Answered step by step

Verified Expert Solution

Question

1 Approved Answer

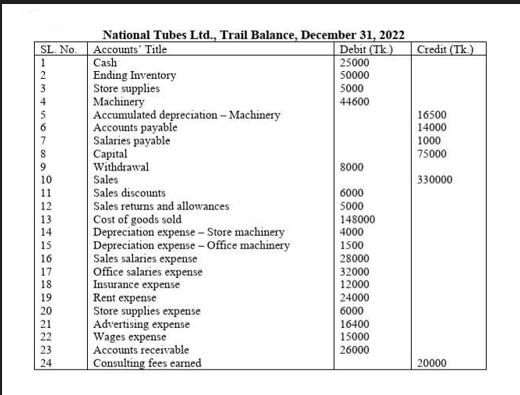

SL. No. 1 234567 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 National Tubes Ltd., Trail

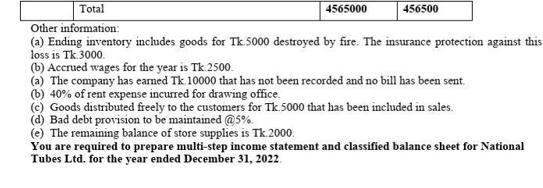

SL. No. 1 234567 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 National Tubes Ltd., Trail Balance, December 31, 2022 Accounts Title Debit (Tk) 25000 50000 5000 44600 Cash Ending Inventory Store supplies Machinery Accumulated depreciation - Machinery Accounts payable Salaries payable Capital Withdrawal Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense - Store machinery Depreciation expense-Office machinery Sales salaries expense Office salaries expense Insurance expense Rent expense Store supplies expense Advertising expense Wages expense Accounts receivable Consulting fees earned 8000 6000 5000 148000 4000 1500 28000 32000 12000 24000 6000 16400 15000 26000 Credit (Tk) 16500 14000 1000 75000 330000 20000 Total Other information: (a) Ending inventory includes goods for Tk 5000 destroyed by fire. The insurance protection against this loss is Tk. 3000. 4565000 456500 (b) Accrued wages for the year is Tk 2500 (a) The company has earned Tk. 10000 that has not been recorded and no bill has been sent. (b) 40% of rent expense incurred for drawing office. (c) Goods distributed freely to the customers for Tk 5000 that has been included in sales. (d) Bad debt provision to be maintained @5%. (e) The remaining balance of store supplies is Tk 2000. You are required to prepare multi-step income statement and classified balance sheet for National Tubes Ltd. for the year ended December 31, 2022

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

MultiStep Income Statement Income Statement Amount Tk Sales 4565000 Sales discounts 4000 Sales retur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started