Answered step by step

Verified Expert Solution

Question

1 Approved Answer

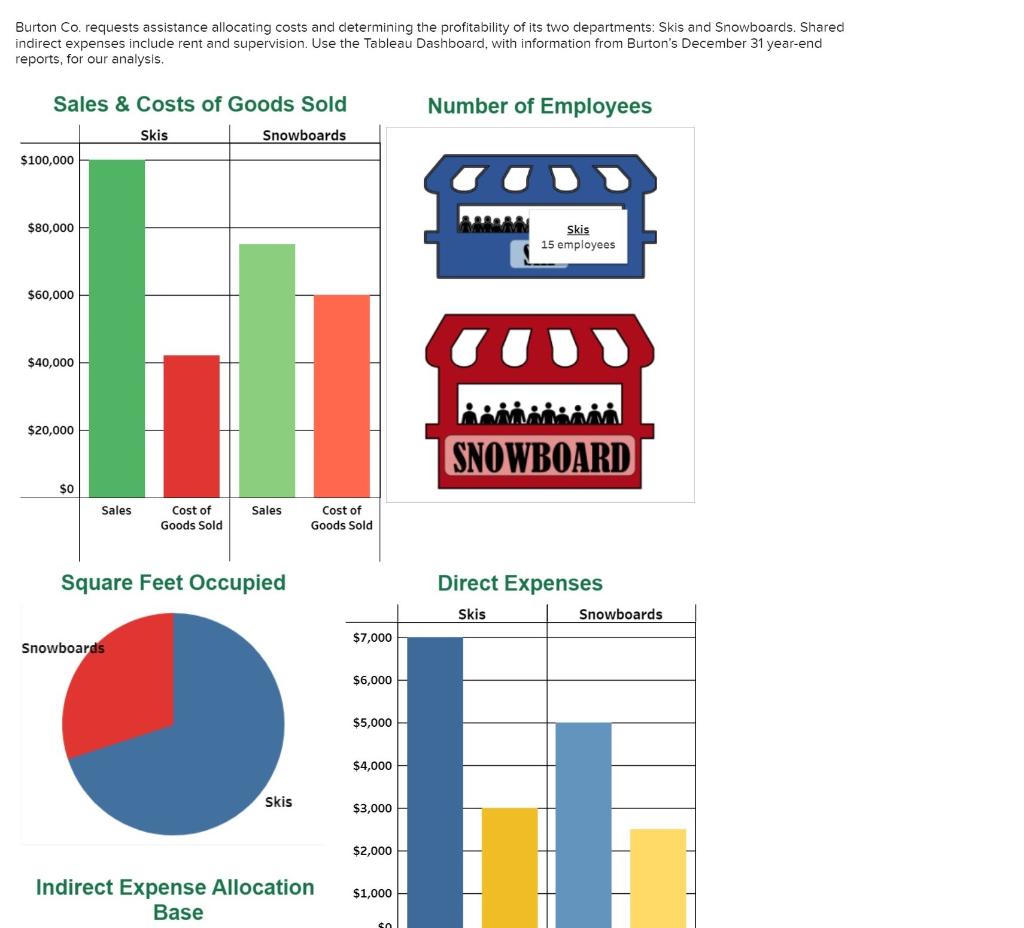

SKIS SALES: $100,000 COST OF GOOD SOLD: $42,000 SNOWBOARD SALES: $75,000 COST OF GOOD SOLD: $60,000 NUMBER OF EMPLOYEES : SKI : 15 SNOWBOARD :

SKIS

SALES: $100,000

COST OF GOOD SOLD: $42,000

SNOWBOARD

SALES: $75,000

COST OF GOOD SOLD: $60,000

NUMBER OF EMPLOYEES:

SKI : 15

SNOWBOARD : 10

SQUARE FEET OCCUPIED:

SKI : 14,000 SQ FT

SNOWBOARD : 6,000 SQ FT

DIRECT EXPENSES:

SKI :

SALARIES EXPENSE: $7,000

SUPPLIES EXPENSE: $3,000

SNOWBOARD :

SALARIES EXPENSE: $5,000

SUPPLIES EXPENSE: $2,500

THANK YOU!

