Answered step by step

Verified Expert Solution

Question

1 Approved Answer

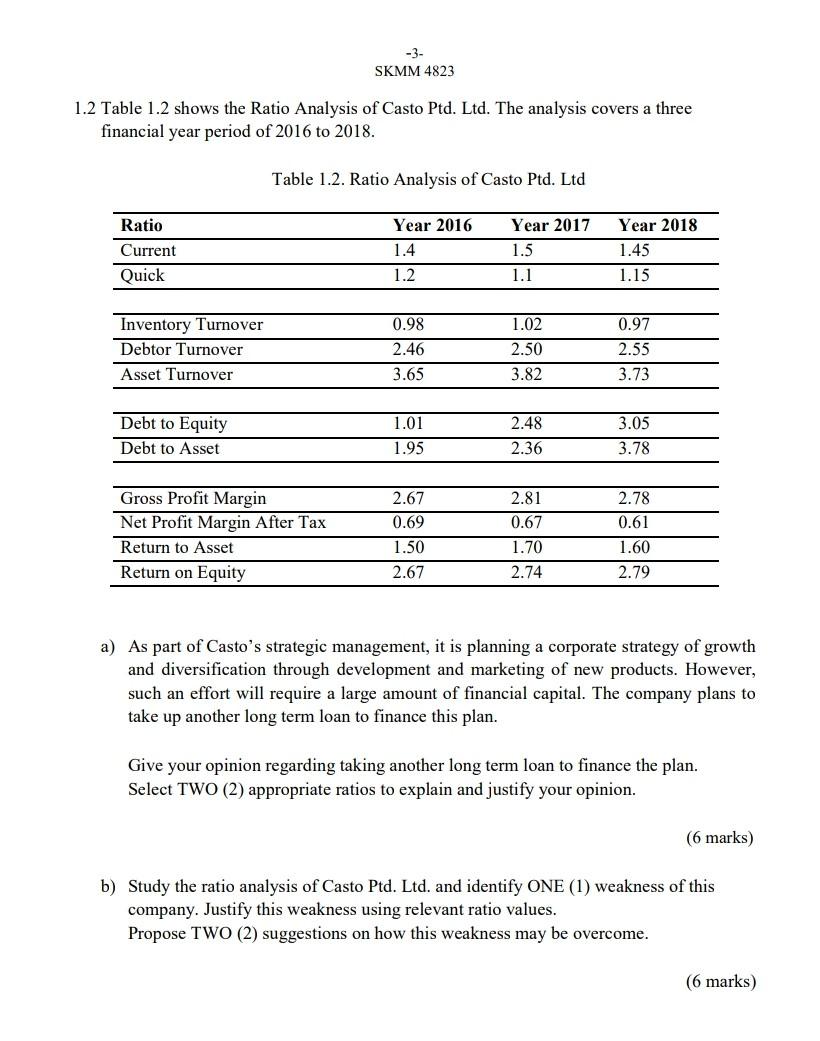

SKMM 4823 1.2 Table 1.2 shows the Ratio Analysis of Casto Ptd. Ltd. The analysis covers a three financial year period of 2016 to 2018.

SKMM 4823 1.2 Table 1.2 shows the Ratio Analysis of Casto Ptd. Ltd. The analysis covers a three financial year period of 2016 to 2018. Table 1.2. Ratio Analysis of Casto Ptd. Ltd Ratio Current Quick Year 2016 1.4 1.2 Year 2017 1.5 1.1 Year 2018 1.45 1.15 0.97 Inventory Turnover Debtor Turnover Asset Turnover 0.98 2.46 3.65 1.02 2.50 3.82 2.55 3.73 2.48 Debt to Equity Debt to Asset 1.01 1.95 3.05 3.78 2.36 2.81 0.67 Gross Profit Margin Net Profit Margin After Tax Return to Asset Return on Equity 2.67 0.69 1.50 2.67 2.78 0.61 1.60 2.79 1.70 2.74 a) As part of Casto's strategic management, it is planning a corporate strategy of growth and diversification through development and marketing of new products. However, such an effort will require a large amount of financial capital. The company plans to take up another long term loan to finance this plan. Give your opinion regarding taking another long term loan to finance the plan. Select TWO (2) appropriate ratios to explain and justify your opinion. (6 marks) b) Study the ratio analysis of Casto Ptd. Ltd. and identify ONE (1) weakness of this company. Justify this weakness using relevant ratio values. Propose TWO (2) suggestions on how this weakness may be overcome. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started