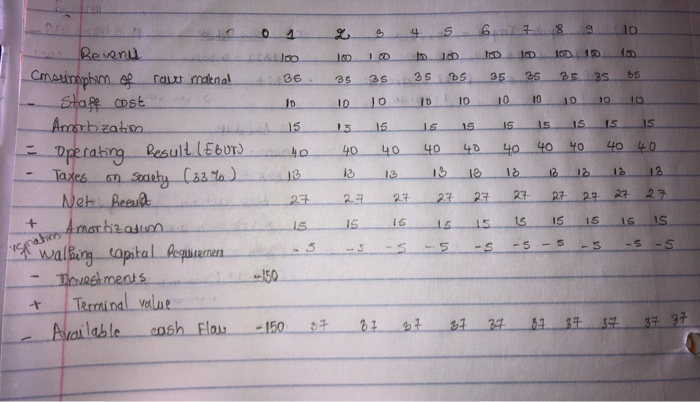

SLN is a subcontractor for automobile constructions. The manager assesses a new plant for the production of engine blocks for commercial vehicles. The cost of capital of this project is 12%. Cash flows (operating cash flow: FME) available in advance are in thousands of dollars): a) According to this scenario, what is the NPV of this project? (10 POINTS) b) The CEO is not sure of his turnover expectations. He therefore wishes to study the sensitivity of NPV to turnover assumptions. What is the NPV of project if turnover is 10% lower or higher than expected? (20 POINTS) c) Rather than assuming that the operating cash flows from this project are constant, the CEO would like to analyze the sensitivity of the NPV to growth in turnover and costs ... project if turnover is 10% lower or higher than expected? (20 POINTS) c) Rather than assuming that the operating cash flows from this project are constant, the CEO would like to analyze the sensitivity of the NPV to growth in turnover and costs of production. More specifically, he wishes to study the hypothesis of an increase of 2% per year of turnover, consumption of raw materials and staff from year 2. What is the new NPV for the project? And if the increase is 5% per year? (30 POINTS) d) To analyze the sensitivity of this project to the discount rate, the CEO wishes to calculate the NPV for different capital costs. Make a graph representing the NPV in function the discount rate (between 5% and 30%). For which rate range the VAVN update positive? 0 9 L 4 5 P 10 Joo ISD 150 36 35 35 35 OS 35 35 os 35 35 JO 10 ID ID 10 10 ID 10 10 GY6 15 15 IS 15 IS 15 15 15 15 40 40 40 40 40 40 40 40 40 40 13 Taxes 13 12 1e 12 12 12 Revenu Cmeeimplio e Tant material Stage cost Anstb zatis Operating Result (EBUT) 67 Sodety (33%) 13 Net Beaud Amor bizam walbeing capital Requiremena Investments Terminal value Available cash Flow - 150 27 23 27 27 27 27 2 27 27 + 15 IS 16 5 15 15 15 15 15 IS . 5 -S -5 - 5 - 5 -5 -5 -5 + 87 37 37 37 37 37 SLN is a subcontractor for automobile constructions. The manager assesses a new plant for the production of engine blocks for commercial vehicles. The cost of capital of this project is 12%. Cash flows (operating cash flow: FME) available in advance are in thousands of dollars): a) According to this scenario, what is the NPV of this project? (10 POINTS) b) The CEO is not sure of his turnover expectations. He therefore wishes to study the sensitivity of NPV to turnover assumptions. What is the NPV of project if turnover is 10% lower or higher than expected? (20 POINTS) c) Rather than assuming that the operating cash flows from this project are constant, the CEO would like to analyze the sensitivity of the NPV to growth in turnover and costs ... project if turnover is 10% lower or higher than expected? (20 POINTS) c) Rather than assuming that the operating cash flows from this project are constant, the CEO would like to analyze the sensitivity of the NPV to growth in turnover and costs of production. More specifically, he wishes to study the hypothesis of an increase of 2% per year of turnover, consumption of raw materials and staff from year 2. What is the new NPV for the project? And if the increase is 5% per year? (30 POINTS) d) To analyze the sensitivity of this project to the discount rate, the CEO wishes to calculate the NPV for different capital costs. Make a graph representing the NPV in function the discount rate (between 5% and 30%). For which rate range the VAVN update positive? 0 9 L 4 5 P 10 Joo ISD 150 36 35 35 35 OS 35 35 os 35 35 JO 10 ID ID 10 10 ID 10 10 GY6 15 15 IS 15 IS 15 15 15 15 40 40 40 40 40 40 40 40 40 40 13 Taxes 13 12 1e 12 12 12 Revenu Cmeeimplio e Tant material Stage cost Anstb zatis Operating Result (EBUT) 67 Sodety (33%) 13 Net Beaud Amor bizam walbeing capital Requiremena Investments Terminal value Available cash Flow - 150 27 23 27 27 27 27 2 27 27 + 15 IS 16 5 15 15 15 15 15 IS . 5 -S -5 - 5 - 5 -5 -5 -5 + 87 37 37 37 37 37