Question

Sitara & Co. manufactures Part No. F-1700 for use in its assembly operation. The annual requirements are 5,000 units and the cost per unit

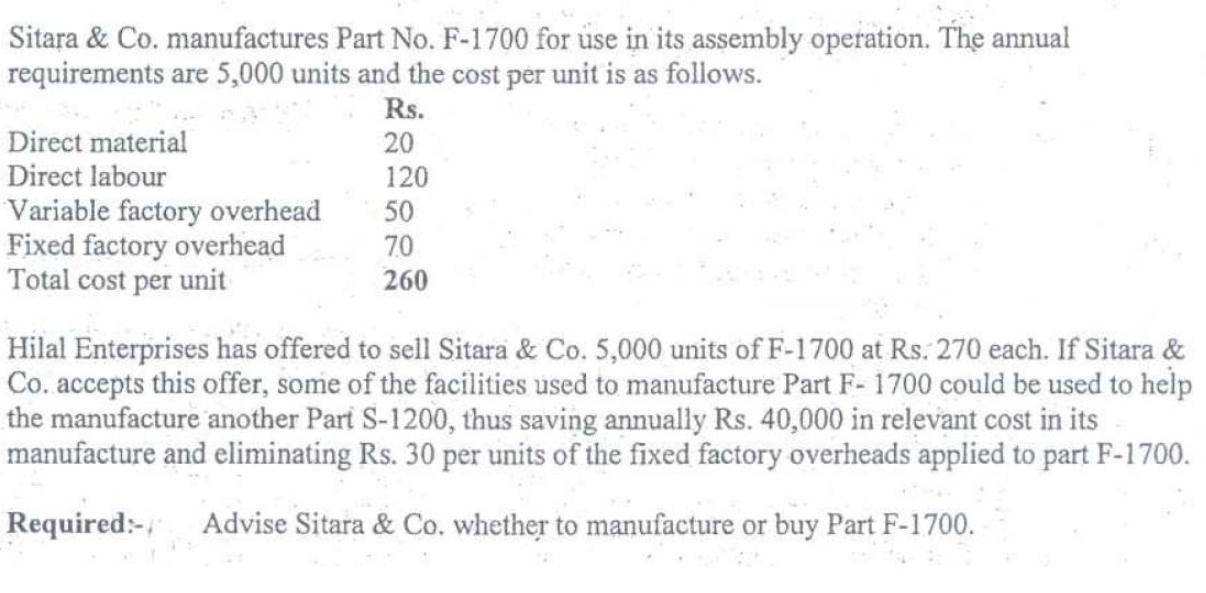

Sitara & Co. manufactures Part No. F-1700 for use in its assembly operation. The annual requirements are 5,000 units and the cost per unit is as follows. Rs. Direct material Direct labour 20 120 Variable factory overhead Fixed factory overhead Total cost per unit 50 70 260 Hilal Enterprises has offered to sell Sitara & Co. 5,000 units of F-1700 at Rs. 270 each. If Sitara & Co. accepts this offer, some of the facilities used to manufacture Part F- 1700 could be used to help the manufacture another Pari S-1200, thus saving annually Rs. 40,000 in relevant cost in its manufacture and eliminating Rs. 30 per units of the fixed factory overheads applied to part F-1700. Required:- Advise Sitara & Co. whether to manufacture or buy Part F-1700.

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer The decision to whether ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J Wild, Ken Shaw

25th Edition

1260247988, 978-1260247985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App