Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Small and Bold ECN 3 5 0 Your client Small and Bold, a leading microfinance entity, is considering developing a new fiveyear fund SBOLD to

Small and Bold

ECN

Your client Small and Bold, a leading microfinance entity, is considering developing a new fiveyear fund SBOLD to expand operations across the world. SBOLD's sources of funding include:

Commercial investors who demand security and high rates of return

SubCommercial investors who like security and are willing to accept lower rates of return because they believe in Small and Bold's mission

Small and Bold's own funds

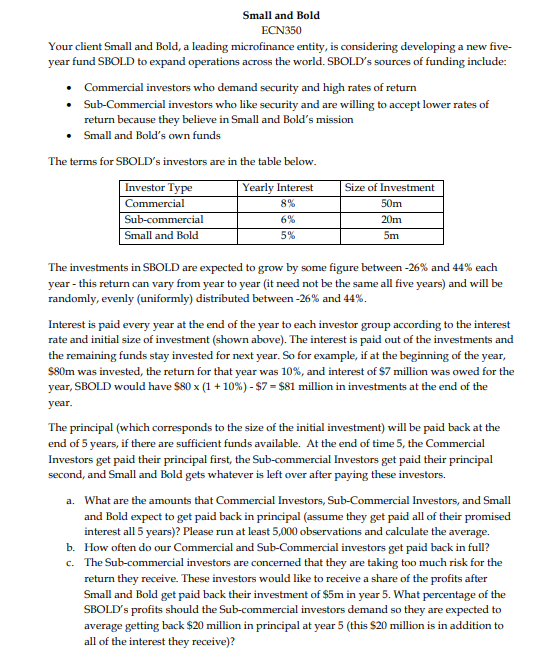

The terms for SBOLD's investors are in the table below.

tableInvestor Type,Yearly Interest,Size of InvestmentCommercial mSubcommercial, mSmall and Bold, m

The investments in SBOLD are expected to grow by some figure between and each year this return can vary from year to year it need not be the same all five years and will be randomly, evenly uniformly distributed between and

Interest is paid every year at the end of the year to each investor group according to the interest rate and initial size of investment shown above The interest is paid out of the investments and the remaining funds stay invested for next year. So for example, if at the beginning of the year, $ was invested, the return for that year was and interest of $ million was owed for the year, SBOLD would have $$$ million in investments at the end of the year.

The principal which corresponds to the size of the initial investment will be paid back at the end of years, if there are sufficient funds available. At the end of time the Commercial Investors get paid their principal first, the Subcommercial Investors get paid their principal second, and Small and Bold gets whatever is left over after paying these investors.

a What are the amounts that Commercial Investors, SubCommercial Investors, and Small and Bold expect to get paid back in principal assume they get paid all of their promised interest all years Please run at least observations and calculate the average.

b How often do our Commercial and SubCommercial investors get paid back in full?

c The Subcommercial investors are concerned that they are taking too much risk for the return they receive. These investors would like to receive a share of the profits after Small and Bold get paid back their investment of $ in year What percentage of the SBOLD's profits should the Subcommercial investors demand so they are expected to average getting back $ million in principal at year this $ million is in addition to all of the interest they receive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started