Question

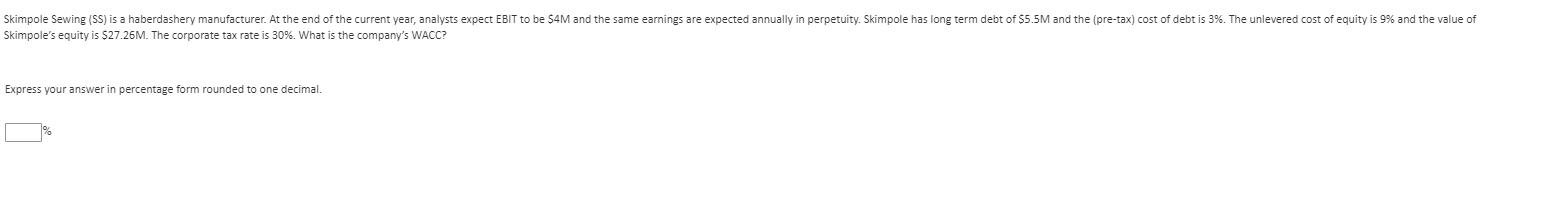

Skimpole Sewing (SS) is a haberdashery manufacturer. At the end of the current year, analysts expect EBIT to be $4M and the same earnings

Skimpole Sewing (SS) is a haberdashery manufacturer. At the end of the current year, analysts expect EBIT to be $4M and the same earnings are expected annually in perpetuity. Skimpole has long term debt of $5.5M and the (pre-tax) cost of debt is 3%. The unlevered cost of equity is 9% and the value of Skimpole's equity is $27.26M. The corporate tax rate is 30%. What is the company's WACC? Express your answer in percentage form rounded to one decimal.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Cost of equity Re Ra RaRd DE1t Ra unle...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: J. Chris Leach, Ronald W. Melicher

6th edition

1305968352, 978-1337635653, 978-1305968356

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App