Answered step by step

Verified Expert Solution

Question

1 Approved Answer

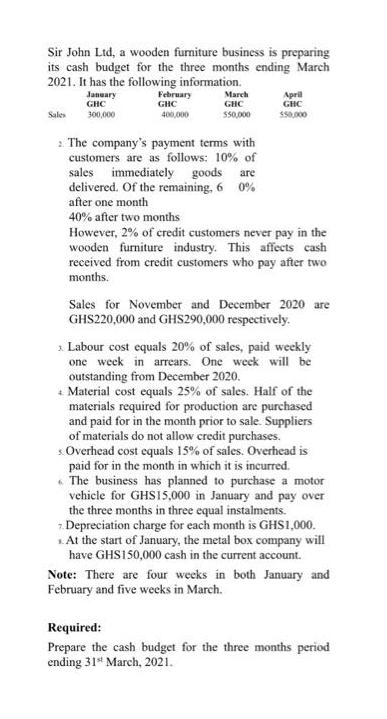

Sir John Ltd, a wooden furniture business is preparing its cash budget for the three months ending March 2021. It has the following information.

Sir John Ltd, a wooden furniture business is preparing its cash budget for the three months ending March 2021. It has the following information. Sales January GHC 300,000 February GHC 400,000 March GHC $50,000 The company's payment terms with customers are as follows: 10% of sales immediately goods are delivered. Of the remaining, 6 0% after one month 40% after two months April GHC $50,000 However, 2% of credit customers never pay in the wooden furniture industry. This affects cash received from credit customers who pay after two months. Sales for November and December 2020 are GHS220,000 and GHS290,000 respectively. > Labour cost equals 20% of sales, paid weekly one week in arrears. One week will be outstanding from December 2020. + Material cost equals 25% of sales. Half of the materials required for production are purchased and paid for in the month prior to sale. Suppliers of materials do not allow credit purchases. s.Overhead cost equals 15% of sales. Overhead is paid for in the month in which it is incurred. The business has planned to purchase a motor vehicle for GHS15,000 in January and pay over the three months in three equal instalments. 7. Depreciation charge for each month is GHS1,000. At the start of January, the metal box company will have GHS150,000 cash in the current account. Note: There are four weeks in both January and February and five weeks in March. Required: Prepare the cash budget for the three months period ending 31st March, 2021.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Receipts Cash Sales 10 Collections from receivables T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started