Answered step by step

Verified Expert Solution

Question

1 Approved Answer

slove step 1 and 2 3. Your client has a 2-year old child whose college education they plan to fund when the child turns 18

slove step 1 and 2

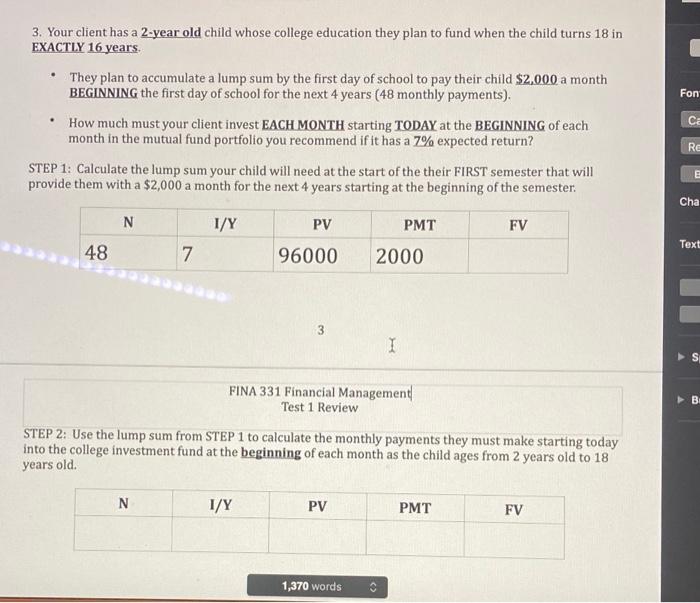

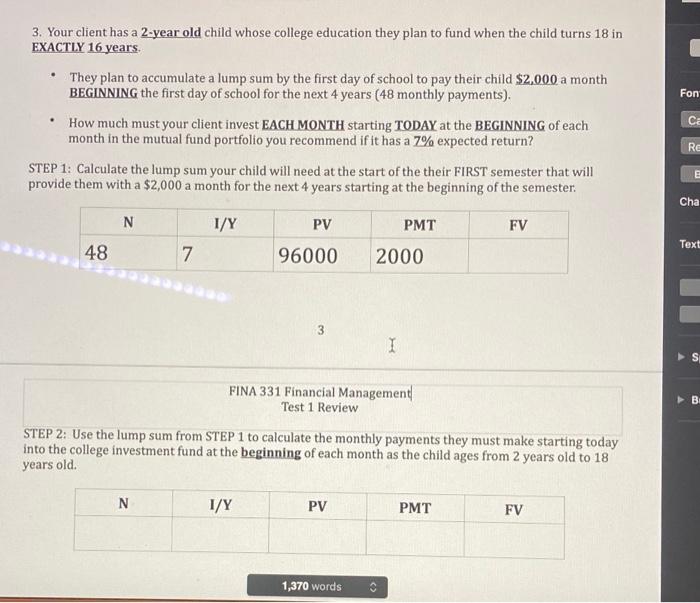

3. Your client has a 2-year old child whose college education they plan to fund when the child turns 18 in EXACTLY 16 years. - They plan to accumulate a lump sum by the first day of school to pay their child $2,000 a month BEGINNING the first day of school for the next 4 years ( 48 monthly payments). - How much must your client invest EACH MONTH starting TODAX at the BEGINNING of each month in the mutual fund portfolio you recommend if it has a 7% expected return? STEP 1: Calculate the lump sum your child will need at the start of the their FIRST semester that will provide them with a $2,000 a month for the next 4 years starting at the beginning of the semester. 3 FINA 331 Financial Management| Test 1 Review STEP 2: Use the lump sum from STEP 1 to calculate the monthly payments they must make starting today into the college investment fund at the beginning of each month as the child ages from 2 years old to 18 years old

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started