (2 points total). Fixed Exchange Rates (1) In response to the decrease in tourism, should be used by the central bank of Jordan to maintain its fuxed exchange rate Since October 23, 1995, the country of Jordan has pegged its currency, the dinar, at 1 dinar =1.41044 dollars (1 U.S. dollar =0.709 dinar) Let's consider some events that would affect the demand and supply of dinars to see what the Jordanian government would have to do to keep its exchange rate fixed. For each of the following scenarios, determine how the initial shock would affect the foreign exchange market and what the Jordanian central bank would have to do to keep the exchange rate fixed at its original level. a. Jordan is the third largest exporter in the world of calcium phosphate and the United States is the second largest importer of this compound. Suppose there is an increase in the demand for calcium phosphate. First, show the impact on the foreign exchange market for the Jordan dinar, then determine the monetary policy response necessary to maintain the current fixed exchange rate Instructions: Use the tool provided 'Di' to plot the new demand curve. Plot only the endpoints of the line ( 2 points total) In response to the increase in demand for calcium phosphate. should be used by the central bank of Jordan to maintain its fixed exchange rate This policy will resuit in b. Suppose that turmoli in the Middle East reduces the number of American (and other) tourists that want to visit Jordan each year causing demand to decrease from D to D1. Using the graph below, show how the government should change supply in response Instructions: Use the tool provided 'Si' to plot the new supply curve. Plot only the endpoints of the line (2 points total). Fixed Exchange Rates (1) In response to the decrease in tourism, should be used by the central bank of Jordan to maintain its fuxed exchange rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started