Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sleepy Head Ltd is a wholesaler of packaging products and you are about to complete the financial report audit for the year ended 31

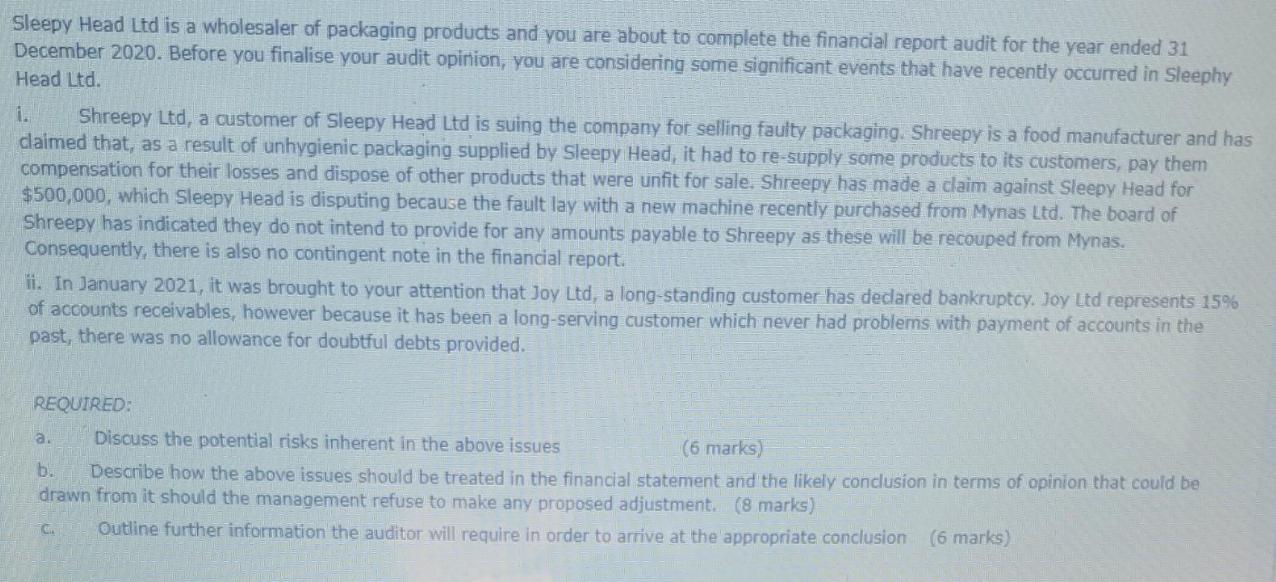

Sleepy Head Ltd is a wholesaler of packaging products and you are about to complete the financial report audit for the year ended 31 December 2020. Before you finalise your audit opinion, you are considering some significant events that have recently occurred in Sleephy Head Ltd. Shreepy Ltd, a customer of Sleepy Head Ltd is suing the company for selling faulty packaging. Shreepy is a food manufacturer and has dlaimed that, as a result of unhygienic packaging supplied by Sleepy Head, it had to re-supply some products to its customers, pay them compensation for their losses and dispose of other products that were unfit for sale. Shreepy has made a claim against Sleepy Head for $500,000, which Sleepy Head is disputing because the fault lay with a new machine recently purchased from Mynas Ltd. The board of Shreepy has indicated they do not intend to provide for any amounts payable to Shreepy as these will be recouped from Mynas. Consequently, there is also no contingent note in the financial report. i. ii. In January 2021, it was brought to your attention that Joy Ltd, a long-standing customer has dedared bankruptcy. Joy Ltd represents 15% of accounts receivables, however because it has been a long-serving customer which never had problems with payment of accounts in the past, there was no allowance for doubtful debts provided. REQUIRED: a. Discuss the potential risks inherent in the above issues (6 marks) b. Describe how the above issues should be treated in the financial statement and the likely conclusion in terms of opinion that could be drawn from it should the management refuse to make any proposed adjustment. (8 marks) Outline further information the auditor will require in order to arrive at the appropriate conclusion (6 marks)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Following potential risks faced by Sleepy Head Ltd Case i FInancial reporting risk Since in the gi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started