Answered step by step

Verified Expert Solution

Question

1 Approved Answer

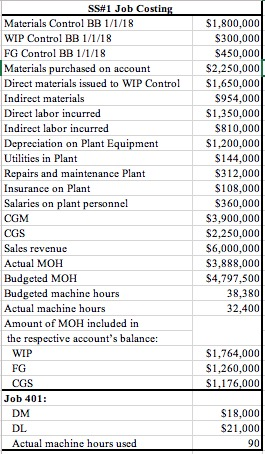

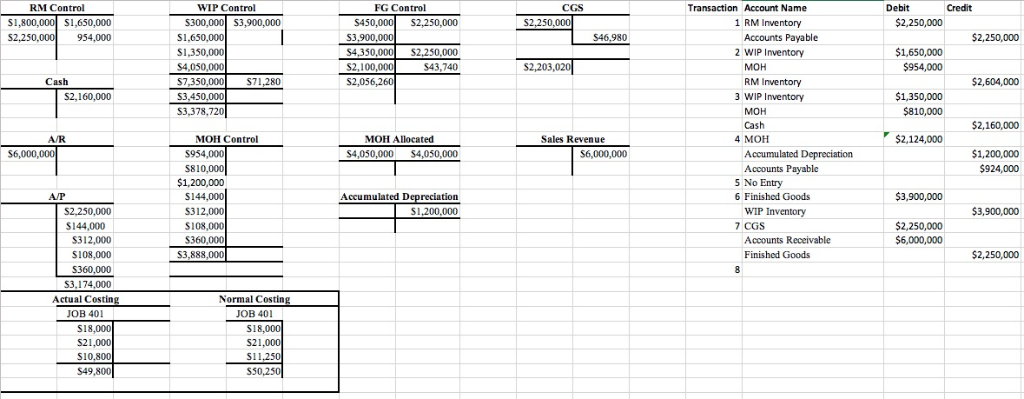

SM Job Costing Materials Control BB 1/1/18 WIP Control BB 1/1/18 FG Control BB 1/1/18 Materials purchased on account Indirect materials Direct labor incurred Indirect

