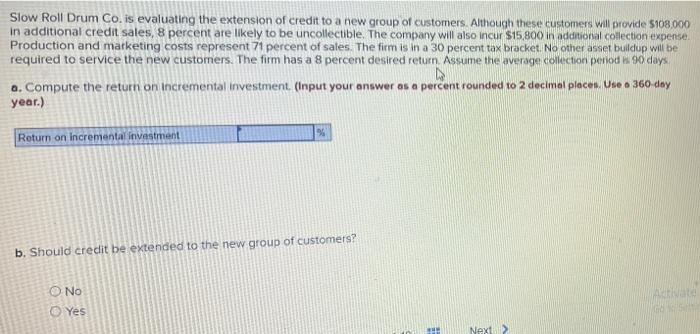

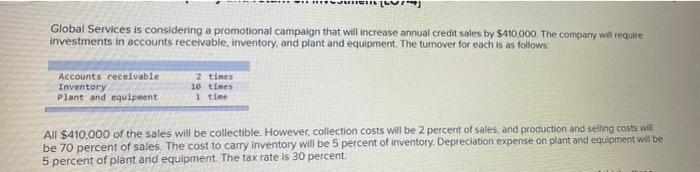

Slow Roll Drum Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide 5108.000 in additional credit sales, 8 percent are likely to be uncollectible. The company will also incur $15,800 in additional collection expense. Production and marketing costs represent 71 percent of sales. The firm is in a 30 percent tax bracket. No other asset buildup will be required to service the new customers. The firm has a 8 percent desired return Assume the average collection period 90 days a. Compute the return on incremental investment (Input your answer as a percent rounded to 2 decimal places. Use . 360 day year.) Return on incremental investment b. Should credit be extended to the new group of customers? O No Yes Next > Henderson Office Supply is considering a more liberal credit policy to increase sales but expects that percent of the new account will be uncollectible. Collection costs are 6 percent of new sales, production and selling costs are 73 percent, and accounts receive turnover is six times. Assume income taxes of 30 percent and an increase in sales of $75,000 No other set buldup will be required to service the new accounts. Dome Metals has credit sales of $432,000 yearly with credit terms of net 90 days, which is also the werage collection period a. Assume the firm offers a 5 percent discount for payment in 15 days and every customer takes advantage of the discount. Also assume the firm uses the cash generated from its reduced receivables to reduce its bank loans which cost 11 percent. What wil the net gain or loss be to the firm if this discount is offered? (Use a 360-day year.) More Global Services is considering a promotional campaign that will increase annual credit sales by $410,000. The company will require investments in accounts receivable, inventory, and plant and equipment. The turnover for each is as follows: Accounts receivable Inventory Plant and equipment 2 times 10 times 1 time All $410,000 of the sales will be collectible. However, collection costs will be 2 percent of sales and production and selling costs will be 70 percent of sales. The cost to carry inventory will be 5 percent of inventory. Depreciation expense on plant and equipment will be 5 percent of plant and equipment. The tax rate is 30 percent