Question

Slingshot Corp is a foreign subsidiary of Porcelain Company, a Canadian company. Slingshot Corp was acquired December 31, 2018 and manufactures tableware for sale based

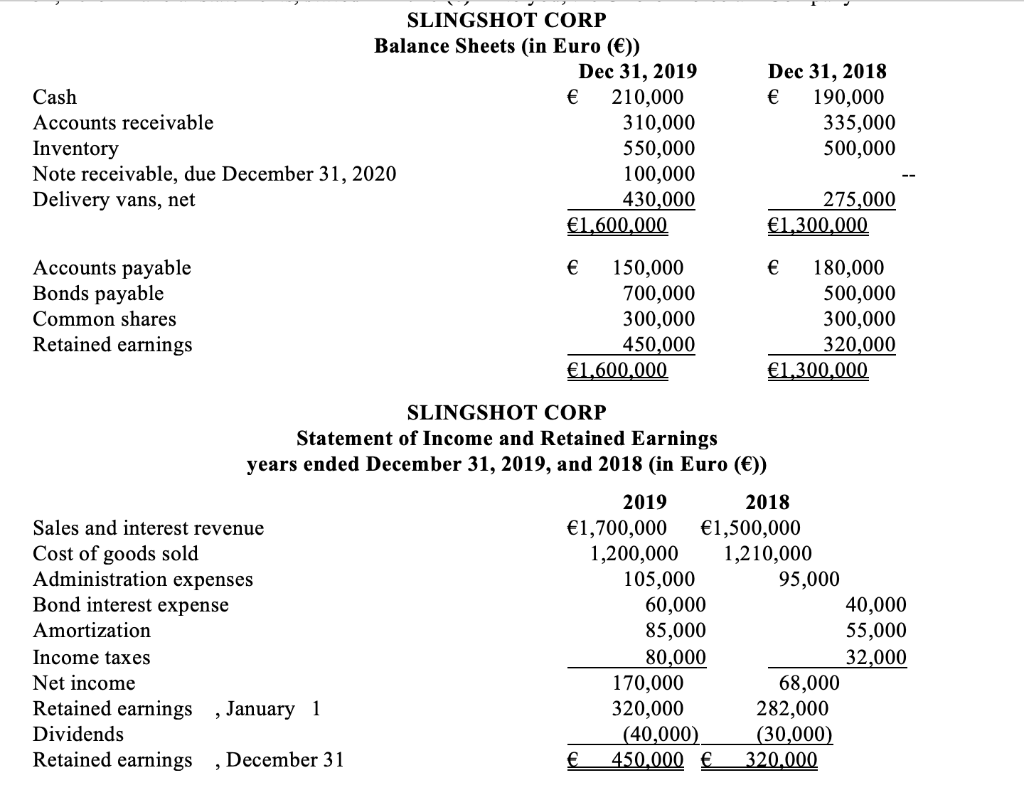

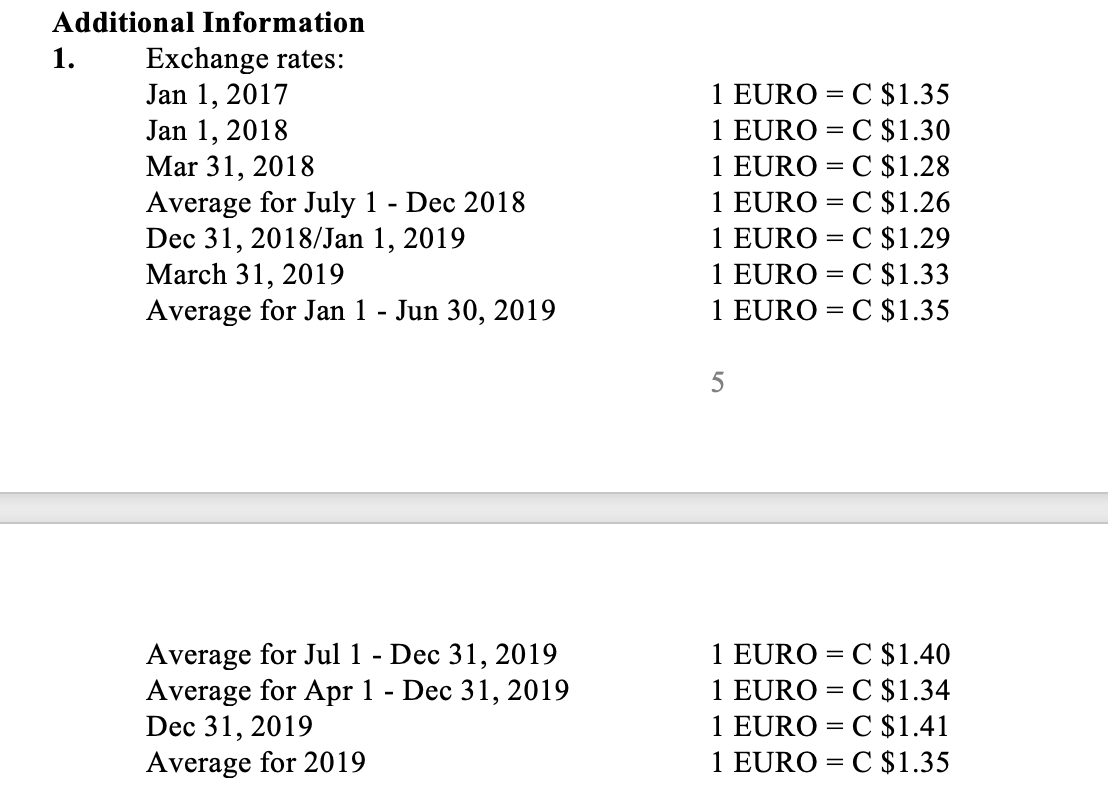

Slingshot Corp is a foreign subsidiary of Porcelain Company, a Canadian company. Slingshot Corp was acquired December 31, 2018 and manufactures tableware for sale based on sales prices determined by world-wide competition. The chief financial officer of Slingshot Corp emailed the following December 31, 2019 financial statements, stated in Euro () to you, the CFO of Porcelain Company

2) Inventories on hand at December 31, 2019 and December 31, 2018 were purchased evenly over the final 6 months of 2019 and 2018 respectively.

3) Slingshot Corp issued 500,000 of its bonds on January 1, 2017 and 300,000 on January 1, 2019. All bonds pay interest at 8% and mature on December 31, 2024. On July 2, 2019, Slingshot Corp repurchased 100,000 of the bonds at their face value.

4) Slingshot Corp declared and paid dividends of 30,000 and 40,000 on March 31, 2018 and March 31, 2019, respectively.

