Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sinclair and Reid, an accounting firm, has budgeted $200 000 in fixed expenses per month for the tax department. It has also budgeted variable

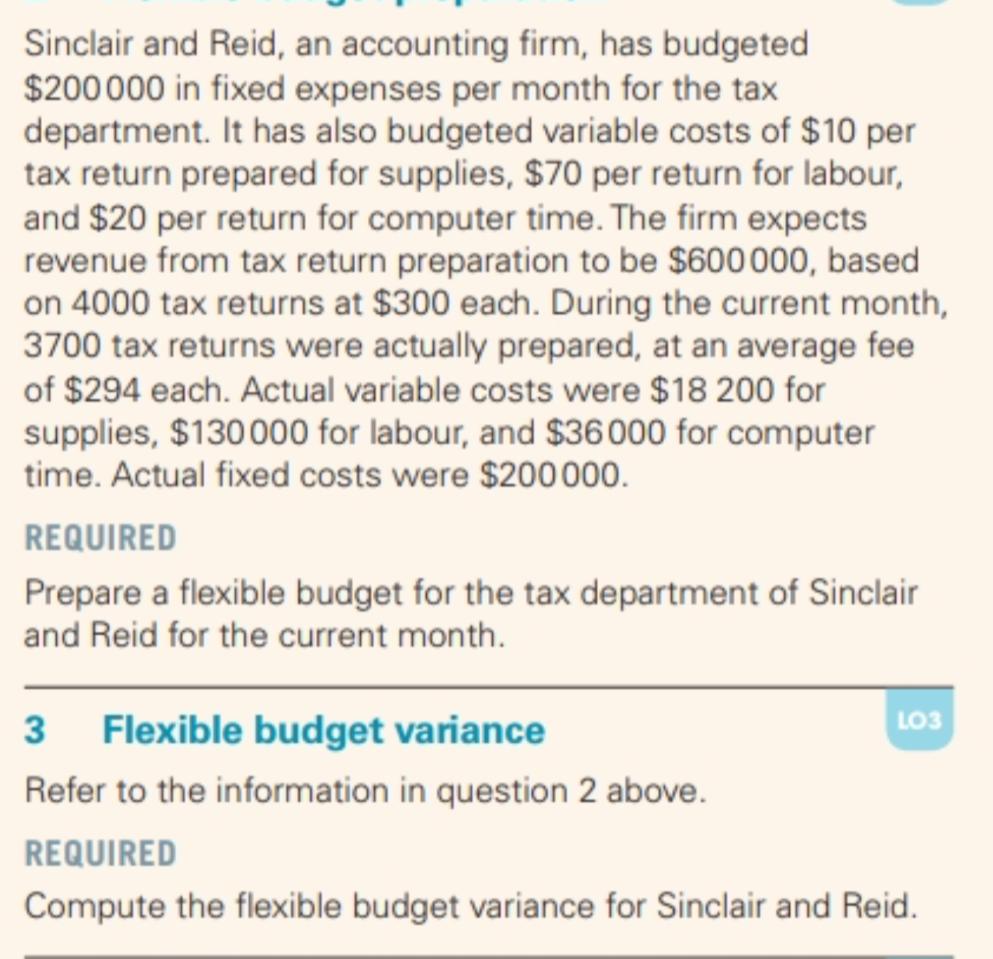

Sinclair and Reid, an accounting firm, has budgeted $200 000 in fixed expenses per month for the tax department. It has also budgeted variable costs of $10 per tax return prepared for supplies, $70 per return for labour, and $20 per return for computer time. The firm expects revenue from tax return preparation to be $600 000, based on 4000 tax returns at $300 each. During the current month, 3700 tax returns were actually prepared, at an average fee of $294 each. Actual variable costs were $18 200 for supplies, $130000 for labour, and $36000 for computer time. Actual fixed costs were $200 000. REQUIRED Prepare a flexible budget for the tax department of Sinclair and Reid for the current month. 3 LO3 Flexible budget variance Refer to the information in question 2 above. REQUIRED Compute the flexible budget variance for Sinclair and Reid.

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Points from Given Information Budgeted Details Fixed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started