Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sixteen-year-old Janet has earned money the last few years by babysitting and shoveling snow for neighbors, who pay her in cash which she mostly

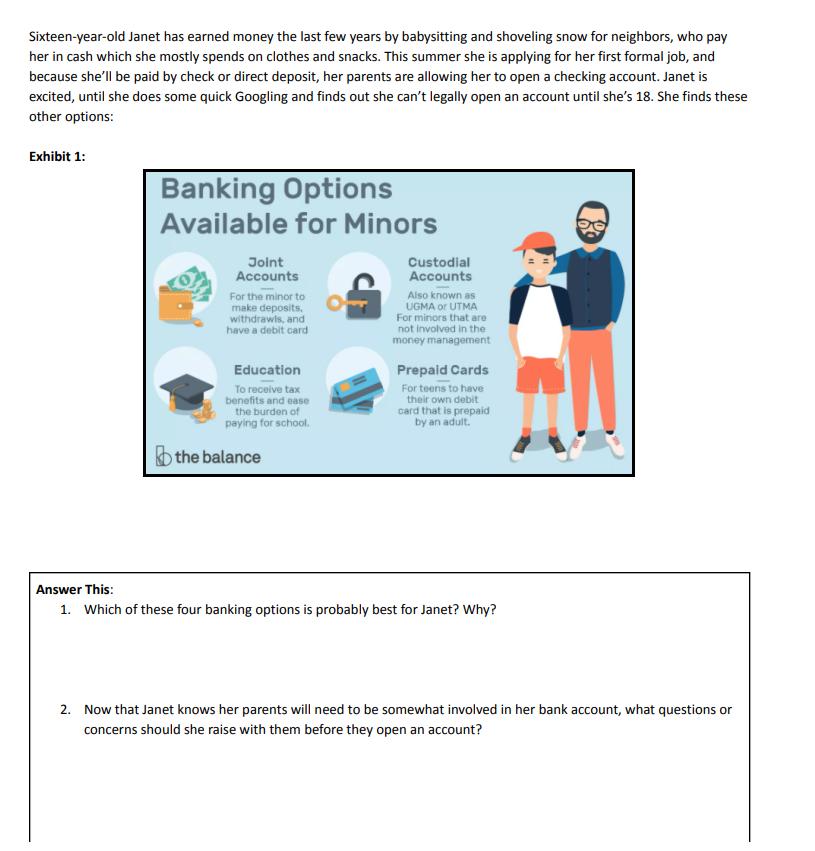

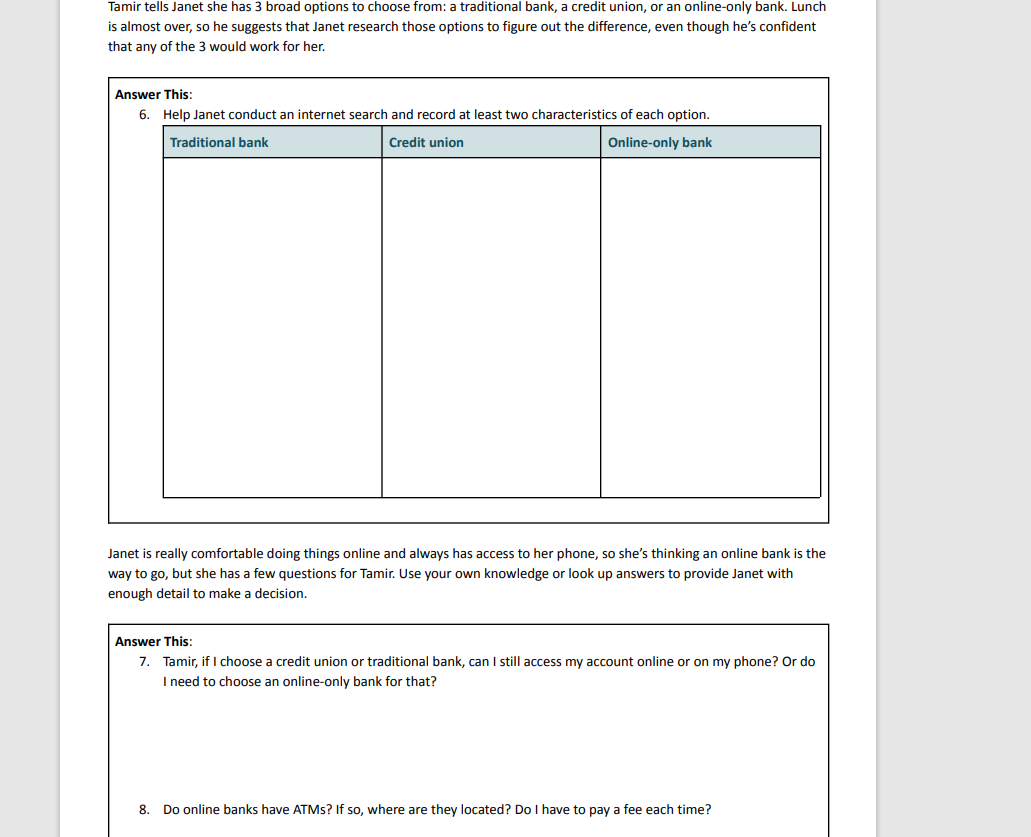

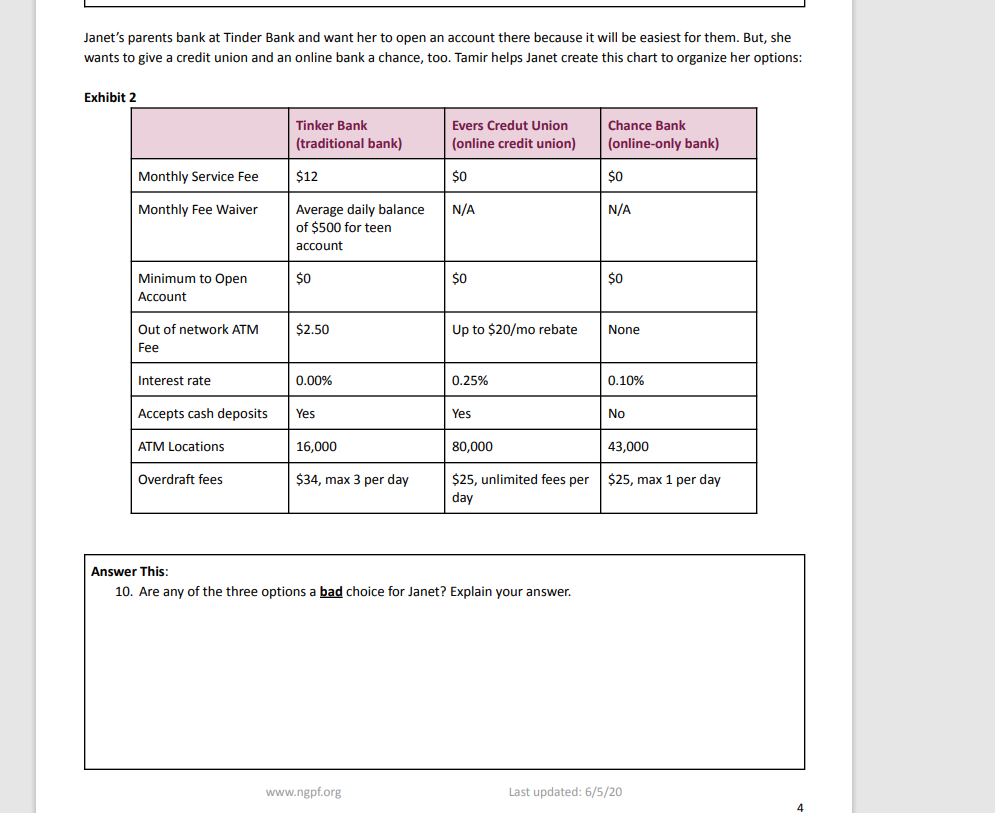

Sixteen-year-old Janet has earned money the last few years by babysitting and shoveling snow for neighbors, who pay her in cash which she mostly spends on clothes and snacks. This summer she is applying for her first formal job, and because she'll be paid by check or direct deposit, her parents are allowing her to open a checking account. Janet is excited, until she does some quick Googling and finds out she can't legally open an account until she's 18. She finds these other options: Exhibit 1: Banking Options Available for Minors Joint Accounts For the minor to make deposits, withdrawls, and have a debit card Education To receive tax benefits and ease the burden of paying for school. the balance Custodial Accounts Also known as UGMA or UTMA For minors that are not involved in the money management Prepaid Cards For teens to have their own debit card that is prepaid by an adult. Answer This: 1. Which of these four banking options is probably best for Janet? Why? 2. Now that Janet knows her parents will need to be somewhat involved in her bank account, what questions or concerns should she raise with them before they open an account? Janet feels like it would be boring to just open an account at the same local bank her parents use, so she heads to her friend Tamir's lunch table the next day at school to ask for his advice. Janet says: "Tamir, once I get a summer job, I basically just need a place to