Answered step by step

Verified Expert Solution

Question

1 Approved Answer

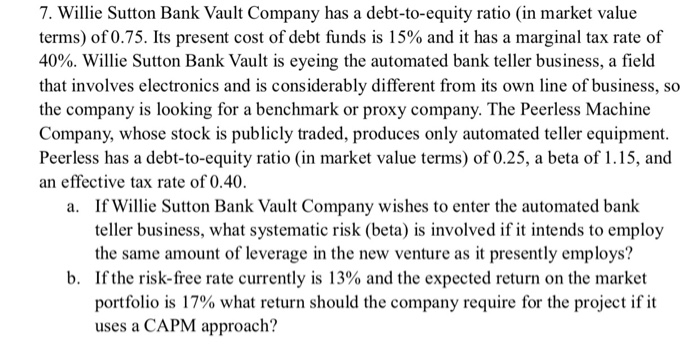

Sincerely thanks!!! 7. Willie Sutton Bank Vault Company has a debt-to-equity ratio (in market value terms) of0.75. Its present cost of debt funds is 15%

Sincerely thanks!!!

7. Willie Sutton Bank Vault Company has a debt-to-equity ratio (in market value terms) of0.75. Its present cost of debt funds is 15% and it has a marginal tax rate of 40%. Willie Sutton Bank Vault is eyeing the automated bank teller business, a field that involves electronics and is considerably different from its own line of business, so the company is looking for a benchmark or proxy company. The Peerless Machine Company, whose stock is publicly traded, produces only automated teller equipment Peerless has a debt-to-equity ratio in market value terms) of 0.25, a beta of 1.15, and an effective tax rate of 0.40 a. If Willie Sutton Bank Vault Company wishes to enter the automated bank teller business, what systematic risk (beta) is involved if it intends to employ the same amount of leverage in the new venture as it presently employs? If the risk-free rate currently is 13% and the expected return on the market portfolio is 17% what return should the company require for the project if it uses a CAPM approach? b Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started