Answered step by step

Verified Expert Solution

Question

1 Approved Answer

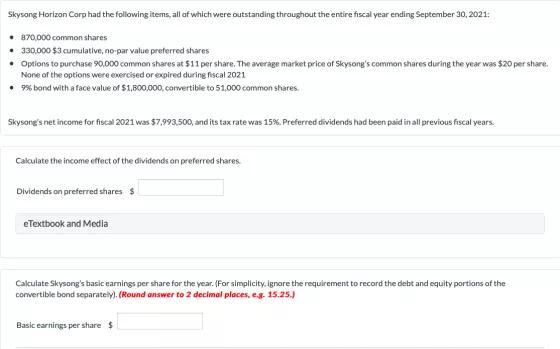

Skysong Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2021: 870,000 common shares

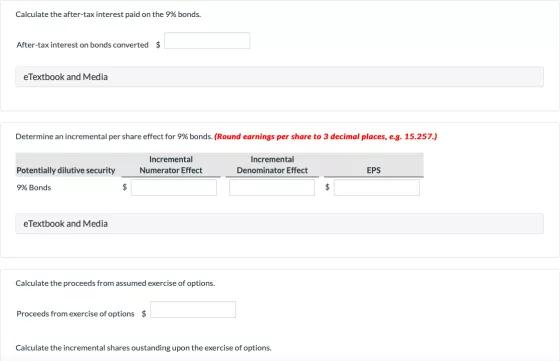

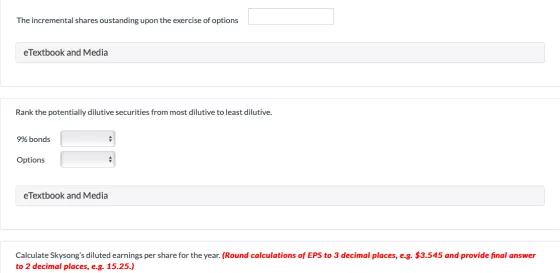

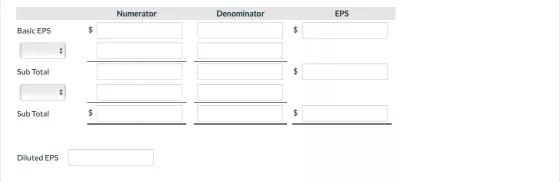

Skysong Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2021: 870,000 common shares 330,000 $3 cumulative, no-par value preferred shares Options to purchase 90,000 common shares at $11 per share. The average market price of Skysong's common shares during the year was $20 per share. None of the options were exercised or expired during fiscal 2021 7% bond with a face value of $1,800,000, corvertible to 51.000 common shares. Skysong's net income for fiscal 2021 was $7,993,500, and its tax rate was 15%. Preferred dividends had been paid in all previous fiscal years. Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares $ eTextbook and Media Cakkulate Skysong's basic earnings per share for the year. (For simplicity, ignare the requirement to record the debt and equity portions of the convertible bond separately). (Round answer to 2 decimal places, eg. 15.25.) Basic earnings per share $ Calculate the after-tax interest paid on the 9% bonds. After-tax interest on bonds converted $ eTextbook and Medla Determine an incremental per share effect for 9% bonds. (Round earnings per share to 3 decimal places, eg. 1s.257.) Incremental Incremental Potentially dilutive security Numerator Effect Denominator Effect EPS 9% Bonds eTextbook and Media Calculate the proceeds from assumed exercise of options. Proceeds from exercise of options $ Cakulate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options eTextbook and Media Rank the potentially dilutive securities from mast dilutive to least dilutive. 9% bonds Options eTextbook and Media Calculate Skysong's diluted earnings per share for the year. (Round calculations of EPS to 3 decimal places, eg. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS Basic EPS %24 Sub Total Sub Total Diluted EP5 Skysong Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2021: 870,000 common shares 330,000 $3 cumulative, no-par value preferred shares Options to purchase 90,000 common shares at $11 per share. The average market price of Skysong's common shares during the year was $20 per share. None of the options were exercised or expired during fiscal 2021 7% bond with a face value of $1,800,000, corvertible to 51.000 common shares. Skysong's net income for fiscal 2021 was $7,993,500, and its tax rate was 15%. Preferred dividends had been paid in all previous fiscal years. Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares $ eTextbook and Media Cakkulate Skysong's basic earnings per share for the year. (For simplicity, ignare the requirement to record the debt and equity portions of the convertible bond separately). (Round answer to 2 decimal places, eg. 15.25.) Basic earnings per share $ Calculate the after-tax interest paid on the 9% bonds. After-tax interest on bonds converted $ eTextbook and Medla Determine an incremental per share effect for 9% bonds. (Round earnings per share to 3 decimal places, eg. 1s.257.) Incremental Incremental Potentially dilutive security Numerator Effect Denominator Effect EPS 9% Bonds eTextbook and Media Calculate the proceeds from assumed exercise of options. Proceeds from exercise of options $ Cakulate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options eTextbook and Media Rank the potentially dilutive securities from mast dilutive to least dilutive. 9% bonds Options eTextbook and Media Calculate Skysong's diluted earnings per share for the year. (Round calculations of EPS to 3 decimal places, eg. