Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sinoneca Industries financial performance for 2019 is above average with return on assets of 15 percent and expect sales in 2020 to increase by

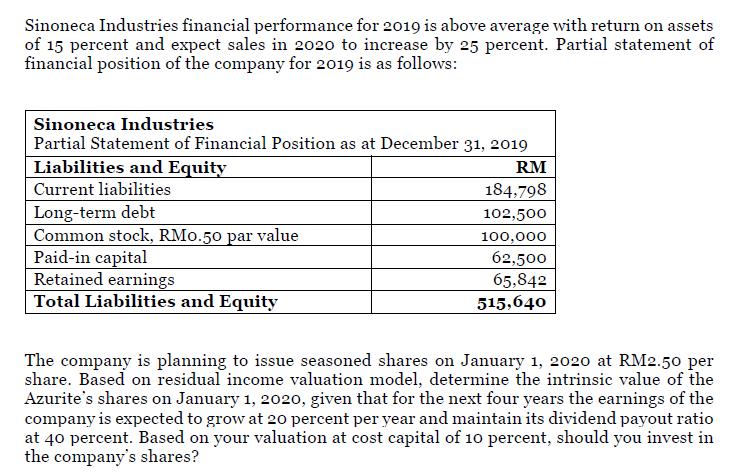

Sinoneca Industries financial performance for 2019 is above average with return on assets of 15 percent and expect sales in 2020 to increase by 25 percent. Partial statement of financial position of the company for 2019 is as follows: Sinoneca Industries Partial Statement of Financial Position as at December 31, 2019 Liabilities and Equity Current liabilities Long-term debt Common stock, RM0.50 par value Paid-in capital Retained earnings Total Liabilities and Equity RM 184,798 102,500 100,000 62,500 65,842 515,640 The company is planning to issue seasoned shares on January 1, 2020 at RM2.50 per share. Based on residual income valuation model, determine the intrinsic value of the Azurite's shares on January 1, 2020, given that for the next four years the earnings of the company is expected to grow at 20 percent per year and maintain its dividend payout ratio at 40 percent. Based on your uation at cost capital of 10 percent, should you invest the company's shares?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the intrinsic value of Sinoneca Industries shares on January 1 2020 we will use the res...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started