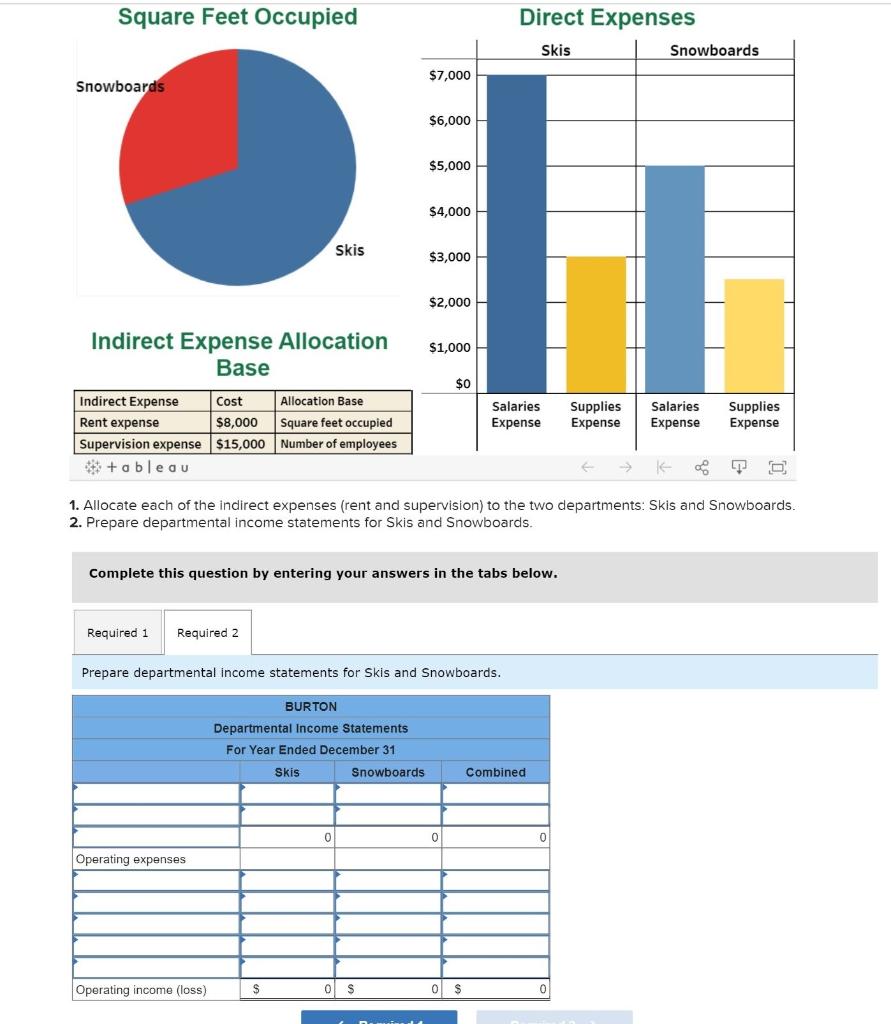

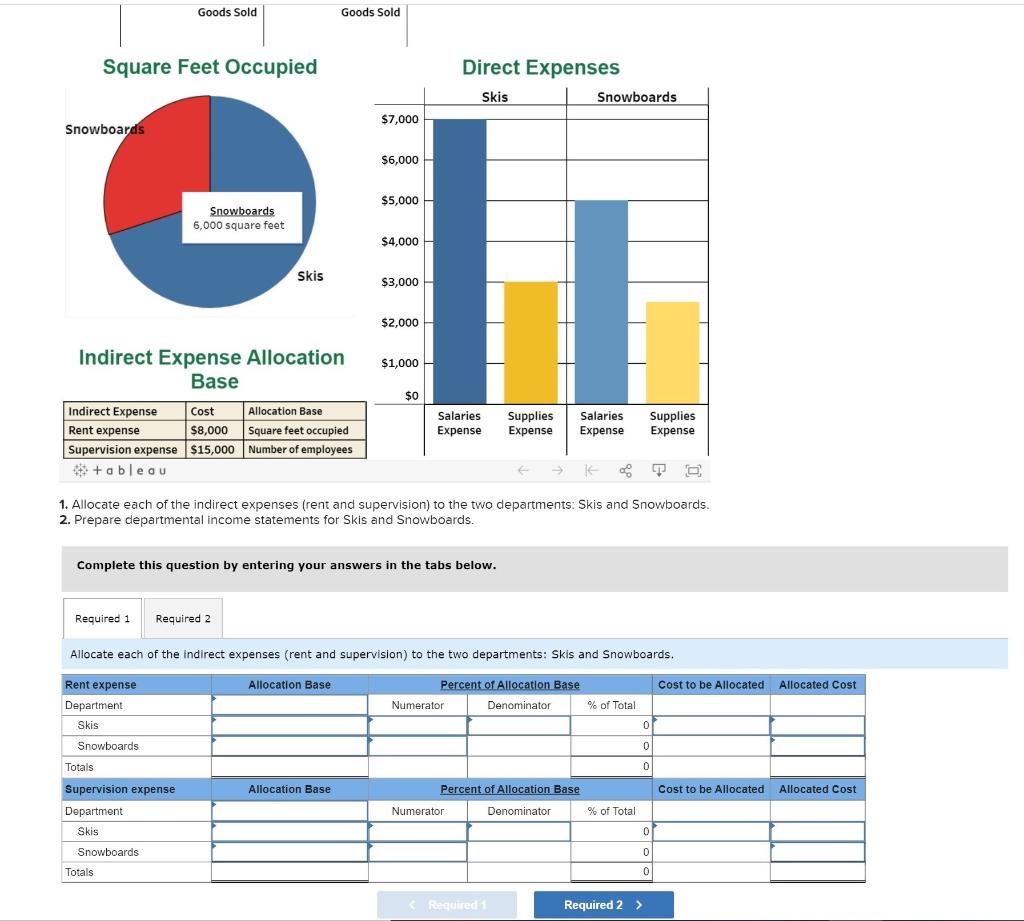

Burton Co. requests assistance allocating costs and determining the profitability of its two departments: Skis and Snowboards. Shared indirect expenses include rent and supervision. Use the Tableau Dashboard, with information from Burton's December 31 year-end reports, for our analysis. Sales & Costs of Goods Sold Number of Employees Skis Snowboards $100,000 - $80,000 Skis 15 employees $60,000 $40,000 $20,000 SNOWBOARD $0 Sales Sales Cost of Goods Sold Cost of Goods Sold Square Feet Occupied Direct Expenses Skis Snowboards $7,000 Snowboards $6,000 $5,000 $4,000 Skis $3,000 $2,000 Indirect Expense Allocation Base $1,000 so Square Feet Occupied Direct Expenses Skis Snowboards $7,000 Snowboards $6,000 $5,000 $4,000 Skis $3,000 $2,000 Indirect Expense Allocation Base $1,000 $0 Salaries Expense Supplies Expense Salaries Expense Supplies Expense Indirect Expense Cost Allocation Base Rent expense $8,000 Square feet occupied Supervision expense $15,000 Number of employees ** tableau TO 1. Allocate each of the indirect expenses (rent and supervision) to the two departments: Skis and Snowboards. 2. Prepare departmental income statements for Skis and Snowboards. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare departmental income statements for Skis and Snowboards. BURTON Departmental Income Statements For Year Ended December 31 Skis Snowboards Combined 0 0 0 Operating expenses Operating income (loss) $ S 0 $ 0 Goods Sold Goods Sold Square Feet Occupied Direct Expenses Skis Snowboards $7,000 Snowboards $6,000 H $5,000 Snowboards 6,000 square feet $4,000 Skis $3,000 $ $2,000 Indirect Expense Allocation Base $1,000 $0 Salaries Expense Supplies Expense Salaries Expense Supplies Expense Indirect Expense Cost Allocation Base Rent expense $8,000 square feet occupied Supervision expense $15,000 Number of employees ** + ableau K TO 1. Allocate each of the indirect expenses (rent and supervision) to the two departments: Skis and Snowboards. 2. Prepare departmental income statements for Skis and Snowboards. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate each of the indirect expenses (rent and supervision) to the two departments: Skis and Snowboards. Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominator % of Total 0 0 0 Rent expense Department Skis Snowboards Totals Supervision expense Department Skis Snowboards Totals Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominator % of Total 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started