Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sir it's one question start from left to right I cropped it to make it more visible please do it correctly will upvote An oil

sir it's one question start from left to right I cropped it to make it more visible please do it correctly will upvote

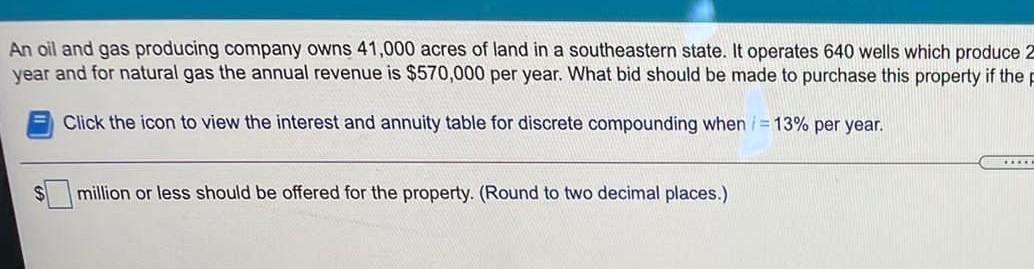

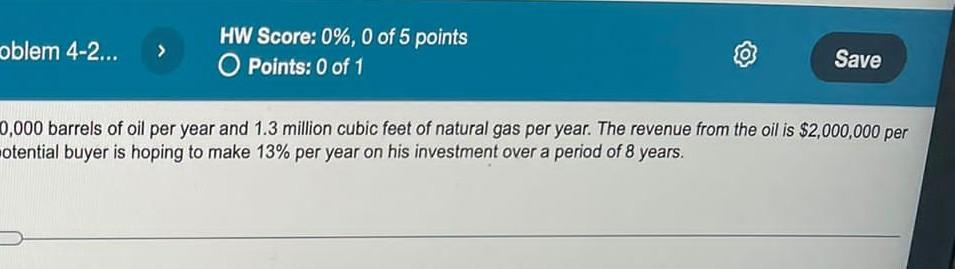

An oil and gas producing company owns 41,000 acres of land in a southeastern state. It operates 640 wells which produce 2 year and for natural gas the annual revenue is $570,000 per year. What bid should be made to purchase this property if the Click the icon to view the interest and annuity table for discrete compounding when = 13% per year. million or less should be offered for the property. (Round to two decimal places.) ern state. It operates 640 wells which produce 20,000 barrels of oil per year and 1.3 million cubic feet of natural gas per year. The hould be made to purchase this property if the potential buyer is hoping to make 13% per year on his investment over a period of nding when i = 13% per year. I places.) oblem 4-2... > HW Score: 0%, 0 of 5 points O Points: 0 of 1 Save 0,000 barrels of oil per year and 1.3 million cubic feet of natural gas per year. The revenue from the oil is $2,000,000 per otential buyer is hoping to make 13% per year on his investment over a period of 8 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started