Answered step by step

Verified Expert Solution

Question

1 Approved Answer

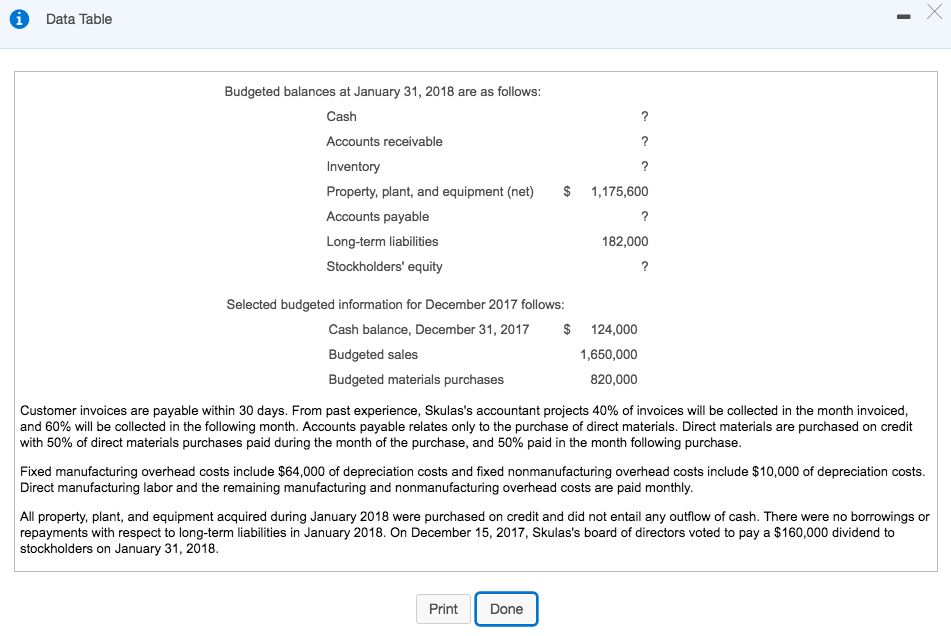

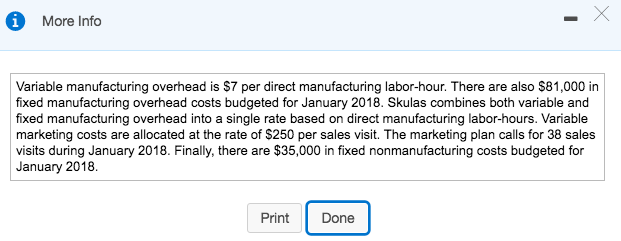

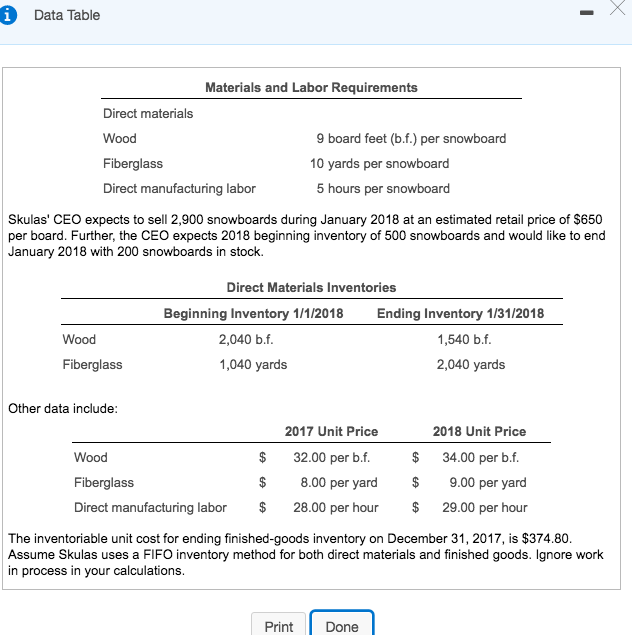

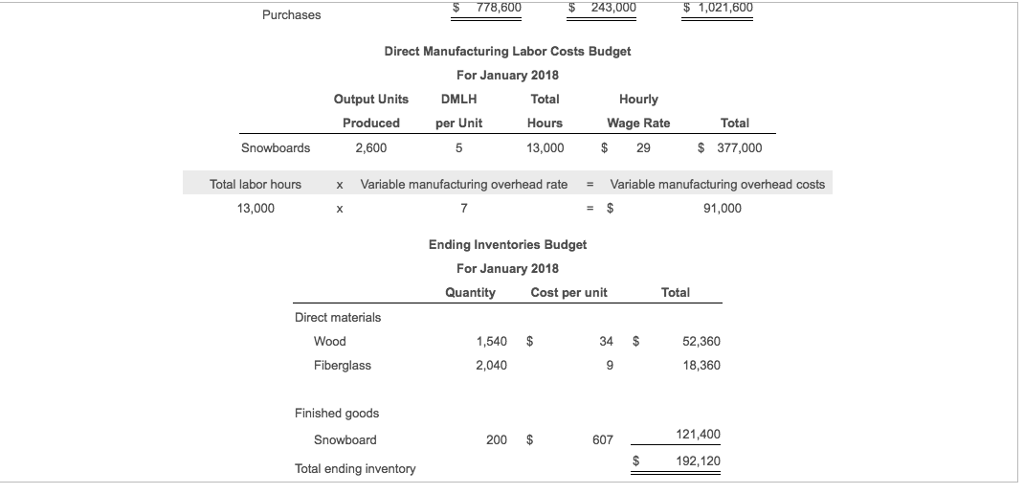

Skulas, Inc., manufactures and sells snowboards. Skulas manufactures a single model, the Pipex. In late 2017, Skulas's management accountant gathered the following data to prepare

Skulas, Inc., manufactures and sells snowboards. Skulas manufactures a single model, the Pipex. In late 2017, Skulas's management accountant gathered the following data to prepare budgets for January 2018:

Requirement:

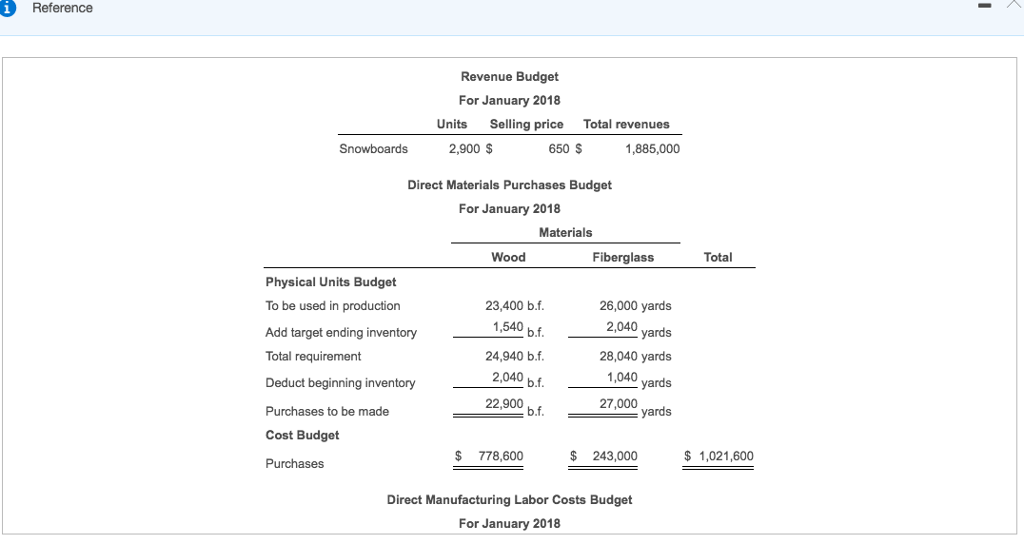

| 1. | Prepare a cash budget for January 2018 Show supporting schedules for the calculation of collection of receivables and payments of accountspayable, and for disbursements for fixed manufacturing and nonmanufacturing overhead. |

| 2. | Skulas is interested in maintaining a minimum cash balance of $120,000 at the end of each month. Will Skulas be in a position to pay the $160,000 dividend on January 31? |

| 4. | Prepare a budgeted balance sheet for January 31,2018 by calculating the January 31,2018 balances in (a) cash (b) accounts receivable (c) inventory(d) accounts payable and (e) plugging in the balance for stockholders' equity. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started