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS Basic EPS %24 Sub Total Sub Total Diluted EP5 Skysong Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2021: 870,000 common shares 330,000 $3 cumulative, no-par value preferred shares Options to purchase 90,000 common shares at $11 per share. The average market price of Skysong's common shares during the year was $20 per share. None of the options were exercised or expired during fiscal 2021 7% bond with a face value of $1,800,000, corvertible to 51.000 common shares. Skysong's net income for fiscal 2021 was $7,993,500, and its tax rate was 15%. Preferred dividends had been paid in all previous fiscal years. Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares $ eTextbook and Media Cakkulate Skysong's basic earnings per share for the year. (For simplicity, ignare the requirement to record the debt and equity portions of the convertible bond separately). (Round answer to 2 decimal places, eg. 15.25.) Basic earnings per share $ Calculate the after-tax interest paid on the 9% bonds. After-tax interest on bonds converted $ eTextbook and Medla Determine an incremental per share effect for 9% bonds. (Round earnings per share to 3 decimal places, eg. 1s.257.) Incremental Incremental Potentially dilutive security Numerator Effect Denominator Effect EPS 9% Bonds eTextbook and Media Calculate the proceeds from assumed exercise of options. Proceeds from exercise of options $ Cakulate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options eTextbook and Media Rank the potentially dilutive securities from mast dilutive to least dilutive. 9% bonds Options eTextbook and Media Calculate Skysong's diluted earnings per share for the year. (Round calculations of EPS to 3 decimal places, eg. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS Basic EPS %24 Sub Total Sub Total Diluted EP5 Skysong Horizon Corp had the following items, all of which were outstanding throughout the entire fiscal year ending September 30, 2021: 870,000 common shares 330,000 $3 cumulative, no-par value preferred shares Options to purchase 90,000 common shares at $11 per share. The average market price of Skysong's common shares during the year was $20 per share. None of the options were exercised or expired during fiscal 2021 7% bond with a face value of $1,800,000, corvertible to 51.000 common shares. Skysong's net income for fiscal 2021 was $7,993,500, and its tax rate was 15%. Preferred dividends had been paid in all previous fiscal years. Calculate the income effect of the dividends on preferred shares. Dividends on preferred shares $ eTextbook and Media Cakkulate Skysong's basic earnings per share for the year. (For simplicity, ignare the requirement to record the debt and equity portions of the convertible bond separately). (Round answer to 2 decimal places, eg. 15.25.) Basic earnings per share $ Calculate the after-tax interest paid on the 9% bonds. After-tax interest on bonds converted $ eTextbook and Medla Determine an incremental per share effect for 9% bonds. (Round earnings per share to 3 decimal places, eg. 1s.257.) Incremental Incremental Potentially dilutive security Numerator Effect Denominator Effect EPS 9% Bonds eTextbook and Media Calculate the proceeds from assumed exercise of options. Proceeds from exercise of options $ Cakulate the incremental shares oustanding upon the exercise of options. The incremental shares oustanding upon the exercise of options eTextbook and Media Rank the potentially dilutive securities from mast dilutive to least dilutive. 9% bonds Options eTextbook and Media Calculate Skysong's diluted earnings per share for the year. (Round calculations of EPS to 3 decimal places, eg. $3.545 and provide final answer to 2 decimal places, e.g. 15.25.) Numerator Denominator EPS Basic EPS %24 Sub Total Sub Total Diluted EP5

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Pfter foe inderest on bords conveied 1620001800000x i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started