Question

Since Ruth's primary goal is not to make an exorbitant profit, how low could her annual net operating cash flows be and still generate

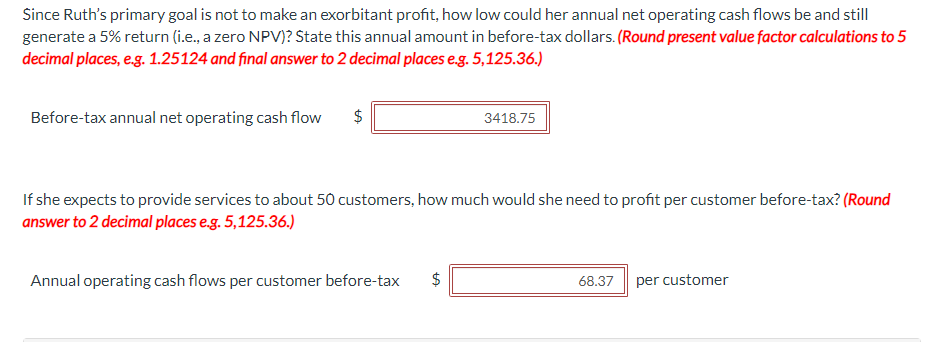

Since Ruth's primary goal is not to make an exorbitant profit, how low could her annual net operating cash flows be and still generate a 5% return (i.e., a zero NPV)? State this annual amount in before-tax dollars. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places e.g. 5,125.36.) Before-tax annual net operating cash flow LA $ 3418.75 If she expects to provide services to about 50 customers, how much would she need to profit per customer before-tax? (Round answer to 2 decimal places e.g. 5,125.36.) Annual operating cash flows per customer before-tax CA $ 68.37 per customer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials of Managerial Finance

Authors: Scott Besley, Eugene F. Brigham

14th edition

324422709, 324422702, 978-0324422702

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App