Question

Singapore Army SAF Procurement Ltd is seeking to place a bid on an Advance Warfare Digital Device (AWDD). The contract requires the vendor to deliver

Singapore Army SAF Procurement Ltd is seeking to place a bid on an Advance Warfare Digital Device (AWDD). The contract requires the vendor to deliver 5 units of AWDD per year for a duration of 3 years. The labour and material costs run at $10,000 per AWDD, while production space can be leased for $12,000 per year. The project requires $50,000 in new equipment which will have a resale value of $10,000 after 3 years. Straight-line depreciation to a value of zero is used. Making AWDD requires a $10,000 increase in net working capital. Assume a 30% tax rate and a required return of 15%. Singapore Army SAF Procurement Ltd submits a bid price of $17,000 per unit. Determine whether the vendor would accept the project or not.

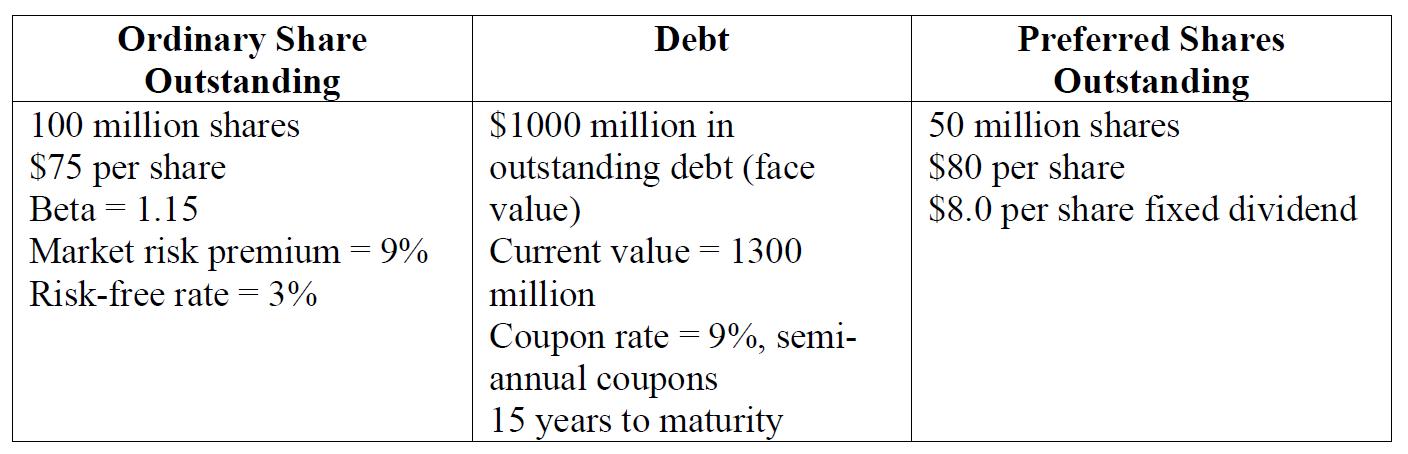

Given the context from the above, an analyst commented that the Singapore Army SAF Procurement Ltd's (through which the bid was submitted) weighted average cost of capital (WACC) should be used instead of the required rate of return for project bid. He researched and found the following information: (a) Help the analyst determine the WACC for the Singapore Army SAF Procurement Ltd.

(a) Help the analyst determine the WACC for the Singapore Army SAF Procurement Ltd.

(b) Explain how your calculated WACC from part (a) will affect the bid price, and the appropriateness of the analyst's use Singapore Army SAF Procurement Ltd's WACC instead of the bid's required rate of return.

Ordinary Share Outstanding 100 million shares $75 per share Beta 1.15 Market risk premium = 9% Risk-free rate = 3% Debt $1000 million in outstanding debt (face value) Current value = 1300 million Coupon rate=9%, semi- annual coupons 15 years to maturity Preferred Shares Outstanding 50 million shares $80 per share $8.0 per share fixed dividend

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution a To calculate the WACC for the Singapore Army SAF Procurement Ltd we need to calculate the cost of equity cost of debt and the weighted aver...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started