Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Situation: An individual resident taxpayer has a business of producing and selling wines in La Trinidad. He is registered with the BIR as a

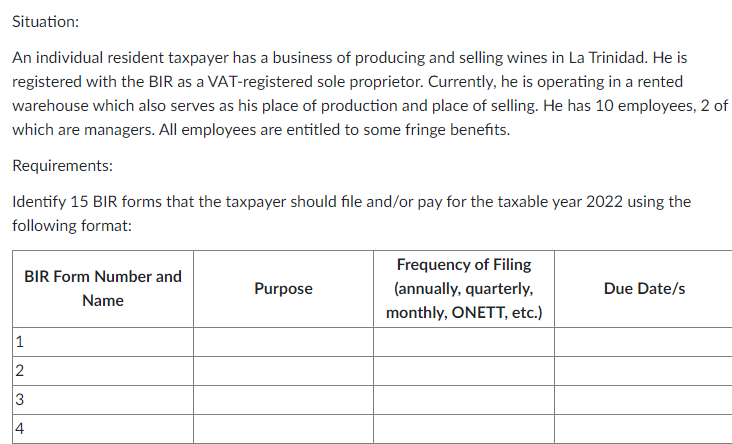

Situation: An individual resident taxpayer has a business of producing and selling wines in La Trinidad. He is registered with the BIR as a VAT-registered sole proprietor. Currently, he is operating in a rented warehouse which also serves as his place of production and place of selling. He has 10 employees, 2 of which are managers. All employees are entitled to some fringe benefits. Requirements: Identify 15 BIR forms that the taxpayer should file and/or pay for the taxable year 2022 using the following format: BIR Form Number and Name 1 2 3 4 Purpose Frequency of Filing (annually, quarterly, monthly, ONETT, etc.) Due Date/s

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given situation here are 15 BIR forms that the taxpayer should file andor pay for the taxable year 2022 1 BIR Form 2551M Monthly ValueAdded Tax Declaration Purpose To declare and pay the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started