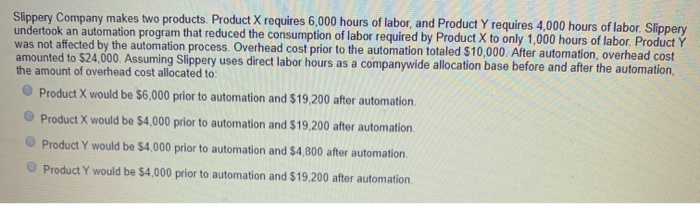

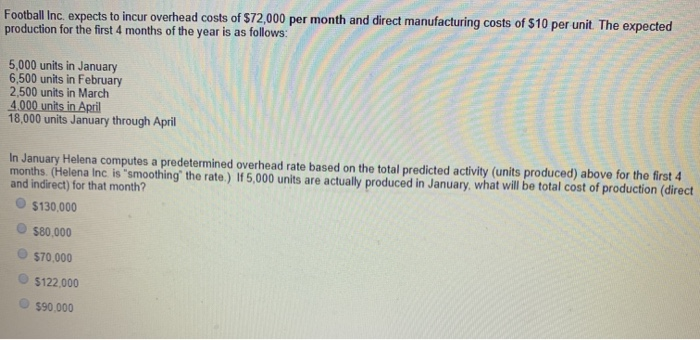

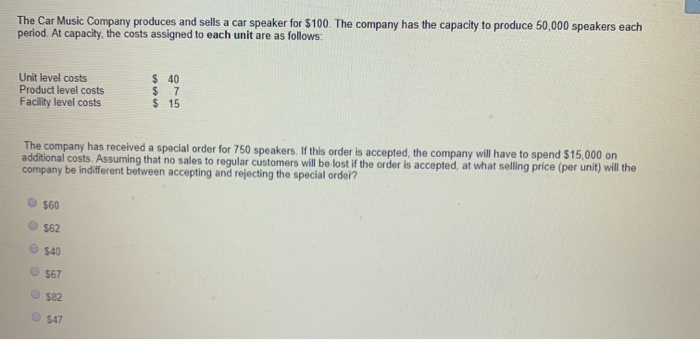

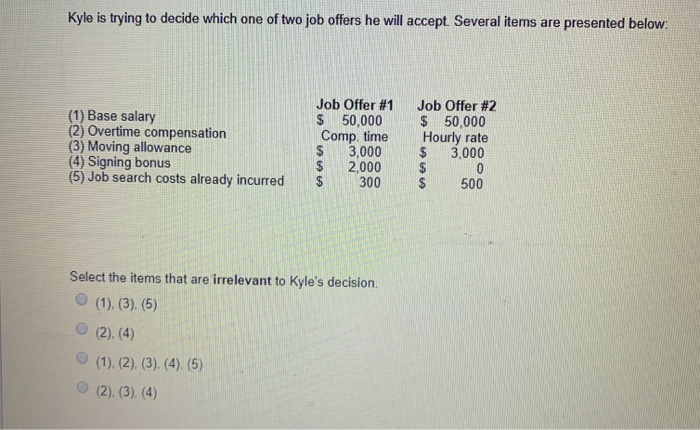

Slippery Company makes two products Product X requires 6,000 hours of labor, and Product Y requires 4,000 hours of labor. Slippery undertook an automation program that reduced the consumption of labor required by Product X to only 1,000 hours of labor. Product Y was not affected by the automation process. Overhead cost prior to the automation totaled $10,000. After automation, overhead cost amounted to $24,000. Assuming Slippery uses direct labor hours as a companywide allocation base before and after the automation the amount of overhead cost allocated to: Product X would be $6,000 prior to automation and $19,200 after automation Product X would be $4,000 prior to automation and $19,200 after automation Product Y would be $4,000 prior to automation and $4,800 after automation Product Y would be $4.000 prior to automation and $19.200 after automation Football Inc, expects to incur overhead costs of $72,000 per month and direct manufacturing costs of $10 per unit. The expected production for the first 4 months of the year is as follows: 5,000 units in January 6,500 units in February 2,500 units in March 4.000 units in April 18,000 units January through April In January Helena computes a predetermined overhead rate based on the total predicted activity (units produced) above for the first 4 months. (Helena Inc is "smoothing the rate.) If5,000 units are actually produced in January, what will be total cost of production (direct and indirect) for that month? $130,000 580,000 $70,000 $122.000 $90,000 The Car Music Company produces and sells a car speaker for $100. The company has the capacity to produce 50,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit level costs Product level costs Facility level costs $ 40 $ 7 $ 15 The company has received a special order for 750 speakers. If this order is accepted, the company will have to spend $15.000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price (per unit) will the company be indifferent between accepting and rejecting the special order? 560 Kyle is trying to decide which one of two job offers he will accept. Several items are presented below: (1) Base salary (2) Overtime compensation (3) Moving allowance (4) Signing bonus (5) Job search costs already incurred Job Offer #1 $ 50,000 Comp. time 3,000 2,000 300 Job Offer #2 $ 50,000 Hourly rate $ 3,000 $ 500 Select the items that are irrelevant to Kyle's decision. (1). (3), (5) (2).(4) (1), (2), (3), (4), (5) (2), (3), (4)