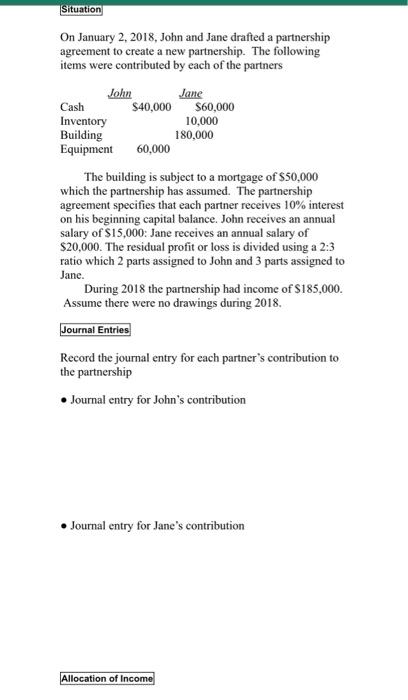

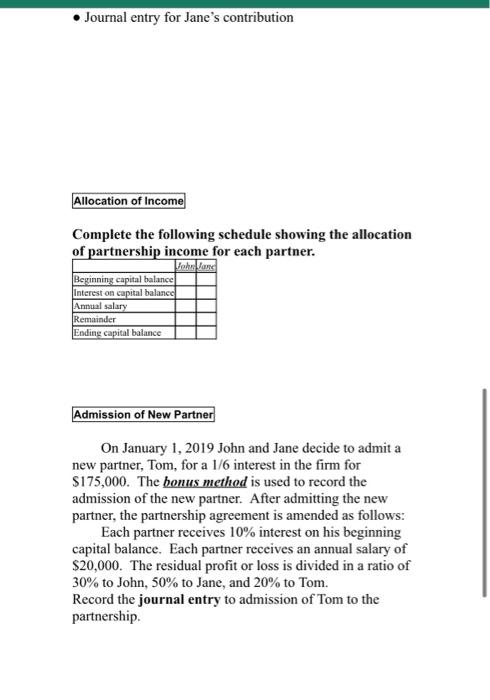

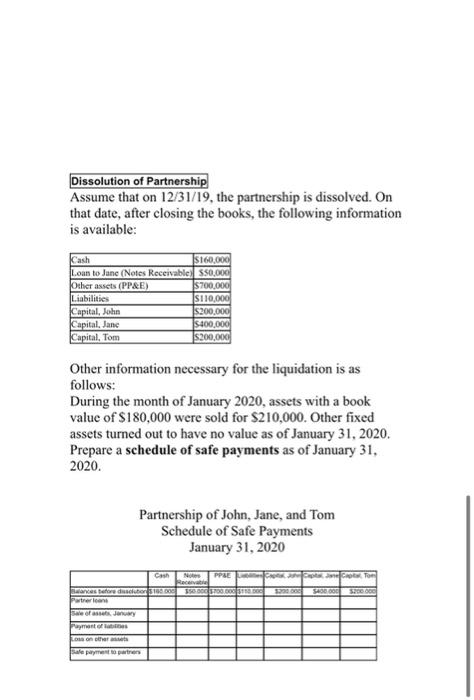

Situation On January 2, 2018, John and Jane drafted a partnership agreement to create a new partnership. The following items were contributed by each of the partners John Jane Cash $40,000 $60,000 Inventory 10,000 Building 180,000 Equipment 60,000 The building is subject to a mortgage of $50,000 which the partnership has assumed. The partnership agreement specifies that each partner receives 10% interest on his beginning capital balance. John receives an annual salary of $15,000: Jane receives an annual salary of $20,000. The residual profit or loss is divided using a 2:3 ratio which 2 parts assigned to John and 3 parts assigned to Jane. During 2018 the partnership had income of $185,000. Assume there were no drawings during 2018 Journal Entries Record the journal entry for each partner's contribution to the partnership Journal entry for John's contribution Journal entry for Jane's contribution Allocation of Income Journal entry for Jane's contribution Allocation of Income Complete the following schedule showing the allocation of partnership income for each partner. VaheJon Beginning capital balance Interest on capital balance Annual salary Remainder Ending capital balance Admission of New Partner On January 1, 2019 John and Jane decide to admit a new partner, Tom, for a 1/6 interest in the firm for $175,000. The bonus method is used to record the admission of the new partner. After admitting the new partner, the partnership agreement is amended as follows: Each partner receives 10% interest on his beginning capital balance. Each partner receives an annual salary of $20,000. The residual profit or loss is divided in a ratio of 30% to John, 50% to Jane, and 20% to Tom. Record the journal entry to admission of Tom to the partnership Dissolution of Partnership Assume that on 12/31/19, the partnership is dissolved. On that date, after closing the books, the following information is available: Cash $160,000 Loan to Janc (Notes Receivable) S50,000 Other assets (PP&E) $700,000 Liabilities S110,000 Capital, John $200,000 Capital, Jane $400,000 Capital, Tom $200,000 Other information necessary for the liquidation is as follows: During the month of January 2020, assets with a book value of $180,000 were sold for $210,000. Other fixed assets turned out to have no value as of January 31, 2020. Prepare a schedule of safe payments as of January 31, 2020. Partnership of John, Jane, and Tom Schedule of Safe Payments January 31, 2020 PPRE Tom 3988000.00 39.00 S400000 20000 waves for dessuto 1000 Partneri Se fast any Payments on other sale partners