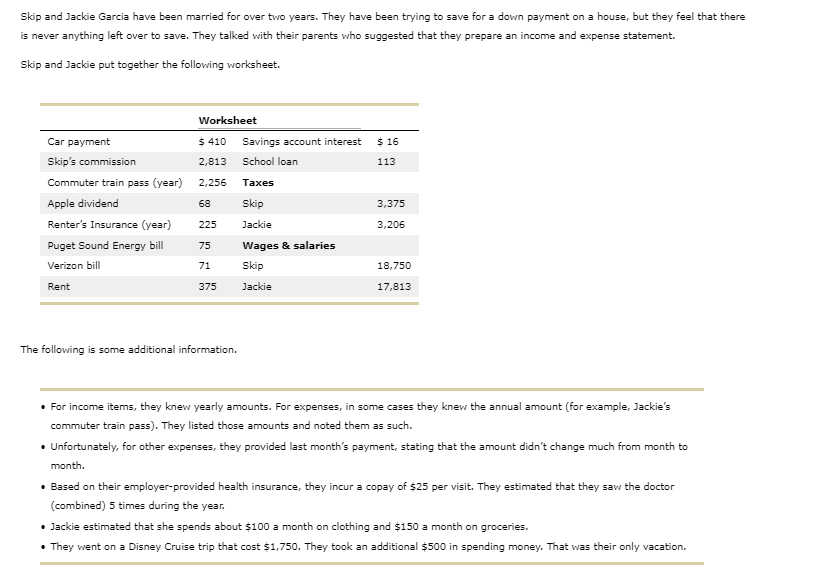

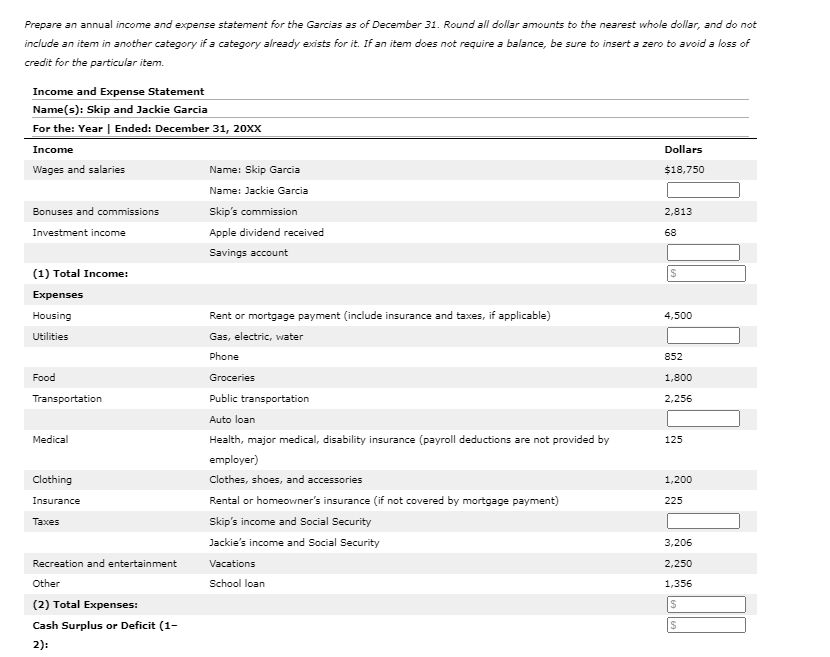

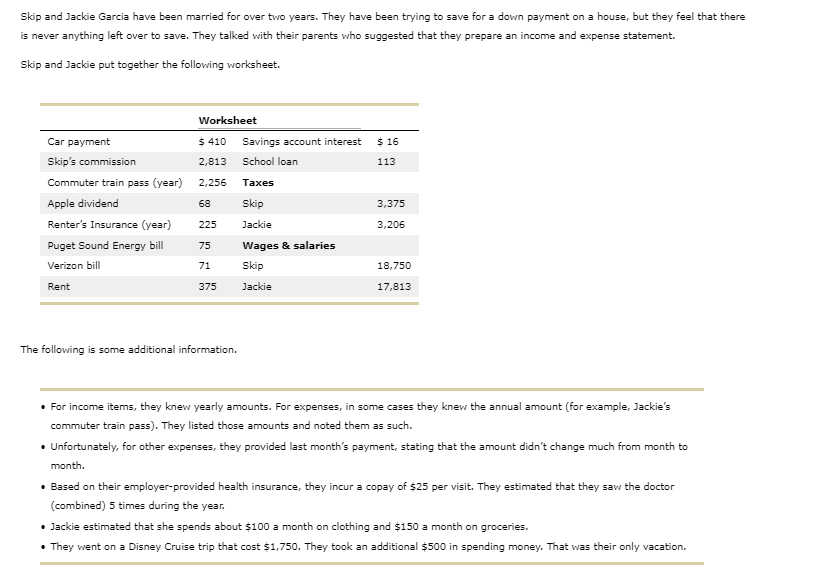

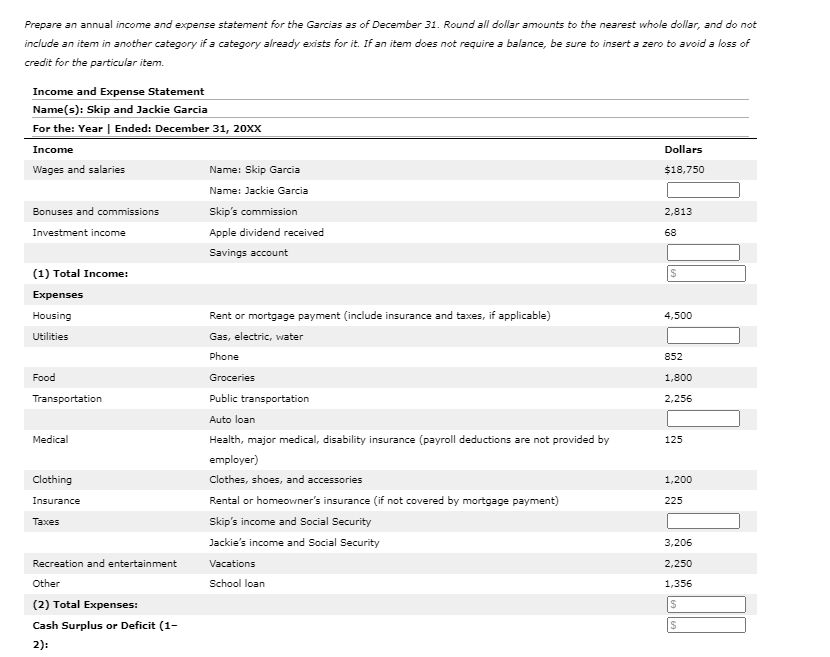

Skip and Jackie Garcia have been married for over two years. They have been trying to save for a down payment on a house, but they feel that there is never anything left over to save. They talked with their parents who suggested that they prepare an income and expense statement. Skip and Jackie put together the following worksheet. Worksheet $ 410 Savings account interest $ 16 2,813 School loan 113 2,256 Taxes Car payment Skip's commission Commuter train pass (year) Apple dividend Renter's Insurance (year) Puget Sound Energy bill Verizon bill 68 3,375 225 3,206 75 Skip Jackie Wages & salaries Skip Jackie 71 18,750 Rent 375 17,813 The following is some additional information. For income items, they knew yearly amounts. For expenses, in some cases they knew the annual amount (for example, Jackie's commuter train pass). They listed those amounts and noted them as such. . Unfortunately, for other expenses, they provided last month's payment, stating that the amount didn't change much from month to month. Based on their employer-provided health insurance, they incur a copay of $25 per visit. They estimated that they saw the doctor (combined) 5 times during the year. Jackie estimated that she spends about $100 a month on clothing and $150 a month on