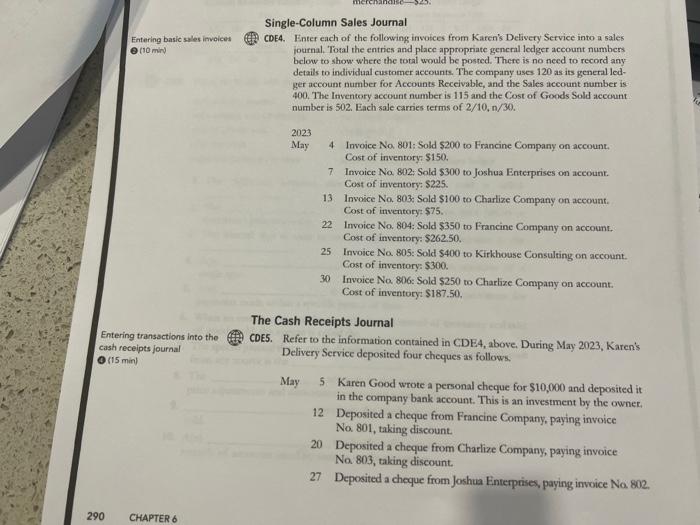

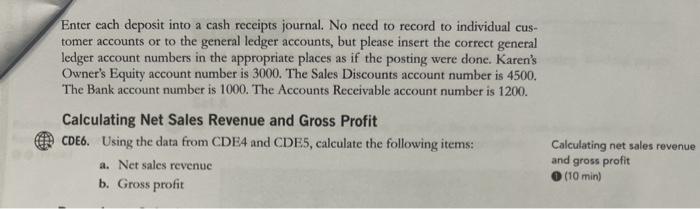

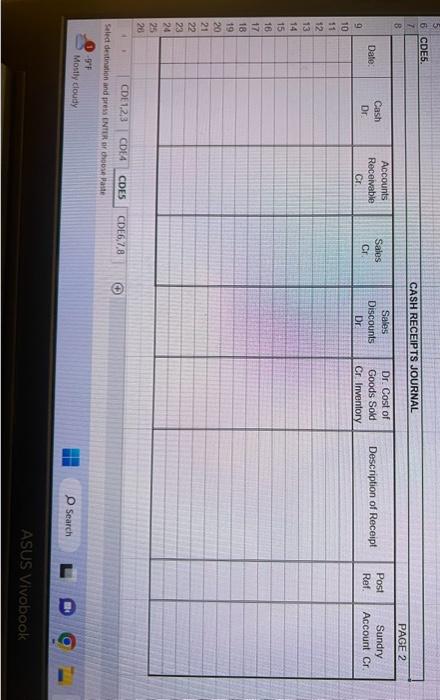

Single-Column Sales Journal Entering basic sales invoices (De CDE. Enter each of the following invoices from Karen's Delivery Service into a 5ales Q (10 min) journal. Total the entrics and place appropriate general ledger account numbers below to show where the total would be posted. There is no need to record any details to individual customer accounts. The company uses 120 as its general ledger account number for Accounts Receivable, and the Sales account number is 400. The Inventory account number is 115 and the Cost of Goods Sold aceount number is 502 . Each sale carnes terms of 2/10,n/30. 2023 May 4 Invoice Na 801 : Sold $200 to Francine Company on account. Cost of inventory: $150, 7. Invoice Na 802; Sold $300 to Joshua Enterprises on account. Cost of inventory: $225. 13. Invoice No. 803. Sold $100 to Charlize Company on account. Cost of inventory: $75. 22 Invoice No. 804: Sold $350 to Francine Company on accouns. Cost of inventory: $262.50. 25 Invoice Na 805 : Sold $400 to Kirkhouse Consuleing on account. Cost of inventory: $300. 30 Invoice Na 806: Sold \$250 to Charlize Company on account. Cost of inventory: $187.50. The Cash Receipts Journal Entering transactions into the CDE5. Refer to the information contained in CDE4, above. During May 2023, Karen's cash receipts journal O (15 min) Delivery Service deposited four cheques as follows. May. 5 Karen Good wrote a personal cheque for $10,000 and deposited it in the company bank account. This is an investment by the owner. 12 Deposited a cheque from Francine Company, paying invoice No. 801, taking discount. 20 Deposited a cheque from Charlize Company, paying invoice No 803 , taking discount. 27 Deposited a cheque from Joshua Enterptises, paying invoice No. 802. Enter each deposit into a cash receipts journal. No need to record to individual customer accounts or to the general ledger accounts, but please insert the correct general ledger account numbers in the appropriate places as if the posting were done. Karen's Owner's Equity account number is 3000 . The Sales Discounts account number is 4500 . The Bank account number is 1000 . The Accounts Receivable account number is 1200. Calculating Net Sales Revenue and Gross Profit CDE6. Using the data from CDE4 and CDE5, calculate the following items: Calculating net sales revenue a. Net sales revenue and gross profit b. Gross profit (1) (10 min) CDE5. CDE 6,7.8 (1) g2F Mostly doudy