Question

SKV represents the price of cigarettes and therefore the tax per unit of cigarette sold. It is regulated as a tax that has the

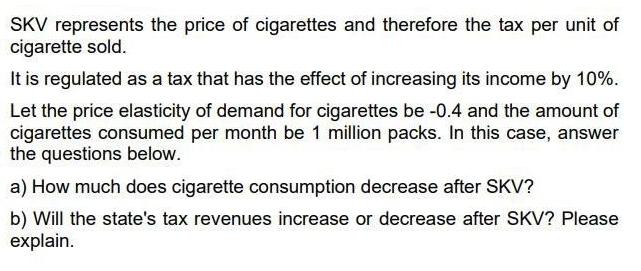

SKV represents the price of cigarettes and therefore the tax per unit of cigarette sold. It is regulated as a tax that has the effect of increasing its income by 10%. Let the price elasticity of demand for cigarettes be -0.4 and the amount of cigarettes consumed per month be 1 million packs. In this case, answer the questions below. a) How much does cigarette consumption decrease after SKV? b) Will the state's tax revenues increase or decrease after SKV? Please explain.

Step by Step Solution

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the decrease in cigarette consumption after the implementation of SKV we need to use ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Macroeconomics Principles Applications And Tools

Authors: Arthur O Sullivan, Steven M. Sheffrin, Stephen J. Perez

7th Edition

978-0134089034, 9780134062754, 134089030, 134062752, 978-0132555234

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App