5) Slingshot Corp leased its delivery vans until January 1, 2018. On that date, it acquired 10 delivery vans at a cost of 330,000. On March 31, 2019, it acquired an additional 8 delivery vans at a cost of 240,000. All of Slingshot Corps delivery vans have an estimated useful life of 6 years from the date of acquisition, with no expected salvage value. None of the delivery vans have been sold since January 1, 2018.

6) The notes receivable was received from one of Slingshot Corps clients on March 31, 2019. It pays interest at 10% and is due on December 31, 2022.

7) All sales, purchases, and other expenses are incurred evenly throughout the year.

8) All amounts for Slingshot Corp are stated in Euro ().

REQUIRED:

- Translate Slingshot Corps 2019 financial statements into Canadian dollars, the Canadian dollar as the functional currency (Income Statement, Retained Earnings, Balance Sheet) Include in your calculations (1) the gain or loss on net monetary assets (liabilities), (2) cost of goods sold, (3) amortization expense. (FCT) (23 marks)

- Assuming that Slingshot uses the Euro (not Canadian $) as the functional currency, Calculate the liabilities and shareholders equity portion of the translated balance sheet as at December 31, 2019. Use the presentation currency translation method (PCT) (7 marks)

SHOW ALL CALCULATIONS, including Accumulated translation adjustments (OCI) at December 31, 2019.