groceries. They went on a Disney Cruise trip that cost $1,750. They took an additional $500 in spending money. That was their only vacation. $18,750 Prepare an annual income and expense statement for the Garcias as of December 31. Round all dollar amounts to the nearest whole dollar, and do not include an item in another category if a category already exists for it. If an item does not require a balance, be sure to insert a zero to avoid a loss of credit for the particular item. Income and Expense Statement Name(s): Skip and Jackie Garcia For the: Year Ended: December 31, 20xx Income Dollars Wages and salaries Name: Skip Garcia Name: Jackie Garcia Bonuses and commissions Skip's commission 2,813 Investment income Apple dividend received Savings account (1) Total Income: Expenses Housing Rent or mortgage payment (include insurance and taxes, if applicable) Utilities Gas, electric, water Phone Food Groceries Transportation Public transportation 2,256 68 $ 4,500 852 1,800 Auto loan Medical 125 1,200 Clothing Insurance 225 Health, major medical, disability insurance (payroll deductions are not provided by employer) Clothes, shoes, and accessories Rental or homeowner's insurance (if not covered by mortgage payment) Skip's income and Social Security Jackie's income and Social Security Vacations School loan Taxes 3,206 2,250 1,356 Recreation and entertainment Other (2) Total Expenses: Cash Surplus or Deficit (1- 2): $