Answered step by step

Verified Expert Solution

Question

1 Approved Answer

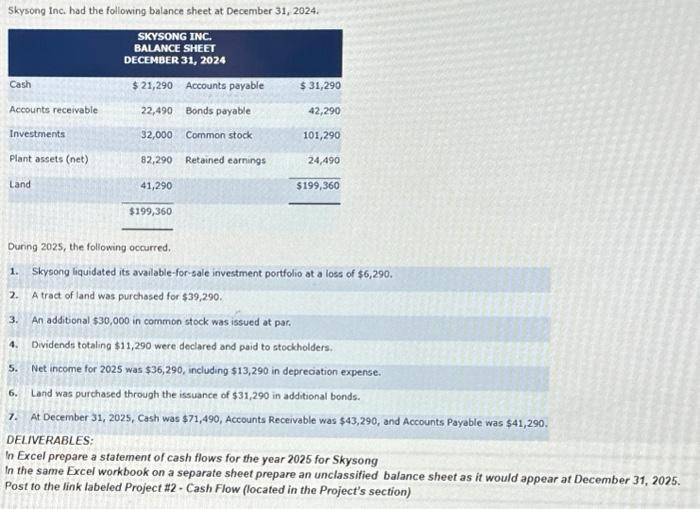

Skysong Inc. had the following balance sheet at December 31, 2024. SKYSONG INC. BALANCE SHEET DECEMBER 31, 2024 $21,290 Accounts payable 22,490 Bonds payable

Skysong Inc. had the following balance sheet at December 31, 2024. SKYSONG INC. BALANCE SHEET DECEMBER 31, 2024 $21,290 Accounts payable 22,490 Bonds payable 32,000 Common stock 82,290 Retained earnings 41,290 $199,360 Cash Accounts receivable Investments Plant assets (net) Land $ 31,290 42,290 101,290 24,490 $199,360 During 2025, the following occurred. 1. Skysong liquidated its available-for-sale investment portfolio at a loss of $6,290. 2. A tract of land was purchased for $39,290. 3. An additional $30,000 in common stock was issued at par. 4. Dividends totaling $11,290 were declared and paid to stockholders. 5. Net income for 2025 was $36,290, including $13,290 in depreciation expense. 6. Land was purchased through the issuance of $31,290 in additional bonds. 7. At December 31, 2025, Cash was $71,490, Accounts Receivable was $43,290, and Accounts Payable was $41,290. DELIVERABLES: In Excel prepare a statement of cash flows for the year 2025 for Skysong In the same Excel workbook on a separate sheet prepare an unclassified balance sheet as it would appear at December 31, 2025. Post to the link labeled Project #2- Cash Flow (located in the Project's section)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Statement of Cash Flows for the year 2025 SKYSONG INC Statement of Cash Flows For the Year ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started