cash my paycheck every two weeks. I'll probably take out most of the money immediately afterward so I have cash for snacks and other stuff like that. Though, I'm excited to have a debit card so I can shop online, too. What should I do? And do you have any clue if I can keep this same bank account once I go off to college? Or do I need to look for something new?" Answer This: 3. What features should Tamir tell Janet to look for when choosing her new checking account? 4. Is there any other advice Tamir should offer based on details Janet has shared so far? 5. Would most standard bank accounts work for Janet based on her banking needs? Why or why not? Tamir tells Janet she has 3 broad options to choose from: a traditional bank, a credit union, or an online-only bank. Lunch is almost over, so he suggests that Janet research those options to figure out the difference, even though he's confident that any of the 3 would work for her. Answer This: 6. Help Janet conduct an internet search and record at least two characteristics of each option. Traditional bank Credit union Online-only bank Janet is really comfortable doing things online and always has access to her phone, so she's thinking an online bank is the way to go, but she has a few questions for Tamir. Use your own knowledge or look up answers to provide Janet with enough detail to make a decision. Answer This: 7. Tamir, if I choose a credit union or traditional bank, can I still access my account online or on my phone? Or do I need to choose an online-only bank for that? 8. Do online banks have ATMs? If so, where are they located? Do I have to pay a fee each time? 9. I'm still planning to do some babysitting in addition to the other summer job. Can I deposit cash if I