Answered step by step

Verified Expert Solution

Question

1 Approved Answer

React = Explain HOW this is possible. Use an example for each problem for a thumbs up! 1. React: If a buyer of a

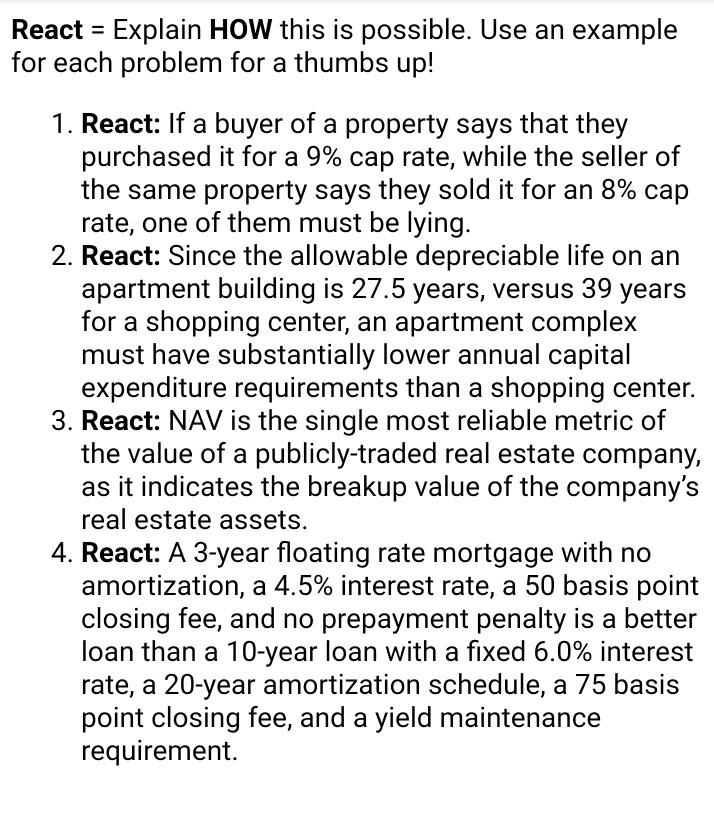

React = Explain HOW this is possible. Use an example for each problem for a thumbs up! 1. React: If a buyer of a property says that they purchased it for a 9% cap rate, while the seller of the same property says they sold it for an 8% cap rate, one of them must be lying. 2. React: Since the allowable depreciable life on an apartment building is 27.5 years, versus 39 years for a shopping center, an apartment complex must have substantially lower annual capital expenditure requirements than a shopping center. 3. React: NAV is the single most reliable metric of the value of a publicly-traded real estate company, as it indicates the breakup value of the company's real estate assets. 4. React: A 3-year floating rate mortgage with no amortization, a 4.5% interest rate, a 50 basis point closing fee, and no prepayment penalty is a better loan than a 10-year loan with a fixed 6.0% interest rate, a 20-year amortization schedule, a 75 basis point closing fee, and a yield maintenance requirement.

Step by Step Solution

★★★★★

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 Cap rate is the ratio of the operating income from the property net capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started