Question

Six alternatives are nominated for constructing a Mall. The alternatives' investment costs and salvage values are identical. A 10-year study period has been specified,

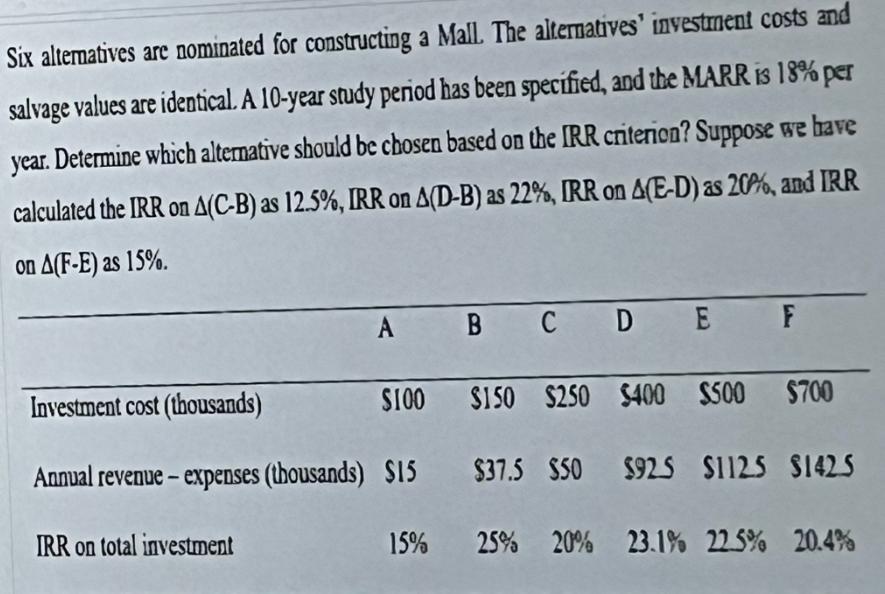

Six alternatives are nominated for constructing a Mall. The alternatives' investment costs and salvage values are identical. A 10-year study period has been specified, and the MARR is 18% per year. Determine which alternative should be chosen based on the IRR criterion? Suppose we have calculated the IRR on A(C-B) as 12.5%, IRR on A(D-B) as 22%, IRR on 4(E-D) as 20%, and IRR on A(F-E) as 15%. B C D E F $100 $150 $250 $400 $500 $700 $37.5 $50 $925 $1125 $1425 25% 20% 23.1% 22.5% 20.4% IRR on total investment A Investment cost (thousands) Annual revenue - expenses (thousands) $15 15%

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine which alternative should be chosen based on the IRR ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App