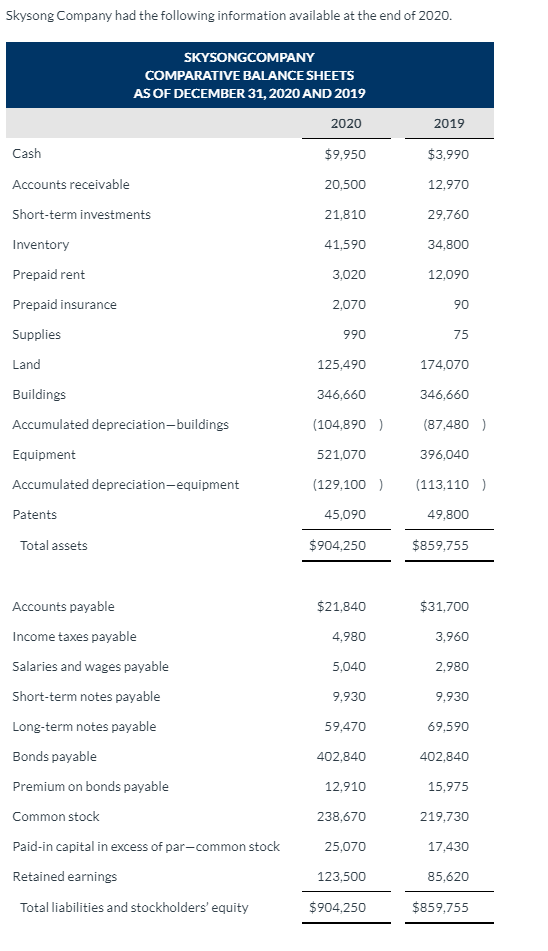

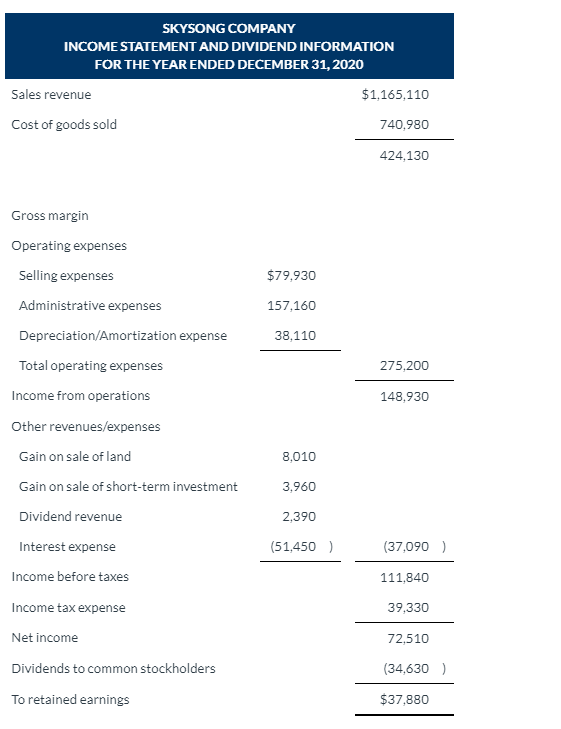

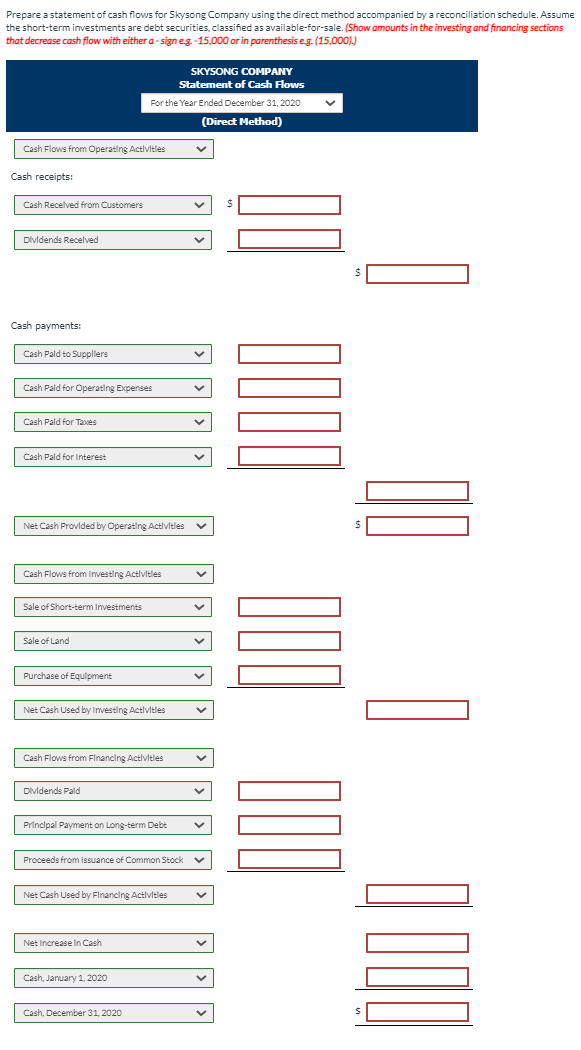

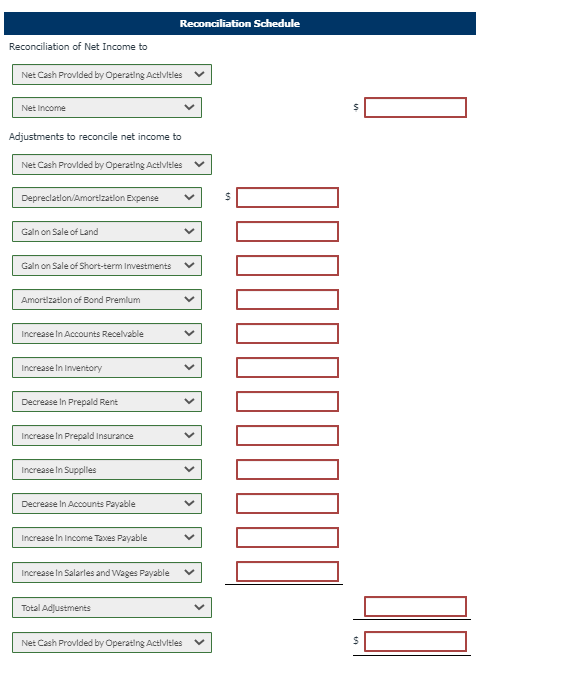

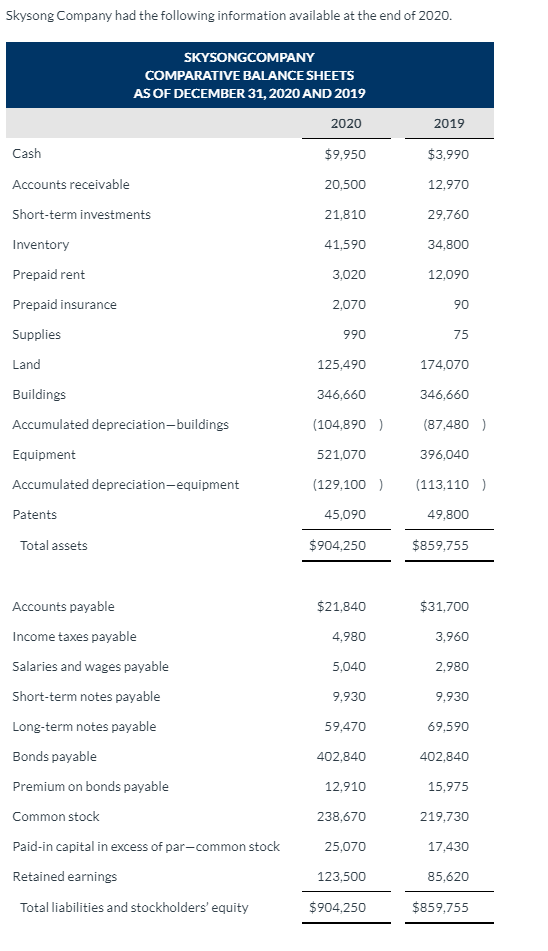

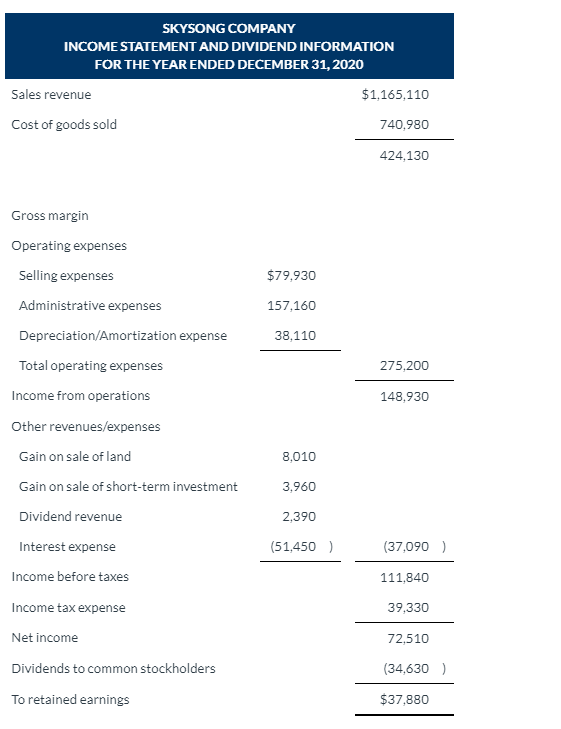

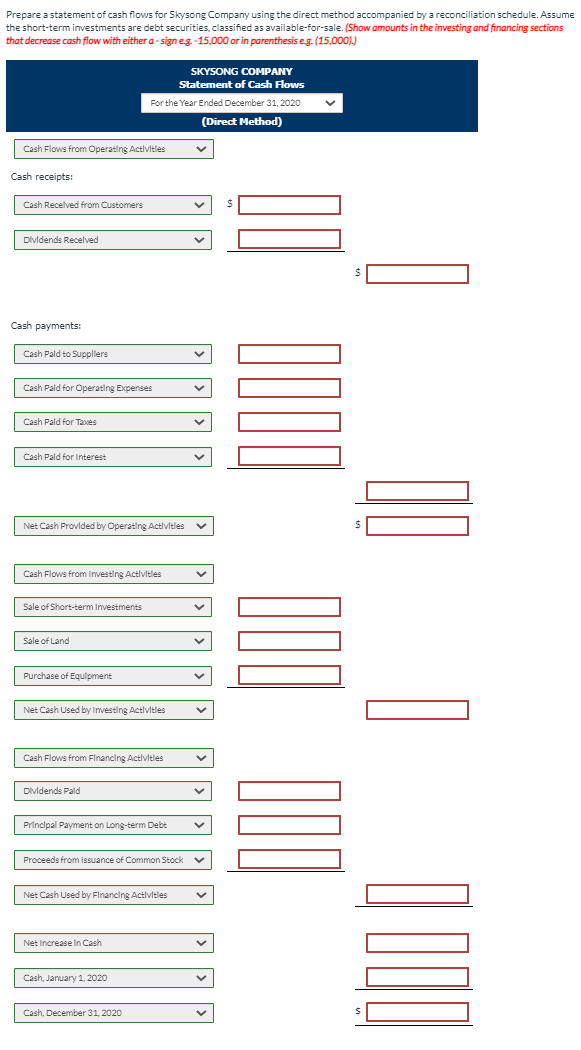

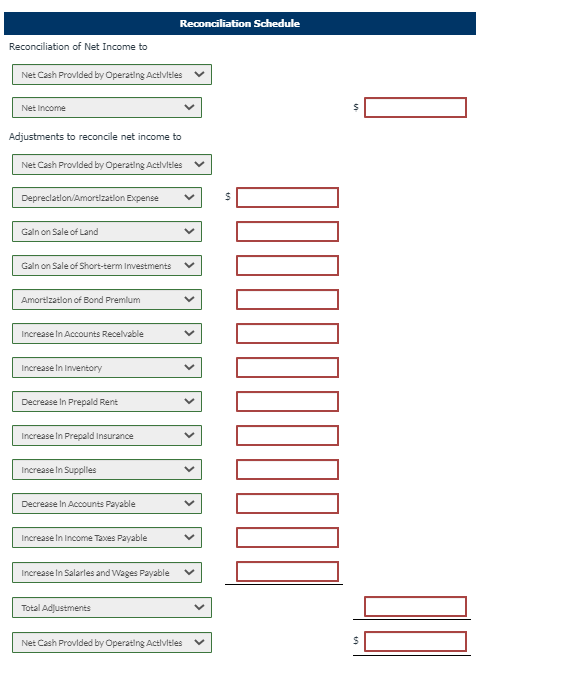

Skysong Company had the following information available at the end of 2020. SKYSONGCOMPANY COMPARATIVE BALANCE SHEETS AS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $9.950 $3.990 20,500 12,970 Accounts receivable Short-term investments 21,810 29.760 Inventory 41,590 34,800 Prepaid rent 3,020 12,090 Prepaid insurance 2,070 90 Supplies 990 75 Land 125,490 174,070 346,660 346,660 Buildings Accumulated