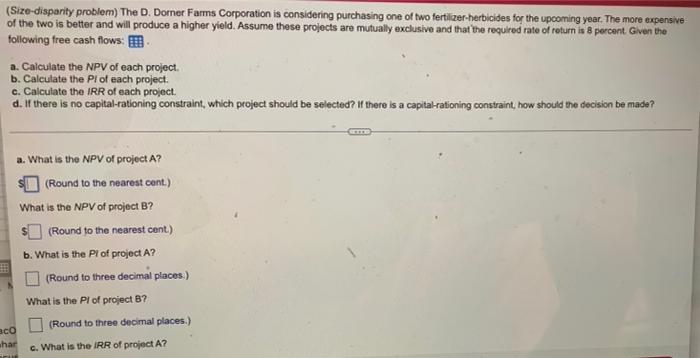

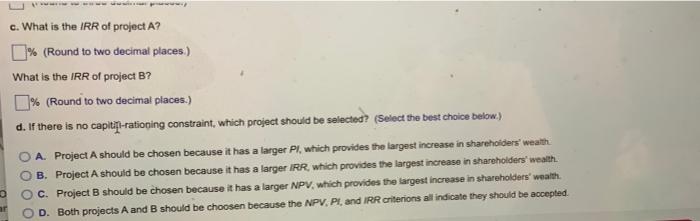

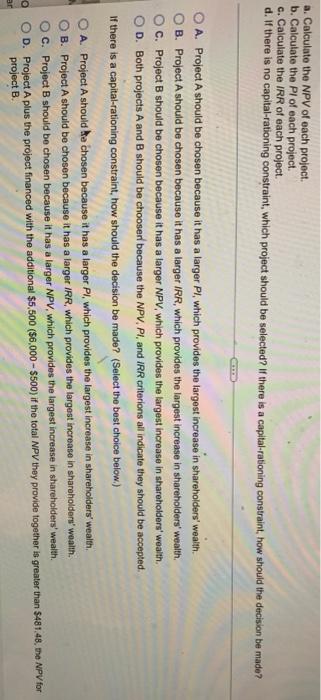

(Size-disparity problem) The D. Dorner Farms Corporation is considering purchasing one of two fertilizer-herbicides for the upcoming year. The more expensive of the two is better and will produce a higher yield. Assume these projects are mutually exclusive and that the required rate of return is 8 percent. Given the following free cash flows: a. Calculate the NPV of each project. b. Calculate the Prof each project. c. Calculate the IRR of each project. d. If there is no capital-rationing constraint, which project should be selected? If there is a capital rationing constraint, how should the decision be made? a. What is the NPV of project A? (Round to the nearest cont.) What is the NPV of project B? (Round to the nearest cent) b. What is the Pl of project A? (Round to three decimal places) What is the pl of project B? aco (Round to three decimal places.) har c. What is the IRR of project A? c. What is the IRR of project A? % (Round to two decimal places.) What is the IRR of project B? 0% (Round to two decimal places.) d. If there is no caplty-rationing constraint, which project should be selected? (Select the best choice below) A. Project A should be chosen because it has a larger Pl, which provides the largest increase in shareholders wealth B. Project A should be chosen because it has a larger IRR which provides the largest increase in shareholders' wealth c. Project B should be chosen because it has a larger NPV, which provides the largest increase in shareholders' wealth D. Both projects A and B should be choosen because the NPV. Pt, and IRR criterions all indicate they should be accepted. a. Calculate the NPV of each project. b. Calculate the Pl of each project. c. Calculate the IRR of each project. d. If there is no capital-rationing constraint, which project should be selected? If there is a capital-rationing constraint, how should the decision be made? A. Project A should be chosen because it has a larger Pl, which provides the largest increase in shareholders' wealth B. Project A should be chosen because it has a larger IRR, which provides the largest increase in shareholders' wealth, C. Project B should be chosen because it has a larger NPV, which provides the largest increase in shareholders' wealth D. Both projects A and B should be chooser because the NPV,Pl, and IRR criterions all indicate they should be accepted. If there is a capital-rationing constraint, how should the decision be made? (Select the best choice below.) A. Project A should he chosen because it has a larger PI, which provides the largest increase in shareholders' wealth, B. Project A should be chosen because it has a larger IRR, which provides the largest increase in shareholders' wealth. C. Project B should be chosen because it has a larger NPV, which provides the largest increase in shareholders' wealth OD. Project A plus the project financed with the additional $5,500 ($6,000 - $500) if the total NPV they provide together is greater than $48148, the NPV for project B ar (Size-disparity problem) The D. Dorner Farms Corporation is considering purchasing one of two fertilizer-herbicides for the upcoming year. The more expensive of the two is better and will produce a higher yield. Assume these projects are mutually exclusive and that the required rate of return is 8 percent. Given the following free cash flows: a. Calculate the NPV of each project. b. Calculate the Prof each project. c. Calculate the IRR of each project. d. If there is no capital-rationing constraint, which project should be selected? If there is a capital rationing constraint, how should the decision be made? a. What is the NPV of project A? (Round to the nearest cont.) What is the NPV of project B? (Round to the nearest cent) b. What is the Pl of project A? (Round to three decimal places) What is the pl of project B? aco (Round to three decimal places.) har c. What is the IRR of project A? c. What is the IRR of project A? % (Round to two decimal places.) What is the IRR of project B? 0% (Round to two decimal places.) d. If there is no caplty-rationing constraint, which project should be selected? (Select the best choice below) A. Project A should be chosen because it has a larger Pl, which provides the largest increase in shareholders wealth B. Project A should be chosen because it has a larger IRR which provides the largest increase in shareholders' wealth c. Project B should be chosen because it has a larger NPV, which provides the largest increase in shareholders' wealth D. Both projects A and B should be choosen because the NPV. Pt, and IRR criterions all indicate they should be accepted. a. Calculate the NPV of each project. b. Calculate the Pl of each project. c. Calculate the IRR of each project. d. If there is no capital-rationing constraint, which project should be selected? If there is a capital-rationing constraint, how should the decision be made? A. Project A should be chosen because it has a larger Pl, which provides the largest increase in shareholders' wealth B. Project A should be chosen because it has a larger IRR, which provides the largest increase in shareholders' wealth, C. Project B should be chosen because it has a larger NPV, which provides the largest increase in shareholders' wealth D. Both projects A and B should be chooser because the NPV,Pl, and IRR criterions all indicate they should be accepted. If there is a capital-rationing constraint, how should the decision be made? (Select the best choice below.) A. Project A should he chosen because it has a larger PI, which provides the largest increase in shareholders' wealth, B. Project A should be chosen because it has a larger IRR, which provides the largest increase in shareholders' wealth. C. Project B should be chosen because it has a larger NPV, which provides the largest increase in shareholders' wealth OD. Project A plus the project financed with the additional $5,500 ($6,000 - $500) if the total NPV they provide together is greater than $48148, the NPV for project B ar