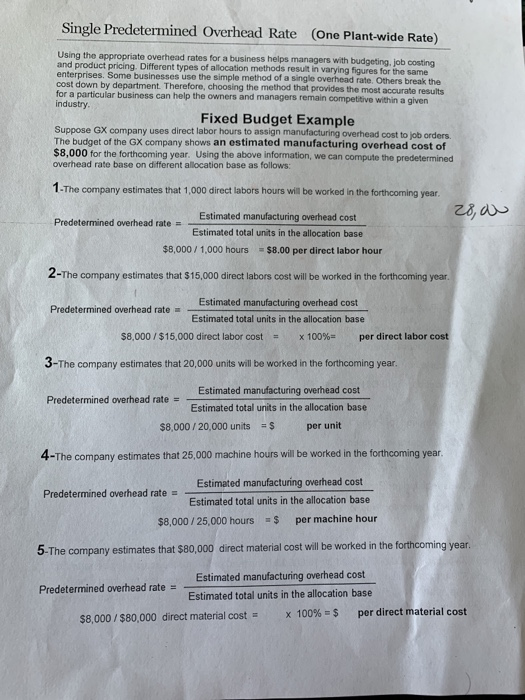

Single Predetermined Overhead Rate (One Plant-wide Rate) Using the appropriate overhead rates for a business helps managers with budgeting, job costing and product pricing. Different types of allocation methods result in varying figures for the same enterprises. Some businesses use the simple method of a single overhead rate. Others break the cost down by department. Therefore, choosing the method that provides the most accurate results for a particular business can help the owners and managers remain competitive within a given industry Fixed Budget Example Suppose GX company uses direct labor hours to assign manufacturing overhead cost to job orders. The budget of the GX company shows an estimated manufacturing overhead cost of $8,000 for the forthcoming year. Using the above information, we can compute the predetermined overhead rate base on different allocation base as follows: 1-The company estimates that 1,000 direct labors hours wil be worked in the forthcoming year Estimated manufacturing overhead cost Predetermined overhead rate = Estimated total units in the allocation base $8,000/1,000 hours = $8.00 per direct labor hour 2-The company estimates that $15,000 direct labors cost will be worked in the forthcoming year. Estimated manufacturing overhead cost Predetermined overhead rate Estimated total units in the allocation base $8,000/$15,000 direct labor cost x 100% per direct labor cost 3-The company estimates that 20,000 units will be worked in the forthcoming year. Estimated manufacturing overhead cost Predetermined overhead rate Estimated total units in the allocation base $8,000/20,000 units $ per unit 4-The company estimates that 25,000 machine hours will be worked in the forthcoming year. Estimated manufacturing overhead cost Predetermined overhead rate Estimated total units in the allocation base per machine hour = $ $8,000/25,000 hours 5-The company estimates that $80,000 direct material cost will be worked in the forthcoming year. Estimated manufacturing overhead cost. Predetermined overhead rate = Estimated total units in the allocation base per direct material cost x 100% $ $8,000 /$80,000 direct material cost Single Predetermined Overhead Rate (One Plant-wide Rate) Using the appropriate overhead rates for a business helps managers with budgeting, job costing and product pricing. Different types of allocation methods result in varying figures for the same enterprises. Some businesses use the simple method of a single overhead rate. Others break the cost down by department. Therefore, choosing the method that provides the most accurate results for a particular business can help the owners and managers remain competitive within a given industry Fixed Budget Example Suppose GX company uses direct labor hours to assign manufacturing overhead cost to job orders. The budget of the GX company shows an estimated manufacturing overhead cost of $8,000 for the forthcoming year. Using the above information, we can compute the predetermined overhead rate base on different allocation base as follows: 1-The company estimates that 1,000 direct labors hours wil be worked in the forthcoming year Estimated manufacturing overhead cost Predetermined overhead rate = Estimated total units in the allocation base $8,000/1,000 hours = $8.00 per direct labor hour 2-The company estimates that $15,000 direct labors cost will be worked in the forthcoming year. Estimated manufacturing overhead cost Predetermined overhead rate Estimated total units in the allocation base $8,000/$15,000 direct labor cost x 100% per direct labor cost 3-The company estimates that 20,000 units will be worked in the forthcoming year. Estimated manufacturing overhead cost Predetermined overhead rate Estimated total units in the allocation base $8,000/20,000 units $ per unit 4-The company estimates that 25,000 machine hours will be worked in the forthcoming year. Estimated manufacturing overhead cost Predetermined overhead rate Estimated total units in the allocation base per machine hour = $ $8,000/25,000 hours 5-The company estimates that $80,000 direct material cost will be worked in the forthcoming year. Estimated manufacturing overhead cost. Predetermined overhead rate = Estimated total units in the allocation base per direct material cost x 100% $ $8,000 /$80,000 direct material cost