Answered step by step

Verified Expert Solution

Question

1 Approved Answer

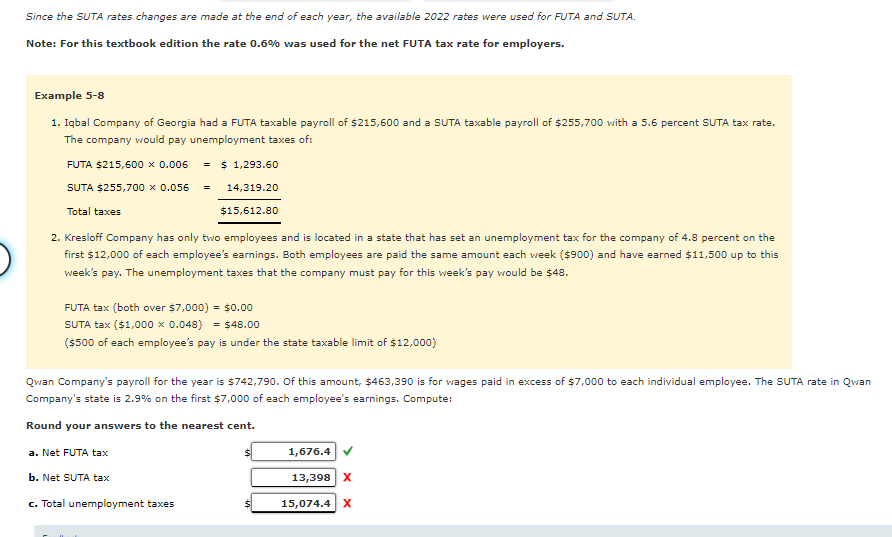

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA. Note: For

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-8 1. Iqbal Company of Georgia had a FUTA taxable payroll of $215,600 and a SUTA taxable payroll of $255,700 with a 5.6 percent SUTA tax rate. The company would pay unemployment taxes of: FUTA $215,6000.006=$1,293.60 SUTA $255,7000.056=$15,612.8014,319.20 Total taxes 2. Kresloff Company has only two employees and is located in a state that has set an unemployment tax for the company of 4.8 percent on the first $12,000 of each employee's earnings. Both employees are paid the same amount each week ( $900) and have earned $11,500 up to this week's pay. The unemployment taxes that the company must pay for this week's pay would be $48. FUTA tax (both over $7,000)=$0.00 SUTA tax($1,0000.048)=$48.00 ( $500 of each employee's pay is under the state taxable limit of $12,000 ) Qwan Company's payroll for the year is $742,790. Of this amount, $463,390 is for wages paid in excess of $7,000 to each individual employee. The SUTA rate in Qwan Company's state is 2.9% on the first $7,000 of each employee's earnings. Compute: Round your answers to the nearest cent

Since the SUTA rates changes are made at the end of each year, the available 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. Example 5-8 1. Iqbal Company of Georgia had a FUTA taxable payroll of $215,600 and a SUTA taxable payroll of $255,700 with a 5.6 percent SUTA tax rate. The company would pay unemployment taxes of: FUTA $215,6000.006=$1,293.60 SUTA $255,7000.056=$15,612.8014,319.20 Total taxes 2. Kresloff Company has only two employees and is located in a state that has set an unemployment tax for the company of 4.8 percent on the first $12,000 of each employee's earnings. Both employees are paid the same amount each week ( $900) and have earned $11,500 up to this week's pay. The unemployment taxes that the company must pay for this week's pay would be $48. FUTA tax (both over $7,000)=$0.00 SUTA tax($1,0000.048)=$48.00 ( $500 of each employee's pay is under the state taxable limit of $12,000 ) Qwan Company's payroll for the year is $742,790. Of this amount, $463,390 is for wages paid in excess of $7,000 to each individual employee. The SUTA rate in Qwan Company's state is 2.9% on the first $7,000 of each employee's earnings. Compute: Round your answers to the nearest cent Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started