Answered step by step

Verified Expert Solution

Question

1 Approved Answer

S&L Financial buys and sells securities expecting to earn profits on short-term differences in price. On December 27, 2018, S&L purchased Coca-Cola bonds at par

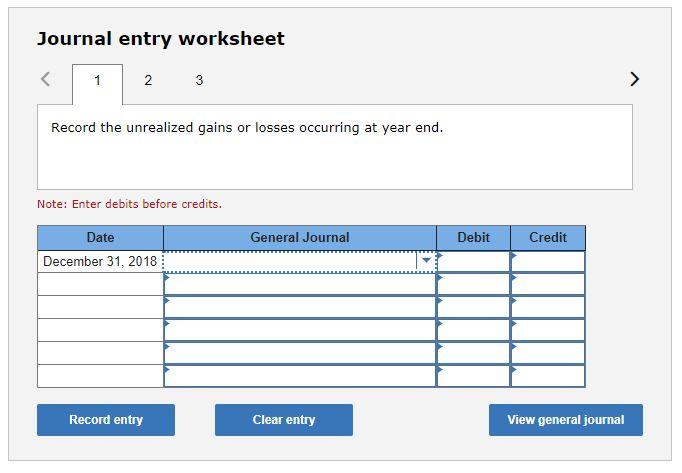

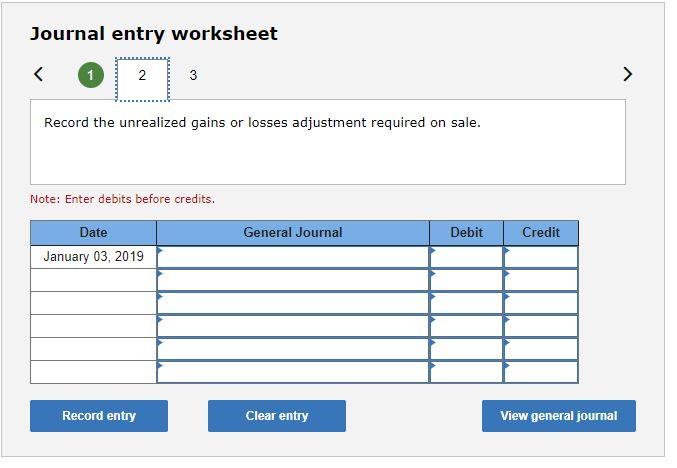

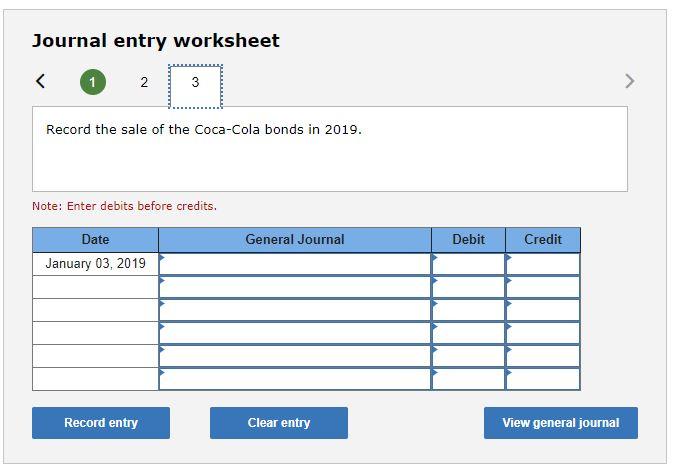

S&L Financial buys and sells securities expecting to earn profits on short-term differences in price. On December 27, 2018, S&L purchased Coca-Cola bonds at par for $883,000 and sold the bonds on January 3, 2019, for $890,000. At December 31, the bonds had a fair value of $877,000.

Prepare journal entries to record (a) any unrealized gains or losses occurring in 2018 and (b) the sale of the bonds in 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started