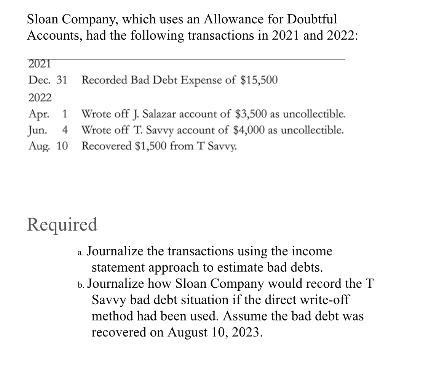

Sloan Company, which uses an Allowance for Doubtful Accounts, had the following transactions in 2021 and 2022: 2021 Dec. 31 Recorded Bad Debt Expense

Sloan Company, which uses an Allowance for Doubtful Accounts, had the following transactions in 2021 and 2022: 2021 Dec. 31 Recorded Bad Debt Expense of $15,500 2022 Apr. 1 Wrote off J. Salazar account of $3,500 as uncollectible. Jun. 4 Wrote off T. Savvy account of $4,000 as uncollectible. Aug, 10 Recovered $1,500 from T Savvy. Required a Journalize the transactions using the income statement approach to estimate bad debts. b. Journalize how Sloan Company would record the T Savvy bad debt situation if the direct write-off method had been used. Assume the bad debt was recovered on August 10, 2023.

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below ANSWER Step 1 I A journal entry is a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started