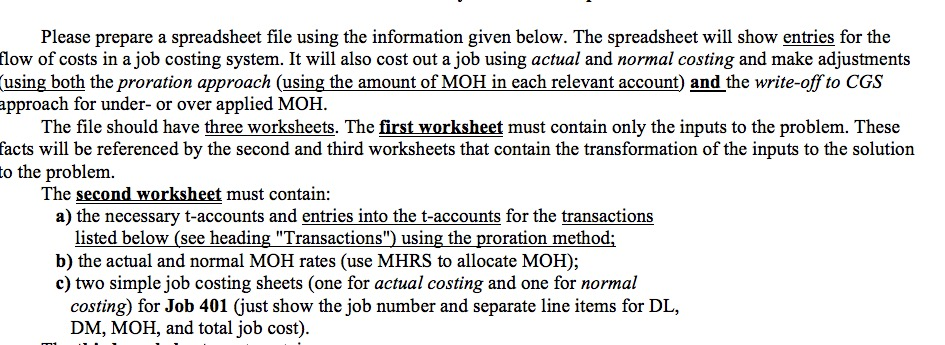

SM Job Costing Materials Control BB 1/1/18 WIP Control BB 1/1/18 FG Control BB 1/1/18 Materials purchased on account Indirect materials Direct labor incurred Indirect labor incurred Depreciation on Plant Equipment Utilities n Plant Repairs and maintenance Plant Insurance on Plant Salaries on plant personnel CGM CGS Sales revenue Actual MOH Budgeted MOH Budgeted machine hours Actual machine hours Amount of MOH included in S1,800,000 S300,000 $450,000 S2,250,000 Direct materials issued to WIP ContS1,650,000 $954,000 $1,350,000 $810,000 $1,200,000 $144,000 S312,000 $108,000 S360,000 $3,900,000 $2,250,000 6,000,000 S3,888,000 $4,797,500 38,380 32,400 the respective account's balance: WIP FG CGS $1,764,000 $1,260,000 1,176,000 Job 401: DM DL Actual machine hours used S18,000 S21,000 RM Control WIP Control FG Control CGS Transaction Account Name Debit S450 S3,900 $4,350,000 2,250,000 S2,100,000 1,800,000 S1,6 50,000 954,000 S300,000 S3,900,000 S1,650,000 $1,350,000 $4,050,000 S2,250,000 1 RM Inventory Accounts Payable 2 WIP Inventory $1,650,000 $954,000 $43,740 $2,203,02 RM Inventory 3 WIP Inventory S71,280 $2,604,000 S2,160,000 3,378,720 Cash $2,160,000 MOH Control MOH Allocated $4,050,000 S4,050,000 $2,124,000 A/R Sales Revenue 4 MOH $954,000 $810,000 $1,200,000 $144,000 S312,000 $108,000 $360,000 $3,888,000 $1,200,000 $924,000 $6,000,000 Accumulated Depreciation Accounts Pavablc 5 No Entry 6 Finished Goods A/P Accumulated Depreciation S1,200,000 $3,900,000 $144,000 CGS 2,250,000 $312,000 $108,000 5360,000 S3,174,000 Actual Costin Accounts Receivable Finished Goods Normal Costin OB 401 JOB 401 $18,000 $21,000 S10,800 549,800 S21 11,2 Please prepare a spreadsheet file using the information given below. The spreadsheet will show entries for the flow of costs in a job costing system. It will also cost out a job using actual and normal costing and make adjustments (using both the proration approach (using the amount of MOH in each relevant account) and the write-offto CGS approach for under- or over applied MOH. The file should have three worksheets. The first worksheet must contain only the inputs to the problem. These facts will be referenced by the second and third worksheets that contain the transformation of the inputs to the solution to the problem. The second worksheet must contain: a) the necessary t-accounts and entries into the t-accounts for the transactions listed below (see heading "Transactions") using the proration method; b) the actual and normal MOH rates (use MHRS to allocate MOH); c) two simple job costing sheets (one for actual costing and one for normal costing) for Job 401 (just show the job number and separate line items for DL, DM, MOH, and total job cost). SM Job Costing Materials Control BB 1/1/18 WIP Control BB 1/1/18 FG Control BB 1/1/18 Materials purchased on account Indirect materials Direct labor incurred Indirect labor incurred Depreciation on Plant Equipment Utilities n Plant Repairs and maintenance Plant Insurance on Plant Salaries on plant personnel CGM CGS Sales revenue Actual MOH Budgeted MOH Budgeted machine hours Actual machine hours Amount of MOH included in S1,800,000 S300,000 $450,000 S2,250,000 Direct materials issued to WIP ContS1,650,000 $954,000 $1,350,000 $810,000 $1,200,000 $144,000 S312,000 $108,000 S360,000 $3,900,000 $2,250,000 6,000,000 S3,888,000 $4,797,500 38,380 32,400 the respective account's balance: WIP FG CGS $1,764,000 $1,260,000 1,176,000 Job 401: DM DL Actual machine hours used S18,000 S21,000 RM Control WIP Control FG Control CGS Transaction Account Name Debit S450 S3,900 $4,350,000 2,250,000 S2,100,000 1,800,000 S1,6 50,000 954,000 S300,000 S3,900,000 S1,650,000 $1,350,000 $4,050,000 S2,250,000 1 RM Inventory Accounts Payable 2 WIP Inventory $1,650,000 $954,000 $43,740 $2,203,02 RM Inventory 3 WIP Inventory S71,280 $2,604,000 S2,160,000 3,378,720 Cash $2,160,000 MOH Control MOH Allocated $4,050,000 S4,050,000 $2,124,000 A/R Sales Revenue 4 MOH $954,000 $810,000 $1,200,000 $144,000 S312,000 $108,000 $360,000 $3,888,000 $1,200,000 $924,000 $6,000,000 Accumulated Depreciation Accounts Pavablc 5 No Entry 6 Finished Goods A/P Accumulated Depreciation S1,200,000 $3,900,000 $144,000 CGS 2,250,000 $312,000 $108,000 5360,000 S3,174,000 Actual Costin Accounts Receivable Finished Goods Normal Costin OB 401 JOB 401 $18,000 $21,000 S10,800 549,800 S21 11,2 Please prepare a spreadsheet file using the information given below. The spreadsheet will show entries for the flow of costs in a job costing system. It will also cost out a job using actual and normal costing and make adjustments (using both the proration approach (using the amount of MOH in each relevant account) and the write-offto CGS approach for under- or over applied MOH. The file should have three worksheets. The first worksheet must contain only the inputs to the problem. These facts will be referenced by the second and third worksheets that contain the transformation of the inputs to the solution to the problem. The second worksheet must contain: a) the necessary t-accounts and entries into the t-accounts for the transactions listed below (see heading "Transactions") using the proration method; b) the actual and normal MOH rates (use MHRS to allocate MOH); c) two simple job costing sheets (one for actual costing and one for normal costing) for Job 401 (just show the job number and separate line items for DL, DM, MOH, and total job cost)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started