choose an online bank? How do I do it? Janet's parents bank at Tinder Bank and want her to open an account there because it will be easiest for them. But, she wants to give a credit union and an online bank a chance, too. Tamir helps Janet create this chart to organize her options: Exhibit 2 Tinker Bank (traditional bank) Evers Credut Union (online credit union) Chance Bank (online-only bank) Monthly Service Fee $12 $0 $0 Monthly Fee Waiver Average daily balance of $500 for teen account N/A N/A Minimum to Open $0 $0 $0 Account Out of network ATM Fee $2.50 Up to $20/mo rebate None Interest rate 0.00% 0.25% 0.10% Accepts cash deposits Yes ATM Locations 16,000 Yes 80,000 No 43,000 Overdraft fees $34, max 3 per day $25, unlimited fees per $25, max 1 per day day Answer This: 10. Are any of the three options a bad choice for Janet? Explain your answer. www.ngpf.org Last updated: 6/5/20 4 11. Janet immediately notices the difference in overdraft fees. a. Briefly explain to her how overdraft protection works. b. How worried should Janet be about overdraft fees? Explain your answer. 12. How much should Janet prioritize interest rates when making her decision of where to open the account? Janet goes home to sleep on her decision. She thinks back on all of her conversations with Tamir and tries to predict how she'll use her account this summer once she has a part-time job. She also considers that she'll need to convince her parents if she goes with any option other than their local Tinker Bank: Is it worth the hassle? Janet drifts off to sleep but wakes the next morning, confident in her choice. Answer This: 13. Where should Janet open her checking account? Explain why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started