depreciation-buildings (104,890) (87,480) Equipment 521,070 396,040 Accumulated depreciation-equipment (129,100) (113,110) Patents 45,090 49,800 Total assets $904,250 $859,755 $21,840 $31,700 4.980 3,960 5,040 2.980 9,930 9,930 59,470 69,590 Accounts payable Income taxes payable Salaries and wages payable Short-term notes payable Long-term notes payable Bonds payable Premium on bonds payable Common stock Paid-in capital in excess of par-common stock Retained earnings 402,840 402,840 12,910 15,975 238,670 219,730 25,070 17.430 123,500 85,620 Total liabilities and stockholders' equity $904,250 $859,755 SKYSONG COMPANY INCOME STATEMENT AND DIVIDEND INFORMATION FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $1,165,110 Cost of goods sold 740,980 424,130 Gross margin Operating expenses Selling expenses $79,930 157,160 Administrative expenses Depreciation/Amortization expense Total operating expenses 38.110 275,200 Income from operations 148,930 8.010 3,960 Other revenues/expenses Gain on sale of land Gain on sale of short-term investment Dividend revenue Interest expense Income before taxes Income tax expense 2,390 (51,450) (37,090) 111.840 39,330 Net income 72,510 Dividends to common stockholders (34,630) To retained earnings $37,880 Prepare a statement of cash flows for Skysong Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are debt securities, classified as available-for-sale. (Show amounts in the investing and financing sections that decrease cash flow with either a-signes -15,000 or in parenthesis eg. (15,000).) SKYSONG COMPANY Statement of Cash Flows For the Year Ended December 31, 2020 (Direct Method) Cash Flows from Operating Activities Cash receipts: Cash Received from Customers $ Dividends Recelved Cash payments: Cash Pald to Suppliers Cash Pald for Operating Expenses Cash Pald for Taxes Cash Pald for interest Net Cash Provided by Operating Activitles Cash Flows from Investing Activities Sale of Short-term Investments Sale of Land Purchase of Equipment Net Cash Used by Investing Activities 10 1 100 Cash Flows from Financing Activities Dividends Pald Principal Payment on Long-term Debt Proceeds from Issuance of Common Stock Net Cash Used by Financing Activitles Net Increase in Cash Cash, January 1, 2020 Cash, December 31, 2020