SLINGSHOT CORP Balance Sheets (in Euro ()) Dec 31, 2019 Cash 210,000 Accounts receivable 310,000 Inventory 550,000 Note receivable, due December 31, 2020 100,000 Delivery vans, net 430,000 1,600,000 Dec 31, 2018 190,000 335,000 500,000 275,000 1.300.000 Accounts payable Bonds payable Common shares Retained earnings 150,000 700,000 300,000 450,000 1.600.000 180,000 500,000 300,000 320,000 1,300,000 2019 SLINGSHOT CORP Statement of Income and Retained Earnings years ended December 31, 2019, and 2018 (in Euro ()) 2018 Sales and interest revenue 1,700,000 1,500,000 Cost of goods sold 1,200,000 1,210,000 Administration expenses 105,000 95,000 Bond interest expense 60,000 40,000 Amortization 85,000 55,000 Income taxes 80,000 32,000 Net income 170,000 68,000 Retained earnings , January 1 320,000 282,000 Dividends (40,000) (30,000) Retained earnings December 31 450.000 320.000 = Additional Information 1. Exchange rates: Jan 1, 2017 Jan 1, 2018 Mar 31, 2018 Average for July 1 - Dec 2018 Dec 31, 2018/Jan 1, 2019 March 31, 2019 Average for Jan 1 - Jun 30, 2019 = 1 EURO = C $1.35 1 EURO = C $1.30 1 EURO = C $1.28 1 EURO = C $1.26 1 EURO = C $1.29 1 EURO = C $1.33 1 EURO = C $1.35 = == 5 = = Average for Jul 1 - Dec 31, 2019 Average for Apr 1 - Dec 31, 2019 Dec 31, 2019 Average for 2019 1 EURO = C $1.40 1 EURO = C $1.34 1 EURO = C $1.41 1 EURO = C $1.35 = SLINGSHOT CORP Balance Sheets (in Euro ()) Dec 31, 2019 Cash 210,000 Accounts receivable 310,000 Inventory 550,000 Note receivable, due December 31, 2020 100,000 Delivery vans, net 430,000 1,600,000 Dec 31, 2018 190,000 335,000 500,000 275,000 1.300.000 Accounts payable Bonds payable Common shares Retained earnings 150,000 700,000 300,000 450,000 1.600.000 180,000 500,000 300,000 320,000 1,300,000 2019 SLINGSHOT CORP Statement of Income and Retained Earnings years ended December 31, 2019, and 2018 (in Euro ()) 2018 Sales and interest revenue 1,700,000 1,500,000 Cost of goods sold 1,200,000 1,210,000 Administration expenses 105,000 95,000 Bond interest expense 60,000 40,000 Amortization 85,000 55,000 Income taxes 80,000 32,000 Net income 170,000 68,000 Retained earnings , January 1 320,000 282,000 Dividends (40,000) (30,000) Retained earnings December 31 450.000 320.000 = Additional Information 1. Exchange rates: Jan 1, 2017 Jan 1, 2018 Mar 31, 2018 Average for July 1 - Dec 2018 Dec 31, 2018/Jan 1, 2019 March 31, 2019 Average for Jan 1 - Jun 30, 2019 = 1 EURO = C $1.35 1 EURO = C $1.30 1 EURO = C $1.28 1 EURO = C $1.26 1 EURO = C $1.29 1 EURO = C $1.33 1 EURO = C $1.35 = == 5 = = Average for Jul 1 - Dec 31, 2019 Average for Apr 1 - Dec 31, 2019 Dec 31, 2019 Average for 2019 1 EURO = C $1.40 1 EURO = C $1.34 1 EURO = C $1.41 1 EURO = C $1.35 =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started