Answered step by step

Verified Expert Solution

Question

1 Approved Answer

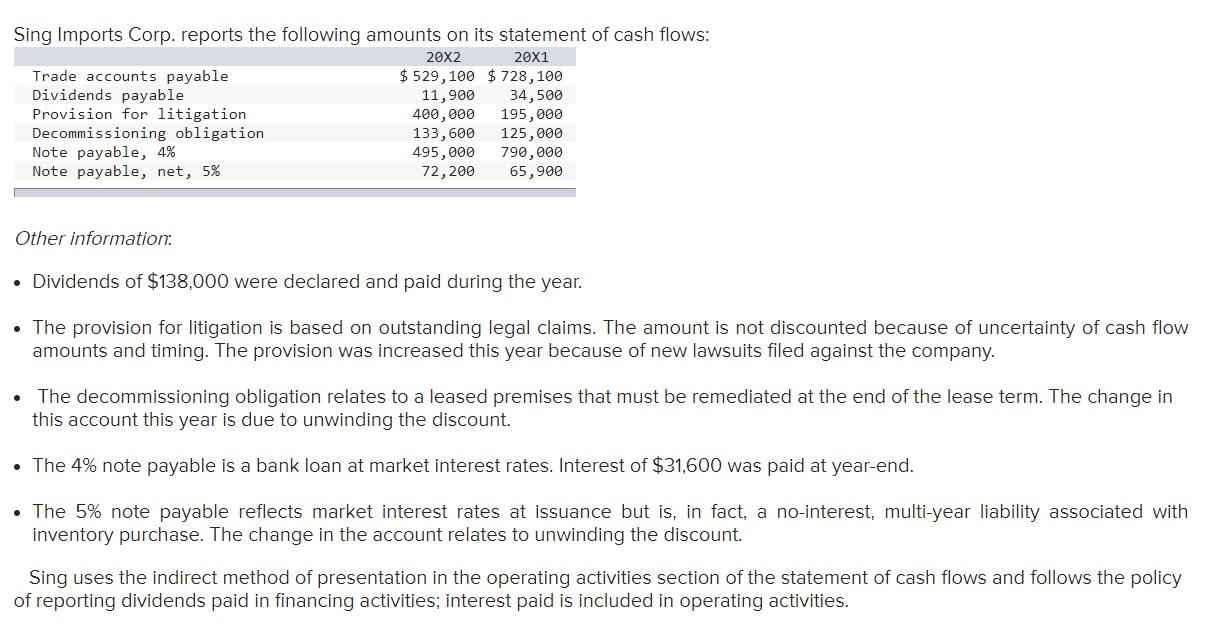

Sing Imports Corp. reports the following amounts on its statement of cash flows: Trade accounts payable Dividends payable Provision for litigation Decommissioning obligation Note

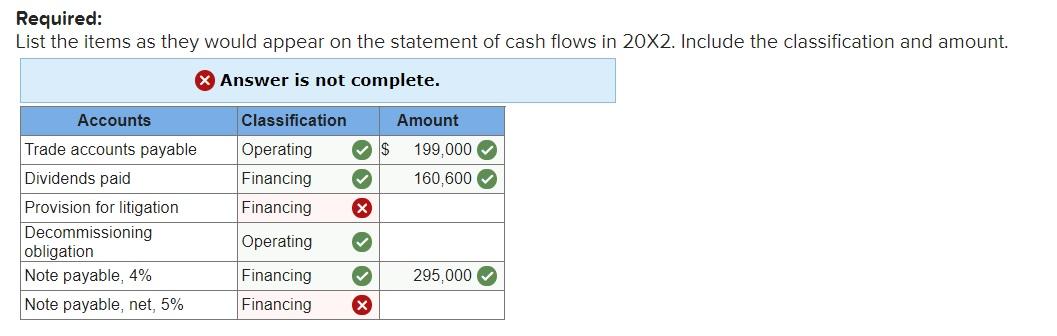

Sing Imports Corp. reports the following amounts on its statement of cash flows: Trade accounts payable Dividends payable Provision for litigation Decommissioning obligation Note payable, 4% Note payable, net, 5% Other information: 20X2 20X1 $529,100 $728,100 11,900 34,500 400,000 195,000 133,600 125,000 495,000 72,200 790,000 65,900 Dividends of $138,000 were declared and paid during the year. The provision for litigation is based on outstanding legal claims. The amount is not discounted because of uncertainty of cash flow amounts and timing. The provision was increased this year because of new lawsuits filed against the company. The decommissioning obligation relates to a leased premises that must be remediated at the end of the lease term. The change in this account this year is due to unwinding the discount. The 4% note payable is a bank loan at market interest rates. Interest of $31,600 was paid at year-end. The 5% note payable reflects market interest rates at issuance but is, in fact, a no-interest, multi-year liability associated with inventory purchase. The change in the account relates to unwinding the discount. Sing uses the indirect method of presentation in the operating activities section of the statement of cash flows and follows the policy of reporting dividends paid in financing activities; interest paid is included in operating activities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started