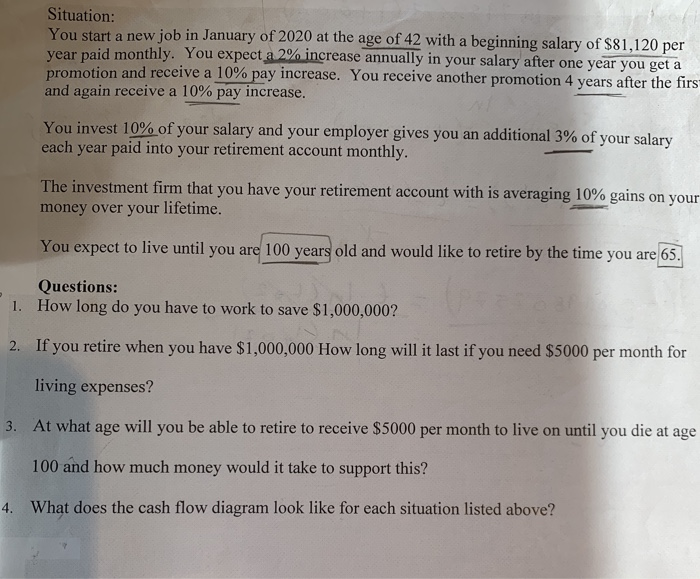

Situation: You start a new job in January of 2020 at the age of 42 with a year paid monthly. You expect a 2% increase annually in your salary after one year you get a promotion and receive a 10% pay increase. You receive another promotion 4 years after the firs and again receive a 10% pay increase. beginning salary of $81,120 per You invest 10% of your salary and your employer gives you each year paid into your retirement account monthly. an additional 3 % of your salary The investment firm that you have your retirement account with is averaging 10% gains money over your lifetime. on your You expect to live until you are 100 years old and would like to retire by the time you are 65 Questions: How long do you have to work to save $1,000,000? 1. 2. If you retire when you have $1,000,000 How long will it last if you need $5000 per month for living expenses? At what age will you be able to retire to receive $5000 per month to live on until you die at age 3. 100 and how much money would it take to support this? 4. What does the cash flow diagram look like for each situation listed above? Situation: You start a new job in January of 2020 at the age of 42 with a year paid monthly. You expect a 2% increase annually in your salary after one year you get a promotion and receive a 10% pay increase. You receive another promotion 4 years after the firs and again receive a 10% pay increase. beginning salary of $81,120 per You invest 10% of your salary and your employer gives you each year paid into your retirement account monthly. an additional 3 % of your salary The investment firm that you have your retirement account with is averaging 10% gains money over your lifetime. on your You expect to live until you are 100 years old and would like to retire by the time you are 65 Questions: How long do you have to work to save $1,000,000? 1. 2. If you retire when you have $1,000,000 How long will it last if you need $5000 per month for living expenses? At what age will you be able to retire to receive $5000 per month to live on until you die at age 3. 100 and how much money would it take to support this? 4. What does the cash flow diagram look like for each situation listed above