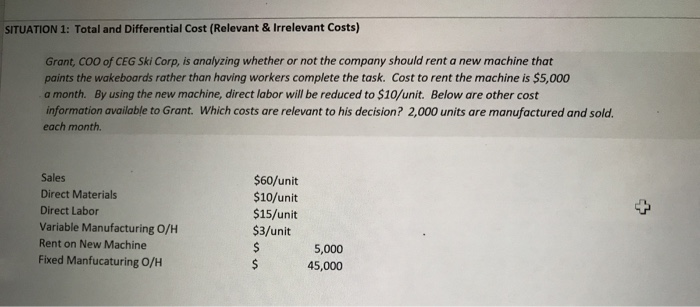

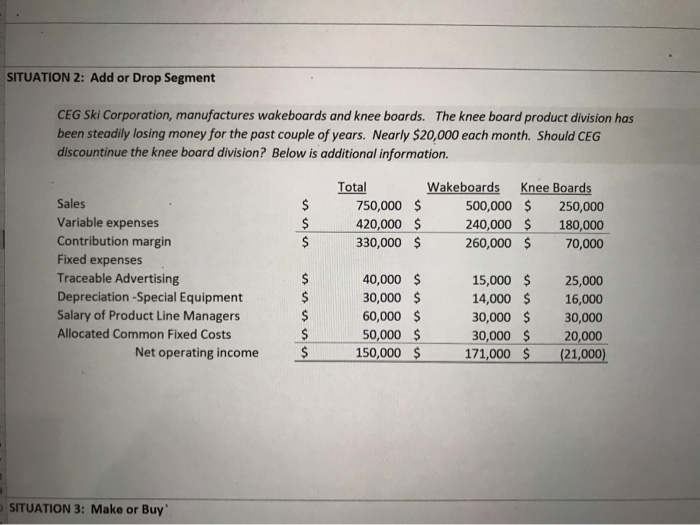

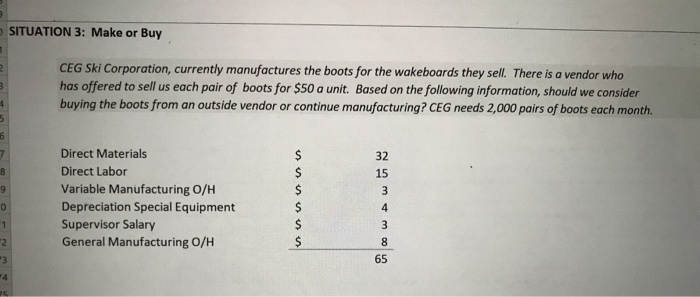

SITUATION 1: Total and Differential Cost (Relevant & Irrelevant Costs) Grant, coo of CEG Ski Corp, is analyzing whether or not the company should rent a new machine that her than having workers complete the task. Cost to rent the machine is $5,000 a month. By using the new machine, direct labor will be reduced to $10/unit. Below are other cost information available to Grant. Which costs are relevant to his decision? 2,000 units are manufactured and sold. each month. Sales Direct Materials Direct Labor Variable Manufacturing O/H Rent on New Machine Fixed Manfucaturing O/H $60/unit $10/unit $15/unit $3/unit 5,000 45,000 SITUATION 2: Add or Drop Segment CEG Ski Corporation, manufactures wakeboards and knee boards. The knee board product division has been steadily losing money for the past couple of years. Nearly $20,000 each month. Should CEG discountinue the knee board division? Below is additional information Total Wakeboards Knee Boards 750,000 $ 500,000 $ 250,000 420,000 $ 240,000 $ 180,000 330,000 $ 260,000 $ 70,000 Sales Variable expenses Contribution margin Fixed expenses Traceable Advertising Depreciation - Special Equipment Salary of Product Line Managers Allocated Common Fixed Costs Net operating income 40,000 $ 30,000 $ 60,000 $ 50,000 $ 150,000 $ 15,000 $ 14,000 $ 30,000 $ 30,000 $ 171,000 $ 25,000 16,000 30,000 20,000 (21,000) SITUATION 3: Make or Buy SITUATION 3: Make or Buy CEG Ski Corporation, currently manufactures the boots for the wakeboards they sell. There is a vendor who has offered to sell us each pair of boots for $50 a unit. Based on the following information, should we consider buying the boots from an outside vendor or continue manufacturing? CEG needs 2,000 pairs of boots each month. Direct Materials Direct Labor Variable Manufacturing O/H Depreciation Special Equipment Supervisor Salary General Manufacturing O/H SITUATION 4: Special Orders CEG Ski Corporation, has received a special order from an Australian Company for 500 wakeboards. The Aussie company has offered to pay $300 per wakeboard. Should CEG agree to the special order. Assume that this order will not interfere with regular production and CEG has the capacity to complete the order. Current information about the production of CEG wakeboards (w/o special order) is as follows. Wakeboards 500,000 240,000 260,000 Sales (1,000 units) Variable expenses Contribution margin Fixed expenses Traceable Advertising Depreciation - Special Equipment Salary of Product Line Managers Allocated Common Fixed Costs Net operating income 15,000 14,000 30,000 30,000 171,000 SITUATION 5: Managing Constraints CEG has a machine it uses on both the wakeboard and kneeboard production. Monthly demand for each product is 400 and 150 units, respectively. Which product should CEG focus its efforts on first? Machine can operate 12000 minutes per month. Sales Price per Unit Variable Cost per Unit Contribution Margin Fixed Costs Net Operating Income Wakeboards Kneeboards 500 $ 400 320 $ 250 180 $ 80 $ 100 $ Machine minutes needed SITUATION 6: Sell or Process Further AJ Corporation, manufactures several products from processing nylon. The material and processing costs total $100,000. $30,000 of the material and processing costs can be allocated to nylon fabric product. AJ Corporation can sell the nylon fabric for $26/yard or process further and produce waterproof nylon fabric to sell for $35/yard. The additional processing costs would be $7,500. Should AJ Corporation sell at the split off point or process further? AJ Corp will sell 1,000 units