Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been hired by Nike Inc (NKE) to assess the viability of a new line athleisure wear. The expected sales and costs for

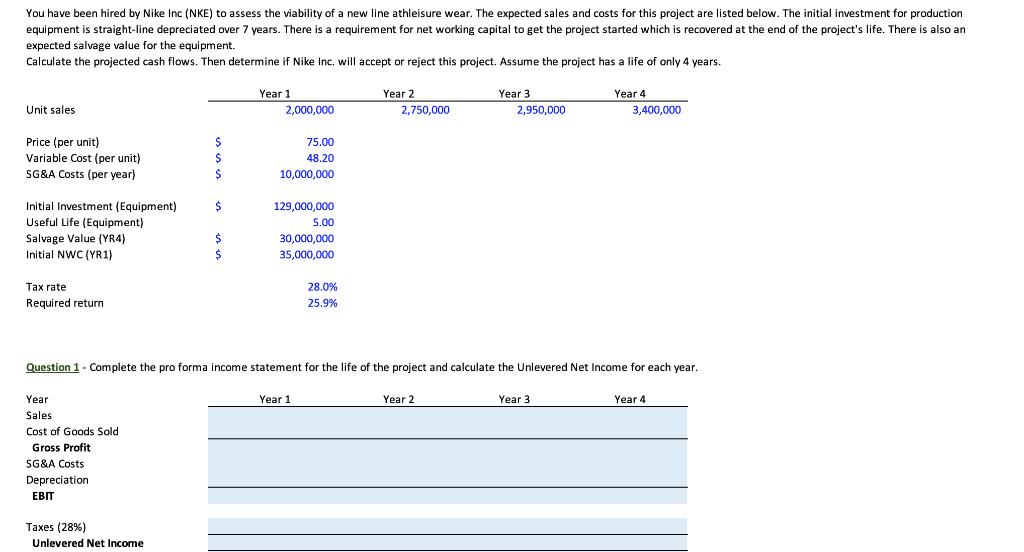

You have been hired by Nike Inc (NKE) to assess the viability of a new line athleisure wear. The expected sales and costs for this project are listed below. The initial investment for production equipment is straight-line depreciated over 7 years. There is a requirement for net working capital to get the project started which is recovered at the end of the project's life. There is also an expected salvage value for the equipment. Calculate the projected cash flows. Then determine if Nike Inc. will accept or reject this project. Assume the project has a life of only 4 years. Unit sales Price (per unit) Variable Cost (per unit) SG&A Costs (per year) Initial Investment (Equipment) Useful Life (Equipment) Salvage Value (YR4) Initial NWC (YR1) Tax rate Required return Year Sales Cost of Goods Sold Gross Profit SG&A Costs Depreciation. EBIT $ $ $ Taxes (28%) Unlevered Net Income $ Year 1 2,000,000 75.00 48.20 10,000,000 129,000,000 5.00 30,000,000 35,000,000 Question 1- Complete the pro forma income statement for the life of the project and calculate the Unlevered Net Income for each year. 28.0% 25.9% Year 1 Year 2 2,750,000 Year 3 2,950,000 Year 2 Year 4 3,400,000 Year 3 Year 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the Unlevered Net Income we need to follow these steps i Calculate the Sales for each y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started